- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Introduction There is a serious risk of extremist violence around the 2024 U.S. presidential election. Many of the same sources of instability and grievances that precipitated the January 6, 2021,…Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

Blogs

Follow the Money

Latest Post

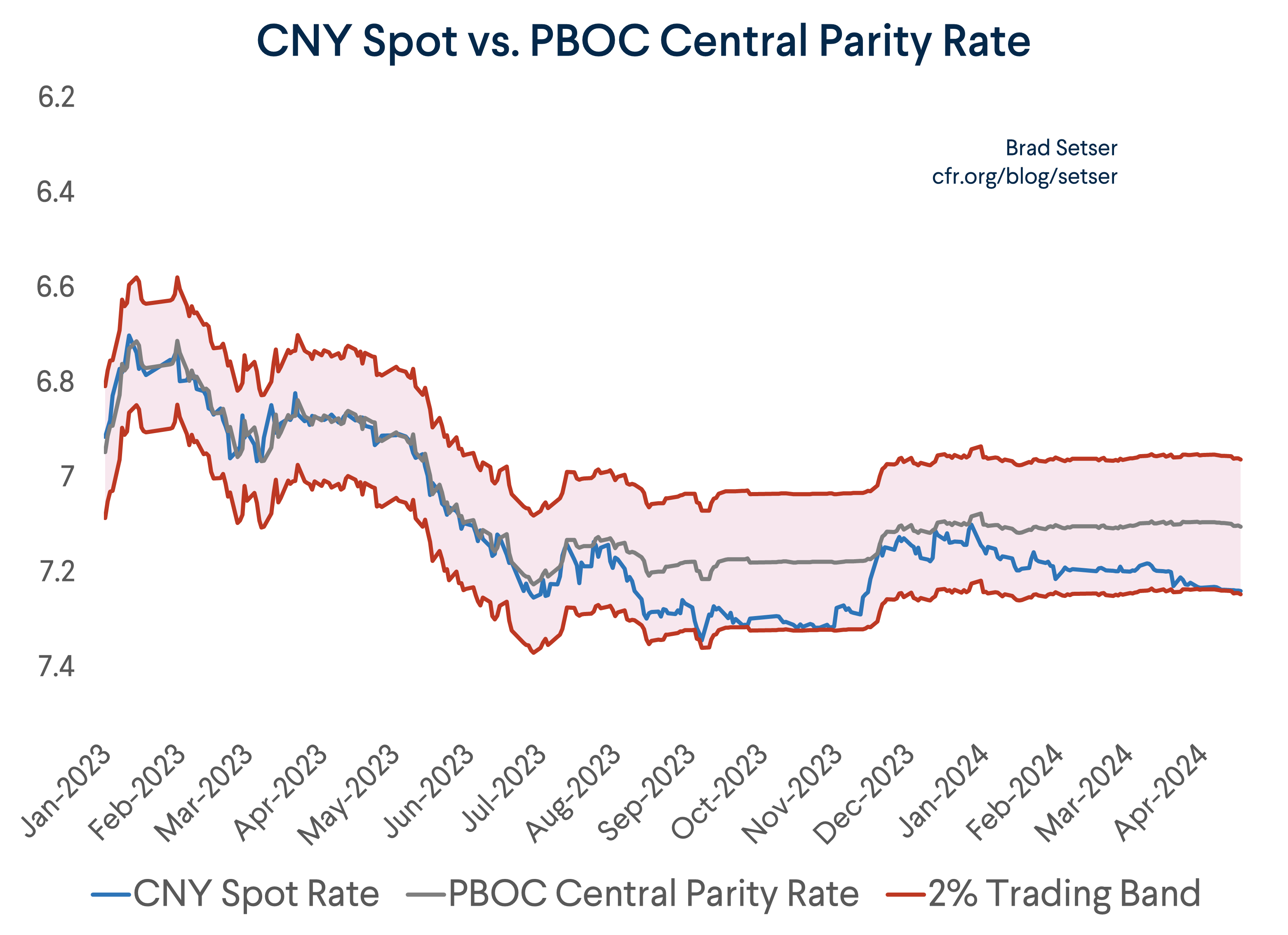

China’s New Currency Peg

The peg that shall not be named, and all the trouble that creates. Read More

Can China Reduce Its Internal Balances Without Renewed External Imbalances?

The rest of the world has a big stake in whether China responds to the demand drag from its construction and real estate slump with looser monetary policy or with direct stimulus to households.

China Isn't Shifting Away From the Dollar or Dollar Bonds

China's reserves has shifted its dollar reserves from Treasuries to Agencies, and made increased use of offshore custodians. The available evidence suggests that it still holds about 50 percent of its reserves in dollar bonds.

How to Hide Your Foreign Exchange Reserves—A User’s Guide

A deep dive into the techniques China used to hide its foreign exchange reserves over the last twenty years

Turkey’s Increasing Balance Sheet Risks

Turkey is heading for a classic currency crisis. All of its reserves and then some are borrowed.

Using an SDR Bond Creatively to Boost Concessional and Climate Finance

Combining an SDR with budget funding is the most efficient way to stretch budgeted dollars (and euros) and increased the global supply of concessional financing.

Getting Debt Restructuring Terms Right

State contingent instruments can play a role in debt restructuring agreements, but they shouldn’t be a give-away to investors. There is a compelling case for their use in Zambia—but not in Sri Lanka.

Online Store

Online Store