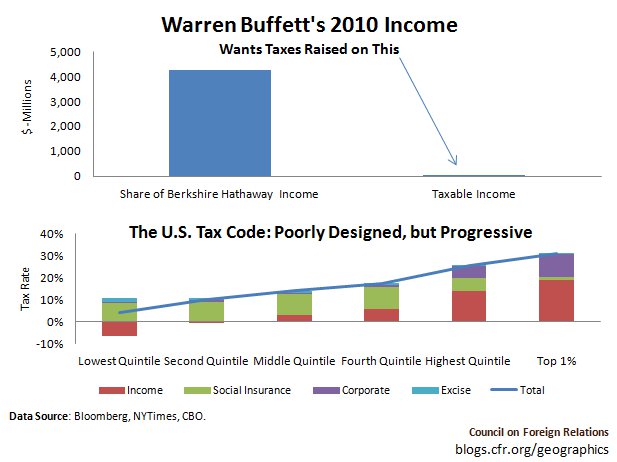

Buffett Wants to Pay Higher Taxes—on Less Than 1% of His Income

More on:

In a now-famous August 14, 2011 New York Times op-ed, billionaire Warren Buffett called for tax rates to be raised “immediately on taxable incomes in excess of $1 million, including, of course, dividends and capital gains.” The key word here is “taxable.” In Buffett’s case, his taxable income is a mere 0.9% of his income held within Berkshire Hathaway, of which he owns 22%. His share of its 2010 pre-tax income was $4.2 billion dollars, taxes on which amounted to over $1.2 billion—a 29% rate. This income would be subject to tax again at the personal rate if it was taken out of the company, but since he has generously pledged to give away his fortune he would avoid the tax he wants to increase. As the bottom figure above shows, when all taxes are accounted for the U.S. tax code—however poorly designed—is in actuality considerably more progressive than Buffett’s storyline suggests.

Buffett: Stop Coddling the Super-Rich

Geo-Graphics: The Payroll Tax Cut and U.S. GDP Growth

Foreign Affairs: The Future of History

More on:

Online Store

Online Store