Our Fed Dual-Mandate Tracker Affirms Taper Timing

More on:

St. Louis Fed President James Bullard continues to burnish his reputation as the FOMC’s least predictable member, reversing course on policy for the second time in 3 months—going from dove to hawk and now back to dove again. Having as recently as August publicly advocated a rate rise in early 2015, he is now calling for the Fed to halt its monthly taper of QE3 bond purchases, citing falling inflation expectations.

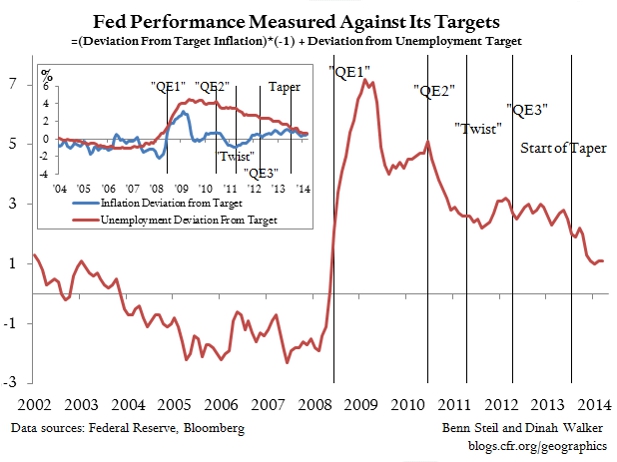

But the Fed’s own preferred measure of inflation expectations, the 5-year 5-year forward breakeven inflation rate, has barely moved since the FOMC’s September meeting—down from 2.4% to 2.3%. Furthermore, as the figure above shows, if we benchmark the Fed’s performance against its dual mandate of price stability and maximum employment, using the Fed’s own definition of each, we see that it has, since the start of the taper in January, been steadily on track towards the zero bliss point.

Bullard has always defended his policy calls as data-driven, but in this case he seems to be navigating more by gut calls as to where the data may be moving in the future. Our dual-mandate tracker suggests clearly that the Fed should stay the course on taper.

Financial Times: U.S. Federal Reserve Set to Halt Asset Purchases

Bloomberg News: Treasuries Rise on Speculation Fed May Keep Low-Rate Policy

Wall Street Journal: Fedspeak Cheatsheet

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store