Do Not Tell Anyone, But the Case For Naming Taiwan a Manipulator Is Stronger than the Case For Naming China

More on:

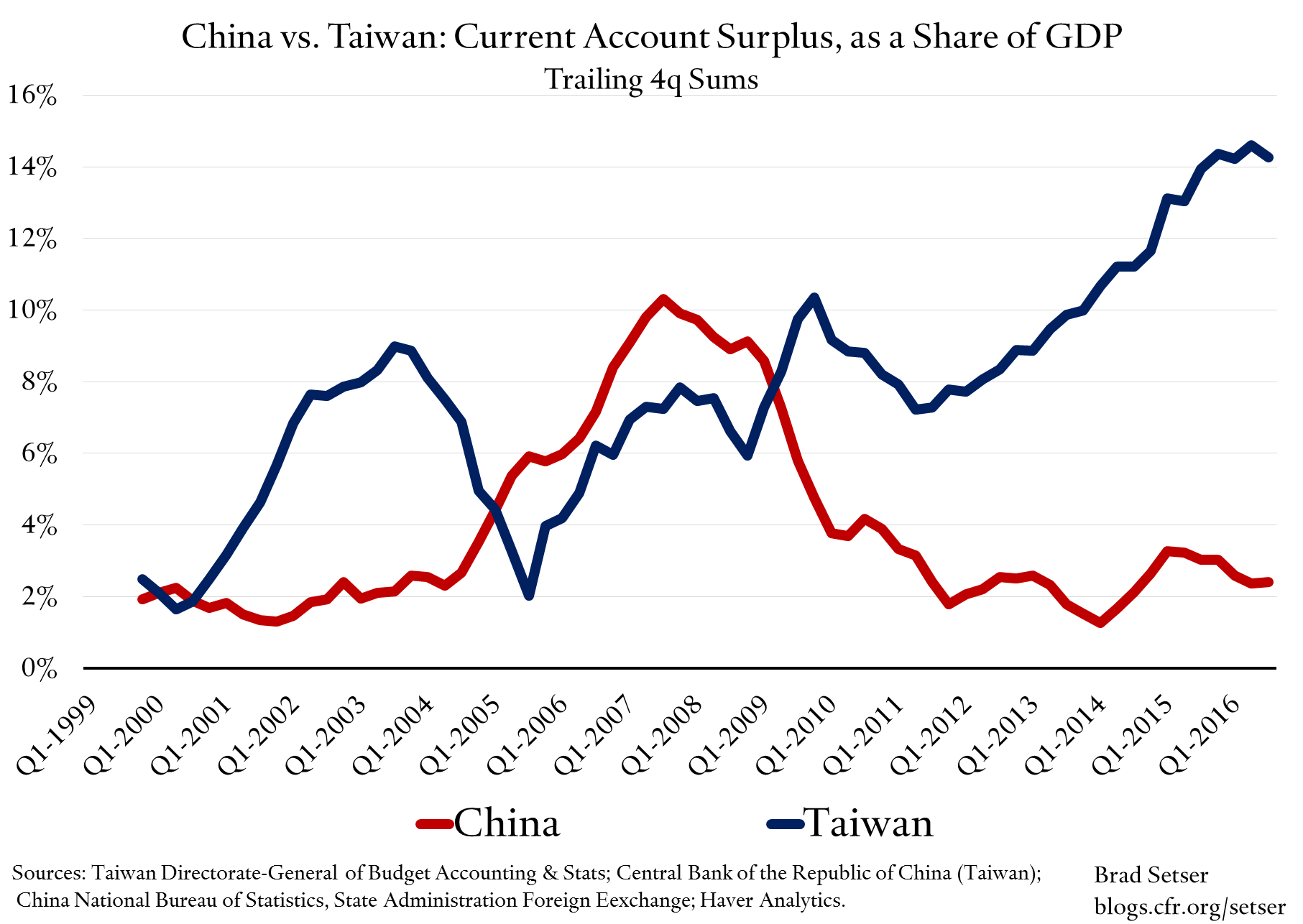

Taiwan has an extremely large current account surplus. Over 14 percent of GDP in 2015, and over 10 percent of GDP since 2012. (See the WEO data or this chart). Relative to its GDP, Taiwan’s current account surplus is far bigger than China’s current account surplus is relative to its GDP.

Taiwan’s central bank clearly has been buying foreign currency in the foreign exchange market. The balance of payments data shows between $10 and $15 billion of purchases a year in recent years, and roughly $3 billion of purchases a quarter this year (data here).

And Taiwan’s government clearly has been encouraging private capital outflows—notably from the the life insurance industry—largely by loosening prudential regulation, and allowing the insurers to take more foreign currency risk. Private outflows help limit the need for central bank intervention to keep the currency down, but also require private institutional investors to take on ever more foreign currency risk.

China by contrast has been selling foreign exchange reserves in the market to prop its currency up. Right now, the case that China is managing its currency in ways that are adverse to U.S. trade interests is not strong.

