Back to the Future of U.S. Energy Security

More on:

The new secular reality in the U.S. oil market—declining net imports, driven by increasing domestic production and lower demand—has been making headlines for some time now. But what does decreasing dependence on imported oil mean for U.S. foreign policy?

That’s the question that’s been on my mind as I’ve looked back at a 2006 CFR Task Force Report, The National Security Consequences of U.S. Oil Dependency. It’s a fantastic study and still well worth a close read, six years later.

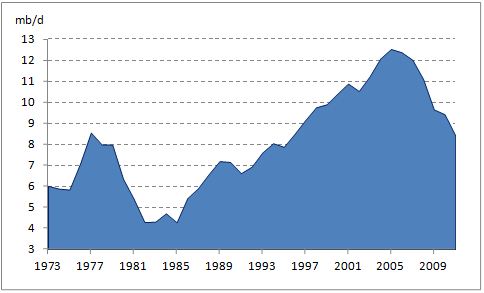

In hindsight, one thing that’s fascinating about the study is its context: it was written around the time that U.S. crude oil net imports hit an all-time high (2005). Back then, the notion of a Western Hemisphere oil boom—and what it might mean for the United States (and even global) economy—had not yet become the talk of the energy community. Imports had been trending higher the last two decades. Few would have predicted the reversal that has taken place in U.S. oil imports, let alone its magnitude.

U.S. Net Imports of Oil (1973 – 2011, in million barrels per day)

Since 2006, U.S. net oil imports have declined by more than thirty percent. A broad consensus of energy analysts expects the trend to continue, predicting game-changing implications for the United States and geopolitics more broadly.

So back to my opening question: To what extent is this decline in imported oil affecting U.S. foreign policy? How might a continuation of the trend affect policy in the future? One way to get at the question is to start by thinking about how you think U.S. dependence on imported oil affects U.S. foreign policy today, then imagining how a decrease in the level of dependence might alter your answers.

Here’s where the 2006 CFR Task Force Report is useful. Its authors identified five major reasons “why dependence on energy traded in world markets is a matter of concern for U.S. foreign policy.” They also examined a sixth, more tentative, reason.

I’ve listed a very abbreviated version of all six reasons below.

How much, if at all, do you think a continued reliance by the United States on oil imports would affect each of the reasons they put forward? Would it have no effect, eliminate the reason altogether, or just lessen its significance? They’re questions that Michael and I have been debating, which I now put to you.

- “The control over enormous oil revenues gives exporting countries the flexibility to adopt policies that oppose U.S. interests and values. [...] Because of their oil wealth, [producer] countries are free to ignore U.S. policies and to pursue interests inimical to our national security."

- “Oil dependence causes political realignments that constrain the ability of the United States to form partnerships to achieve common objectives. Perhaps the most pervasive effect arises as countries dependent on imports subtly modify their policies to be more congenial to suppliers. […] These new realignments have further diminished U.S. leverage, particularly in the Middle East and Central Asia.” Related to the second point, “All consuming countries, including the United States, are more constrained in dealing with producing states when oil markets are tight.”

- “High prices and seemingly scarce supplies create fears—especially evident in Beijing and New Delhi, as well as in European capitals and in Washington—that the current system of open markets is unable to secure supply. The present competition has resulted in oil and gas deals that include political arrangements in addition to commercial terms.” Although they have “little effect on world oil and gas markets because the volumes affected are small,” these arrangements are “worrisome because they lead to special political relationships that pose difficulties for the United States.”

- “Revenues from oil and gas exports can undermine local governance. The United States has an interest in promoting good governance both for its own sake and because it encourages investment that can increase the levels and security of supply.”

- “A significant interruption in oil supply will have adverse political and economic consequences in the United States and in other importing countries.”

- “Some observers see a direct relationship between the dependence of the United States on oil, especially from the Persian Gulf, and the size of the U.S. defense budget.” That said, “U.S. strategic interests in reliable oil supplies from the Persian Gulf are not proportional with the percent of oil consumption that is imported by the United States from the region.” Furthermore, “Even if the Persian Gulf did not have the bulk of the world’s readily available oil reserves, there would be reasons to maintain a substantial military capability in the region.”

More on:

Online Store

Online Store