China: exporter of imported components or exporter?

More on:

The Economist (New York byline):

“However, it’s not clear how much impact this [A more freely floating currency] would really have on exports. For many of the products it exports, China is merely an assembler of parts made elsewhere, which is why its trade surplus with the rest of the world is less impressive than its bilateral one with America. Should the yuan rise, it will make those inputs cheaper for Chinese firms, so export prices will rise less than the yuan-bashers might hope.”

Murtaza Syed of the IMF (box 1.2 of the Asian regional outlook).

“China has often been described as the assembly line of the world, combining expensive high-tech imported inputs with cheap domestic labor to assemble final goods that are exported predominantly to developed markets in Europe and North America … According to this view, as long as China retains its competitive advantage in cheap labor, movements in external demand and the exchange rate would have limited impact on China’s trade balance.

However, there situation may already be evolving, as a result of increased production capacity and capability with China … According to this alternative view, the domestic content of Chinese exports is rising fast … as a result the trade balance is likely to be more responsive to movements in the exchange rate and fluctuations in external demand.

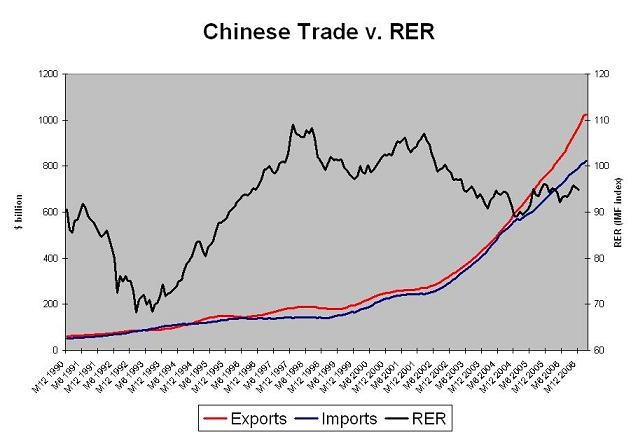

The dramatic shift in China’s trade and production structure observed in recent years tends to support the later view. Over the last two years, China’s current account surplus has risen by nearly 5.5% of GDP, as import growth has begun to lag export growth by a significant margin.”

I tend to agree with Syed and the IMF on this one. Take a look at the chart on p. 24 of the IMF’s regional outlook showing the evolution of China’s trade balance with various regions of the world economy. Since 2004, China surplus with the US and Europe has continued to rise while China’s deficit with the rest of Asia has fallen. And if you look at the chart showing Chinese domestic production of semiconductors (which had to be put on a separate scale …) it is pretty clear that some previously imported electronics components are now made in China.

Electronics isn’t the only sector where China’s role is changing. Things are changing in autos too. Foreign producers in China used to import lot of parts for final assembly in China for the Chinese domestic market. But China is gradually becoming a source of parts – if not assembled cars – for the world market.

I think two things are relatively clear from looking at the recent data. One is that China’s surplus with Europe has increased dramatically over the past few years. China now runs nearly as large as surplus with Europe as with the US. The IMF presents the Chinese data. The European data tells the same story. The EU—25 imported euro 191b ($243b) from China in 2006, and ran a euro 128b ($163b) trade deficit. The US only imported a bit more – $288b v $243, but it also exported a bit less, so its bilateral deficit with China was $232b.

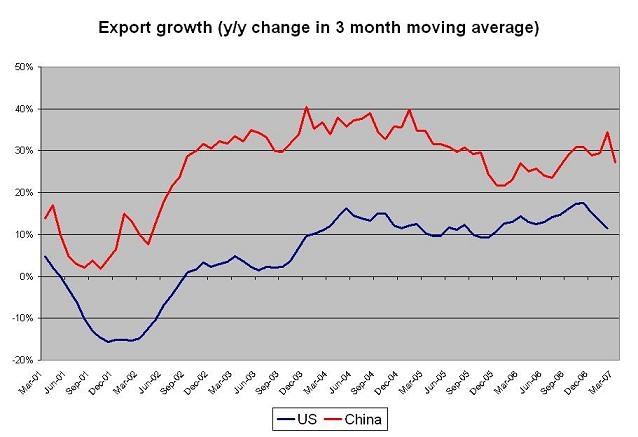

The other is that China’s pace of export growth accelerated significantly in late 2002 and early 2003, and subsequently stayed at a high level. That shows up clearly in the following chart.

There are three plausible explanations for the upward shift in China’s export growth:

- WTO accession;

- State enterprise reform, which made many Chinese firms more efficient;

- The RMB’s real depreciation from 2002 onl.

All three played a role. I would put the most emphasis on the later. Chinese export growth seems to have picked up about the same time US export growth picked up, suggesting that a common factor played a role -- though there is little doubt Chinese exports responded more strongly to the depreciation of the dollar/ RMB than US exports.

The RMB’s real depreciation is certainly the easiest of the three to reverse. After all one would normally expect reforms that increased the pace of productivity growth to push the real exchange rate up – not drive it down.

More on:

Online Store

Online Store