Imbalances Are Back, In Asia and Globally

More on:

The Economist, inspired in part by a recent paper by Caballero, Farhi and Gourinchas, highlighted two key points in its free exchange column criticizing Germany’s surplus:

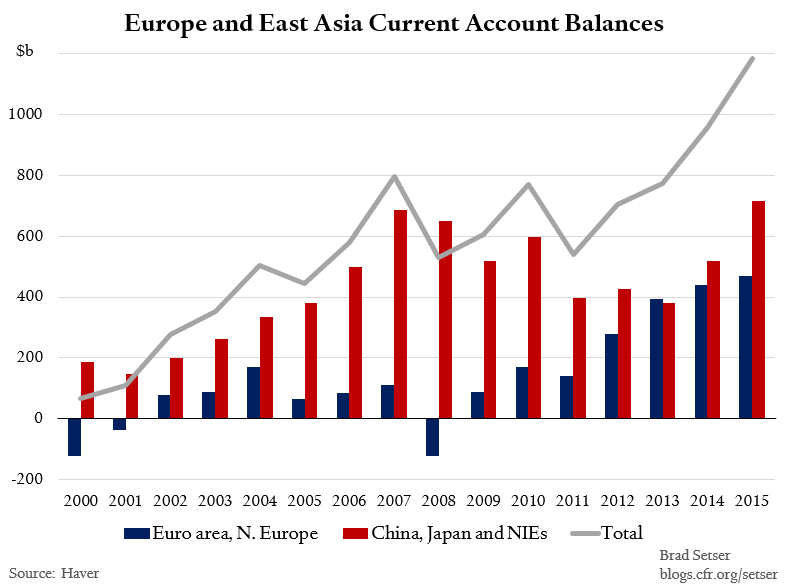

a) Global imbalances have reemerged over the last few years (though this is more obvious from summing the surpluses of surplus countries than from summing the deficits of deficit countries): "... a sustained era of balanced growth failed to emerge [after the global crisis]. Instead, surpluses in China and Japan rebounded. In recent years Europe has followed, thanks to a big switch from borrowing to saving."

b) Those imbalances are a big reason why interest rates globally are low: "Once a few economies become stuck in the zero-rate trap, their current-account surpluses exert a pull which threatens to drag in everyone else."

I have only one small quibble. The rise in Asia’s surplus didn’t just come immediately after the crisis. There was also a significant rise in Asia’s surplus from 2013 to 2015.

Indeed, in 2015, East Asia’s combined surplus actually significantly exceeded that of Europe, adding to the world’s difficulty generating enough demand growth even with ultra-low rates.*

Yes, some of this is oil. But the oil exporters in aggregate aren’t running large external deficits financed by their high saving customers (Russia is in surplus; the Saudis are more an exception than the rule). The IMF puts the aggregate deficit of the main oil exporting regions of the world economy (the Middle East, North Africa, Russia and Central Asia) at $50-100 billion, substantially less than the combined surplus of Europe and Asia. So it isn’t all oil either.

China’s unloved, credit-based stimulus, together with the large reported increase in tourism spending (whether real or fake), looks set to pull China’s surplus down a bit in 2016. But China will retain a surplus of over $200 billion in 2016, and ongoing surpluses in Korea, Taiwan, Singapore and Japan will keep Asia’s aggregate surplus high. I would bet East Asia’s aggregate 2016 surplus will still exceed that of Europe.

There is one additional important difference between the imbalances of the pre-crisis global economy, and today’s imbalances.

Large global imbalances prior to the global crisis came from the combination of large surpluses in Asia and the major commodity exporters—a strange combination, if you think that surpluses (deficits) in oil exporters and deficits (surpluses) in oil importers should trade off. And in both the oil exporters and in Asia, those surpluses were sustained in large part by official outflows (i.e. from governments and central banks). Private flows on net wanted to go into fast growing Asian economies, not run away from them. The puzzle in some sense was why the U.S. attracted large inflows despite having slower growth and often lower interest rates than many major surplus economies.

Today’s surpluses by contrast are predominantly in countries with negative or low interest rates, and thus the flows that support today’s imbalances are mostly private. The euro area, Denmark, Sweden, Switzerland and Japan all have negative interest rates. China isn’t at the zero bound, so in some sense it is the exception. Yet so long as its currency is drifting down there is an incentive for private funds to flee. Korea is another exception, I guess, as it maintains positive interest rates. But it is cutting rates, and it also sustains its surplus in part through intervention.

The best outcome for the world, as George Magnus notes, would be a surge in internal demand in one of the main surplus countries that gives the entire global economy a lift, and helps pull up nominal rates globally. In the Caballero, Farhi and Gourinchas model, monetary expansion by a surplus economy stuck at the zero bound risks exporting its liquidity trap, and pulling other countries into liquidity traps of their own. Fiscal expansion, by contrast, has positive global spillovers.

But for now, that doesn’t seem to be happening, despite a few somewhat encouraging noises from the G-20.

Not in Germany. And not in many of the key countries in Asia, with the possible exception of Japan.

And one of the most obvious risks facing the global economy is that demand growth in one of the main surplus countries could falter. China’s unusually high level of investment over the past seven or so years did not get rid of China’s external surplus, as national savings remained exceptionally high. A more normal level of investment would mean—absent other changes in China that reduce its high level of national savings—less demand from China and more spare Chinese savings that would need to be exported to the world.

Maybe a new rise in China’s surplus would be offset by a fall in the surplus of Europe, or the Asian NIEs.

But, then again, maybe not.

* For East Asia, I summed the surpluses of China, Japan and the NIEs (Korea, Taiwan, Hong Kong and Singapore). I added the surpluses of Sweden, Denmark and Switzerland to the euro area’s surplus to provide a fair comparison. Norway was left out because its surplus hinges on the price of oil.

More on:

Online Store

Online Store