Guest Post: The Petrobras Corruption Scandal and Brazil’s Ethanol Sector

More on:

This is a guest post by Luis Ferreira Alvarez, an analyst with Stratas Advisors’ Global Biofuels Assessment and Global Alternative Fuels divisions covering Latin America.

As Brazil’s Petrobras corruption investigation continues to roil its economy and politics, the ethanol sector is emerging as a clear beneficiary. New government policies are boosting ethanol sales, chipping away at gasoline’s market share.

Brazil’s ethanol comes from sugarcane. Each year producers look to market prices and expectations to decide where to direct their crops. When sugar prices fall, ethanol production increases (and vice versa). Producers must also bet on what type of ethanol will bring higher returns: anhydrous or hydrous. Anhydrous ethanol production is more costly, but demand is guaranteed by Brazil’s laws requiring it be blended into gasoline at the pumps. Hydrous ethanol is a neat fuel that’s cheaper to produce, but competes directly with gasoline. It also has a lower energy content, translating into fewer miles per gallon and meaning that prices must stay below 70 percent of gasoline prices to make it competitive. The vast majority of Brazilian cars are flex fuel, capable of running on blended gasoline or hydrous ethanol.

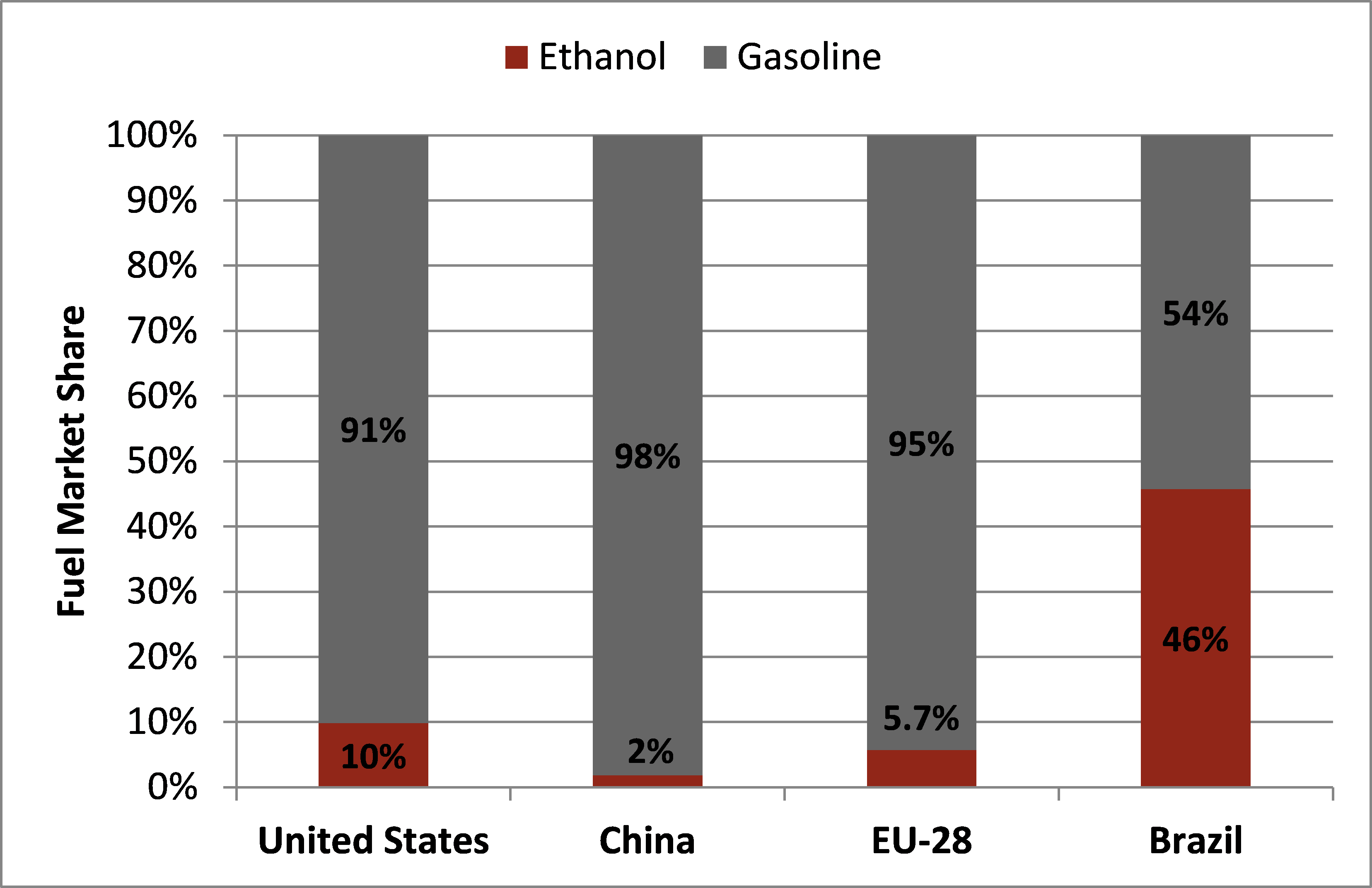

In 2014, Brazil produced 7 billion gallons of ethanol, making it the world’s second largest producer after the United States. Nearly all went to transportation, with anhydrous and hydrous ethanol accounting for nearly 50 percent of all vehicle fuel consumption (Figure 1).

Figure 1: Gasoline and Ethanol Market Shares in 2015F

The last several years have not been easy for ethanol producers. The federal government reduced credit lines provided through the Brazilian Development Bank. Droughts hit harvests in the Center-South region, where some 90 percent of sugarcane is grown. Debt burdened companies, as many had taken out loans during former President Lula da Silva’s quest to make Brazil the “green Saudi Arabia.” And falling global sugar prices hurt an industry still recovering from the 2008 financial crisis.