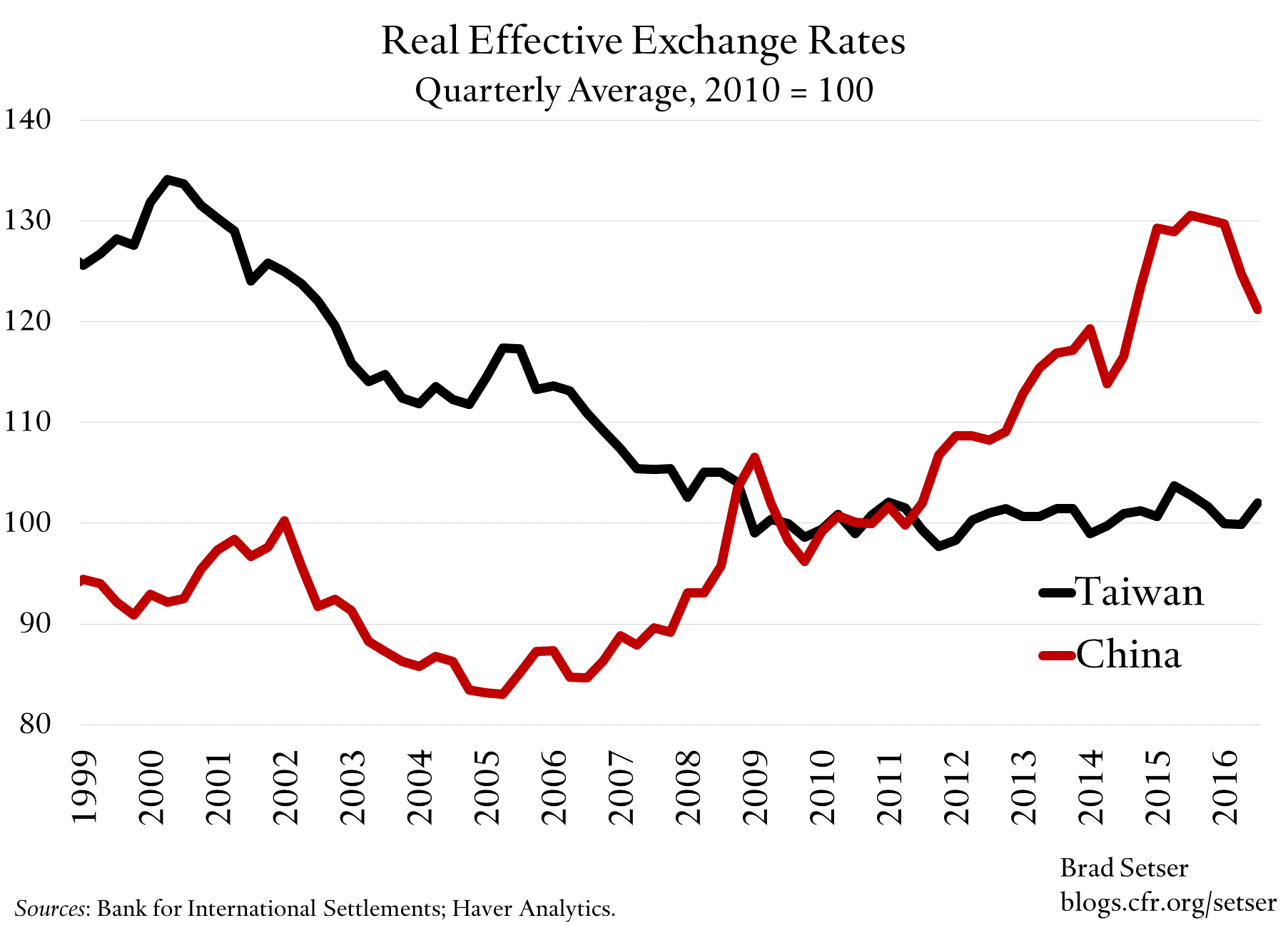

Plus, Taiwan’s real effective exchange rate—using the BIS data—has depreciated significantly over the past ten-plus years, unlike China’s real effective exchange rate. The fact that a weaker real exchange rate has gone hand in hand with the rise in Taiwan’s surplus shouldn’t be a surprise, but there are still a surprising number of folks who believe that real exchange rates don’t matter for trade in an era of global supply chains. In Taiwan’s case, the correlation between a weaker currency and a bigger current account surplus is clear.

“Taiwan is actually intervening in the market to hold its currency down” is the kind of wonky technocratic detail that seems somewhat out of favor right now.*

But it is also factually true that Taiwan has a bigger current account surplus and a more consistent pattern of intervention to resist appreciation over past few years than China does. Korea too, though Korea is a more complex story.** Which adds to the awkwardness of singling China out…if that is in fact what President-Elect Trump plans to do.

And, of course, this is all second order compared to the broader foreign policy issues involved in the "One China" policy.

* Taiwan’s bilateral surplus with the U.S. is modest. But it no doubt would be much bigger if calculated on a value-added basis. Depending on where the quantitative thresholds are set you could make a case that Taiwan would meet the 2015 Bennet amendment’s three criteria. Directionally at least.

** To be clear, Korea intervened heavily to block won appreciation in the third quarter, when the won was around 1100—but it hasn’t been buying recently. No need. The won has sold off with the dollar’s appreciation, with an assist from Korea’s own political uncertainty. It is no longer at levels where the Korean authorities typically intervene to limit appreciation. In fact, the won has depreciated to levels where the Koreans occasionally sell. The detailed data for October indicates very modest sales, after taking into account the fall in Korea’s forward book. November is likely to be similar.

More on:

Online Store

Online Store