Yes or No, Greece Needs Debt Relief

More on:

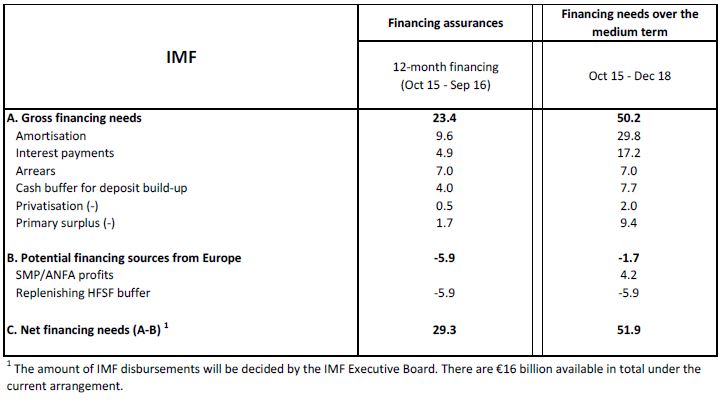

The International Monetary Fund (IMF) has released their most recent debt sustainability analysis for Greece and, while it doesn’t include the devastation resulting from this week’s bank and capital controls, it makes for sober reading. Its bottom line is that, even if Greece were to commit to the policies now being proposed by the creditors, and were to fully implement them, Greece will need over €50 billion in financing over the next three years (see table), and require long-term debt relief through extraordinary maturity extensions and concessional interest rates. Factor in the damage in the past week, and the likelihood of further slippage in the best of scenarios, and the message is clear: however the referendum turns out this weekend, actual debt haircuts eventually will be needed as part of any successful reform program for Greece within the eurozone.

With this document, the IMF is firmly differentiating itself from Germany and Greece’s other creditors in putting “a significant debt operation” squarely on the table, while at the same time still calling for ambitious structural reforms that until now the Greek government has been unwilling to accept. This is consistent with past IMF statements, though more powerful because it is explicit and detailed in its analysis. The Fund also is signalling that they do not want to provide financing for any deal that doesn’t meet these conditions, though whether they can really say no to their major shareholders if it comes to that remains to be seen. That said, given the IMF’s identification with austerity in the minds of the Greek public, a bailout without IMF money may be politically more viable within Greece than one that includes a Fund arrangement.

Where does this leave us?

The referendum will take place this Sunday, as scheduled. Recent polls seem to be leaning to a yes vote, but no one should feel they can predict the outcome with any confidence. If there is a no vote, most analysts see a Greek exit from the eurozone as likely. The government will see itself with a mandate to maintain a tough line, and creditor governments will be unlikely to make further concessions. The limited global market turmoil to date will further strengthen confidence that Europe can weather the contagion that results from Greek exit.

If there is a yes vote, conventional wisdom is that the Greek government would fall. But the politics of any possible realignment are sharply constrained by the deteriorating domestic economy. It will take significant additional liquidity from the European Central Bank (ECB) to reopen Greece’s banks, and that presumably will require agreement on policies. I am further skeptical that the payments system will work well in the absence of physical euros, given uncertainties about whether the banks will reopen or whether deposits are safe. IOUs would allow the government to continue basic services, but would not prevent the further collapse of private activity. If this is the case, Greece may have only a short period in which to decide to take a deal that provides the basis for an ECB decision to reopen the banks, or alternatively move to introduce a new currency.

Yes or no on Sunday, it is worth trying to see if the IMF framework can be agreed. Greece’s European creditors will have to overcome understandably deep resistance to debt reduction for this deal to be on offer after Sunday’s referendum. A Tsipras government with a reorganized economic team should have the capacity to accept this offer. If either side lacks the will to close such a deal, Greek exit from the eurozone will be the best option.

More on:

Online Store

Online Store