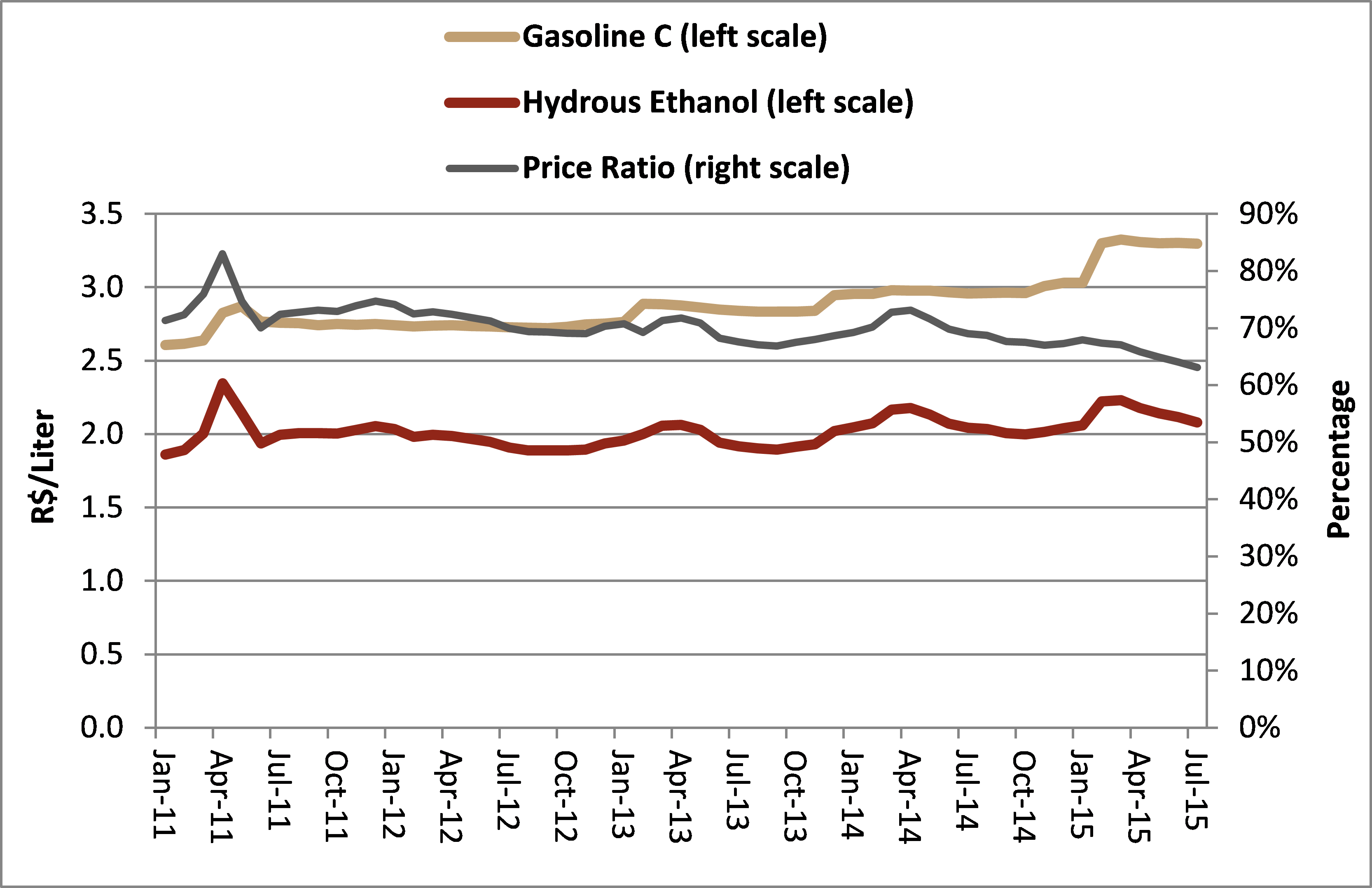

Government policies also undermined the ethanol sector. In its bid to control inflation, the government capped gas prices and removed the infrastructure tax (CIDE) on gasoline, making hydrous ethanol uncompetitive at the pump. Consumers quickly switched fuels, leading to a 10 percent decline in 2012 (Figure 2). As a result, many producers invested in anhydrous ethanol or switched back to sugar. Some forty other ethanol plants folded.

Figure 2: Gasoline C and Hydrous Ethanol Prices in Brazil

In the wake of the Petrobras scandal, the government implemented three major policy shifts to improve its finances and those of the state oil company. First, it increased the required ethanol share in gasoline from 25 percent