As Africa Faces COVID-19, Chinese Debt Relief is a Welcome Development

Stephen Paduano is the executive director of the LSE Economic Diplomacy Commission and a doctoral researcher at the London School of Economics, where he studies African political economy with an emphasis on U.S. and Chinese policy.

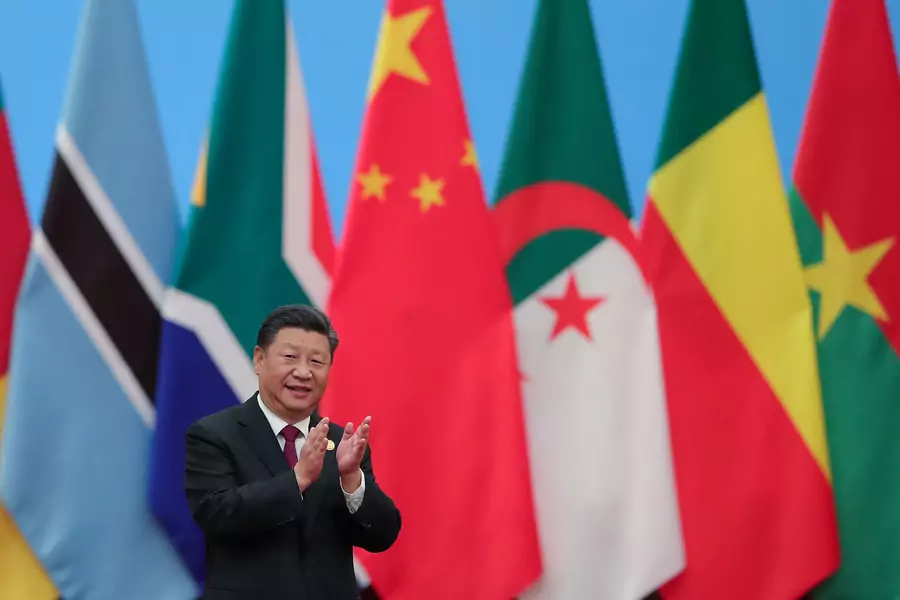

Two weeks ago, African leaders and Chinese President Xi Jinping met by videoconference to discuss debt. What is usually a rather dismal subject in China-Africa relations, proved much more upbeat. During the event, which was billed the “Extraordinary China-Africa Summit on Solidarity Against COVID-19,” President Xi came with what was indeed an extraordinary offer. As the pandemic now pushes most African nations deep into debt, China will be cancelling their interest-free loans.

More on:

In certain respects, it may appear that this was too little, too late. Interest-free loans account for less than 5 percent of Africa’s rapidly mounting debt to China, according to researchers at Johns Hopkins University. The announcement also came a full two months after the World Bank, IMF, and G-20 had begun their own emergency financing operations continent-wide. In the time that Beijing waited, hinting only that it would work with African nations behind closed doors on a bilateral basis, Africa’s COVID-19 caseload rose from 10,000 to 300,000 and the continent slipped into its first recession in twenty-five years.

President Xi’s offer of cancelling interest-free loans may not be extraordinary for its punctuality, but it remains so for its utility and its wider political implications. Although the world has already wised up to Beijing’s role as a global lender—with the mixed-baggage it may bring to developing nations’ debt burdens—Beijing’s role as a serious development partner, one that is willing to undertake less lucrative tasks such as debt cancellation, is only just beginning. New data released by the World Bank last week demonstrate just how serious that role has become. Outstanding debt figures reveal China to be the largest creditor to sub-Saharan Africa’s low-income countries, having lent $64 billion versus the World Bank’s $62 billion. There are many reasons to support this evolution, but there is also cause for concern

China’s relationship with Africa is an outgrowth of the Cold War and its interests there have sometimes appeared stuck in the logic of that conflict. When Beijing first made its push onto the continent in the 1950s, it did so to advance its Maoist ideology, build support beyond Moscow’s and Washington’s blocs, and undermine its northern neighbor following the Sino-Soviet Split of the early 1960s. It found success in all its ambitions, and as African nations swung the 1971 vote to oust Taipei and bring in Beijing to the United Nations, it became clear that China’s investment in Africa was a good one.

However, in the decades that followed, the relationship never evolved beyond an “investment” in the most material of senses. Searching for little more than political and financial yield, Beijing entered the new millennium stalking sites of human rights abuses and abundant oil wealth, such as Angola and Sudan, from which Western states largely kept a distance.

As China now grows fitfully into its role as a global leader, its relations with African nations appear to be expanding beyond such power and resource grabs. In the past two decades, Beijing has come to complement its controversial $152 billion worth of loans with meaningful relief efforts, restructuring or refinancing $15 billion of them. But cancelling debt outright, as was announced at the Extraordinary Summit, has remained a rarity. Since 2000, Beijing had written off just $3.4 billion of African debt.

More on:

Where a restructuring, such as extending maturities, raises concerns of kicking the can down the road, and a refinancing, such as issuing new loans, threatens to increase the debt burden, cancellations promise much-needed fresh starts. Xi’s announcement of cancelling interest-free loans is therefore a welcome development, marking only the ninth such pledge in the history of China-Africa relations. Though the proportion of China’s interest-free loans to its total loans, just 5 percent, may appear small as a headline figure, it will nonetheless prove useful as debtor nations work to build fiscal space in the months ahead.

Given the scale of Africa’s debt crisis, it should be taken as a great reassurance that China, its largest official lender, has warmed to the idea of cancellations. African nations will also benefit from the fact that China does not generally attempt to compel Western private creditors to participate in debt relief—which, when attempted by the G-20, has led credit rating agencies to issue costly warnings and downgrades of African nations’ sovereign debt. Similarly, China’s aid tends to come free from the G-20’s onerous stipulation that participating nations not seek commercial loans for the rest of the year. As a bond rally in emerging markets pushes down borrowing costs and pushes away the G-20, Chinese debt relief may be uniquely positioned for the moment.

Still, there are important consequences to China’s debt relief. Research from the College of William & Mary found that if an African country votes with China an additional 10 percent of the time, it will receive an 86 percent increase in aid—and a 159 percent increase in grants. Further, given China’s indifference to authoritarian governance and human rights abuses, the ability to turn to China for development assistance makes it difficult for Western development institutions to request or impose reforms. Research from Heidelberg University has found that for every percentage point increase in Chinese aid, a nation will receive 15 percent fewer conditions from the World Bank.

Then there is the occasional kowtowing. In recent years, China has leveraged its largesse around the world to keep partners mum on the issue of concentration camps in Xinjiang. In Africa, a dozen nations, some with sizable Muslim populations, have also been compelled to praise the brutality against the Uighur Muslims. Others have gone on to praise the democracy crackdowns in Hong Kong. Likewise, all but one African nation—tiny Eswatini—has complied with China's demand to cut off relations with Taiwan.

Alarming though the consequences of Chinese aid may be, its importance in the current crisis must not be overlooked. There will be much time in the years ahead to challenge Chinese influence at the UN, maintain political conditions at the World Bank, and counteract smaller states' kowtowing. But as Africa’s COVID-19 death toll continues to rise and its debt burden does too, Western nations and institutions must embrace China as an ally in this fight.

Online Store

Online Store