China’s November Reserve Drain

The dollar’s rise doesn’t just have an impact on the United States. It has an impact on all those around the world who borrow in dollars. And it can have an enormous impact on those countries that peg to the dollar (Saudi Arabia is the most significant) or that manage their currency with reference to the dollar. China used to manage against the dollar, and now seems to be managing against a basket. But managing a basket peg when the dollar is going up means a controlled depreciation against the dollar—and historically that hasn’t been the easiest thing for any emerging economy to pull off.

And China’s ability to sustain its current system of currency management—which has looked similar to a pretty pure basket peg for the last 5 months or so—matters for the world economy. If the basket peg breaks and the yuan floats down, many other currencies will follow—and the dollar will rise to truly nose-bleed levels. Levels that would be expected to lead to large and noticeable job losses in manufacturing sectors in the U.S. and perhaps in Europe.

More on:

Hence there is good reason to keep close track of the key indicators of China’s foreign currency intervention.

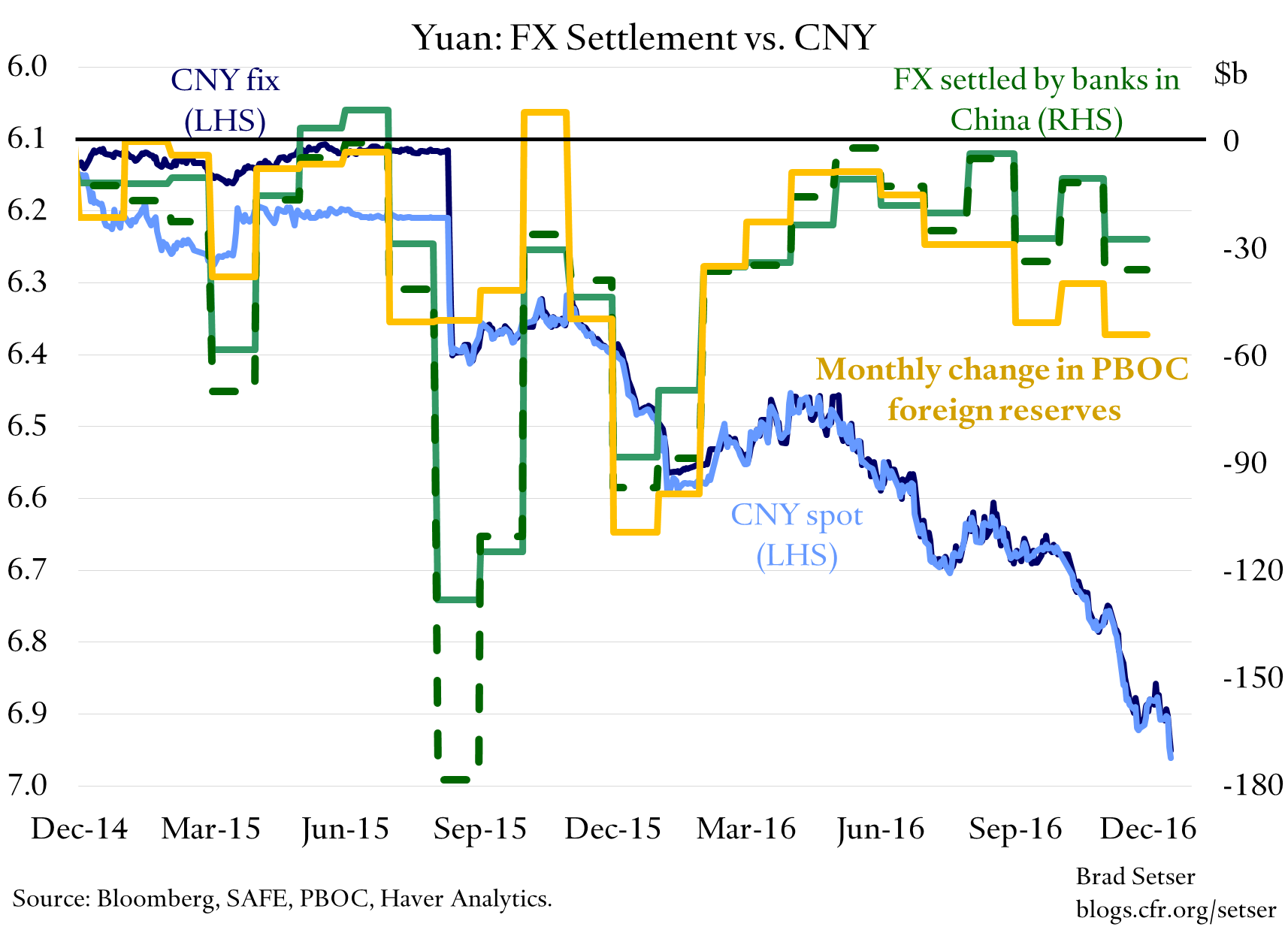

The two main indicators I track are now both available for November:

The PBOC’s yuan balance sheet shows a $56 billion fall in foreign exchange reserves, and a $52-53 billion fall in all foreign assets (other foreign assets rose slightly). I prefer the broader measure, which captures regulatory reserves that the big banks hold in foreign currency at the PBOC.