to 27 percent. Second, Petrobras raised gasoline prices in late 2014. Finally, the government re-introduced the CIDE tax on gasoline in early 2015.

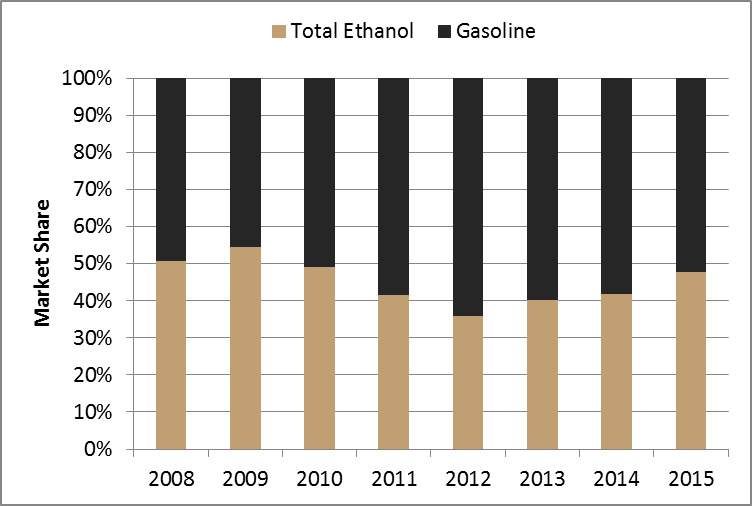

Figure 3: Market Share of Pure Gasoline and Total Ethanol in Brazil

These policy shifts, combined with rain in Brazil’s sugar-producing Center-South region, revitalized the ethanol sector. Producers shifted nearly 60 percent of their sugar harvest to ethanol, and sales rose 28 percent between July 2014 and July 2015 (Figure 3). Although challenges remain—producers are heavily indebted, global sugar prices are low, and gasoline price controls are still in place—ethanol may be among Brazil’s few stable sectors in the coming months.

More on:

Online Store

Online Store