The FX settlement data—which includes all the state banks but historically has been dominated by the PBOC—shows a smaller $36 billion fall counting the change in the forward position (there is a forward component of FX settlement, but it doesn’t capture offshore yuan—e.g. CNH—forwards). Without the forwards the fall is $27 billion.

More on:

Both measures show larger sales in November than October, though the settlement data suggests a smaller net outflow from the banking system than the PBOC balance sheet reserves data. Both thus highlight why PBOC was worried enough to tighten its controls at the end of November and start to review outward foreign direct investment a bit more tightly (a step that it arguably should have taken earlier). (Goldman’s numbers are similar).

The settlement data shows about $300 billion in total sales by the PBOC and the state banks over the first 11 months of 2016; the PBOC foreign reserves data point to $315 billion of sales over 11 months. Very roughly, that suggests annual sales in the $325 to $375 billion range. With a current account surplus that should be around $275 billion, total private outflows will be at least $600 billion (or roughly $50 billion a month, on average). I say very roughly because I would get a higher number if I adjusted for outflows embedded in the current account—notably the possibility that some of China’s $300 billion plus in tourism "imports" are really disguised capital outflows.

China in my view could sustain $350 billion in reserve sales for a couple of years. $350 billion is 3 percent of GDP, and China still has a bit over $3 trillion in official reserves and I suspect a bit more counting its hidden reserves.

But it is also clear that the pace of outflow has not been constant in 2016.

Outflows were higher in the first part of the year, then slowed significantly in the second quarter (when the yuan appreciated against the dollar), and then rose over the last five months. They still seem correlated with moves in the yuan against the dollar, though the magnitude of the reserve drain in November—when the yuan depreciated significantly against the dollar—was smaller than in January. Possibly that is because China’s controls have had an impact, thought is also could just reflect the fact that there is now less foreign currency debt to pay off.

If the current pace of reserve sales is really the $50 billion a month implied by the PBOC’s balance sheet and its stays there, reserves would fall by $600 billion next year. That is uncomfortable even for China.

China’s exchange rate management problem is that stability against a basket—during periods when the dollar is rising, and thus periods when stability against a basket implies further depreciation against the dollar—doesn’t seem to be enough to limit outflows. What works is stability or appreciation against the dollar. Any depreciation against the dollar still seems to lead to expectations of a further move.

As the following chart makes clear, China has unquestionably managed its currency over the past few months to maintain stability against the basket.

It is also clear that China’s hasn’t managed for stability against the basket consistently over the past year. The dollar now is a bit stronger than it was in late December and early January (back when the yen was over 120). Yet the yuan is weaker against the dollar now than it was then. At some point over the summer China seems to have shifted from managing for a depreciation against the basket to managing for stability against the basket.

I see two possible paths from here.

In one, the Chinese authorities continue to be able to manage the yuan so it remains stable against the basket—whether because the dollar stops rising and that takes some of the pressure off, or because China maintains sufficient control that it can limit the pace of the yuan’s depreciation to what is needed to maintain stability against the basket. A key part of this scenario is that the tighter financial controls prove effective, and outflow pressures abate once Chinese firms have more or less finished paying down their existing stock of external foreign currency debt.

It would help if China used fiscal policy to support consumption and maintain demand growth, and thus depends less on monetary policy and cheap credit to support the economy. It would help if Chinese export growth strengthened on the back of the yuan depreciation since mid 2015, providing a more positive narrative around China’s currency. And of course it would help if the dollar didn’t rise too much more.

The recent sell-off in China’s bond market has generally been presented as further evidence of China’s financial weakness. But it can be viewed as positive signal for the longer-run ability of China to maintain its current system of currency management, even if has disturbed the market: Chinese policy makers are now looking to raise rates and tighten credit for domestic reasons, as inflation has picked up and they are worried about froth in the housing market. It will be easier for China to maintain its current de facto basket peg if the PBOC wants to raise rates alongside the Fed next year.*

In the other outcome, Chinese authorities either loose interest in resisting depreciation—perhaps in response to U.S. tariffs or other policy shifts, perhaps in response to a renewed slowdown in domestic growth—or loose control over financial flows and expectations. And, well, that would mean a much weaker yuan, much more pressure on other emerging currencies, a further leg up in the dollar, further falls in U.S. exports, more trade tension, and likely a rise in balance of payments imbalances globally.

* I agree with Gabriel Wildau’s FT article, which emphasizes how the PBOC has chosen not to offset the impact of foreign currency outflows on money market rates because it wants to tighten money market conditions, not because it is incapable of doing so. " Market participants say the PBoC is taking advantage of capital outflows to squeeze leverage out of the bond market. By calibrating the volume of its reverse repos, the PBoC can passively guide short rates upwards. Higher interest rates have the added benefit of discouraging capital outflows by increasing the returns available on renminbi assets."

Online Store

Online Store