China’s October Reserve Sales, And A New Reserves Puzzle

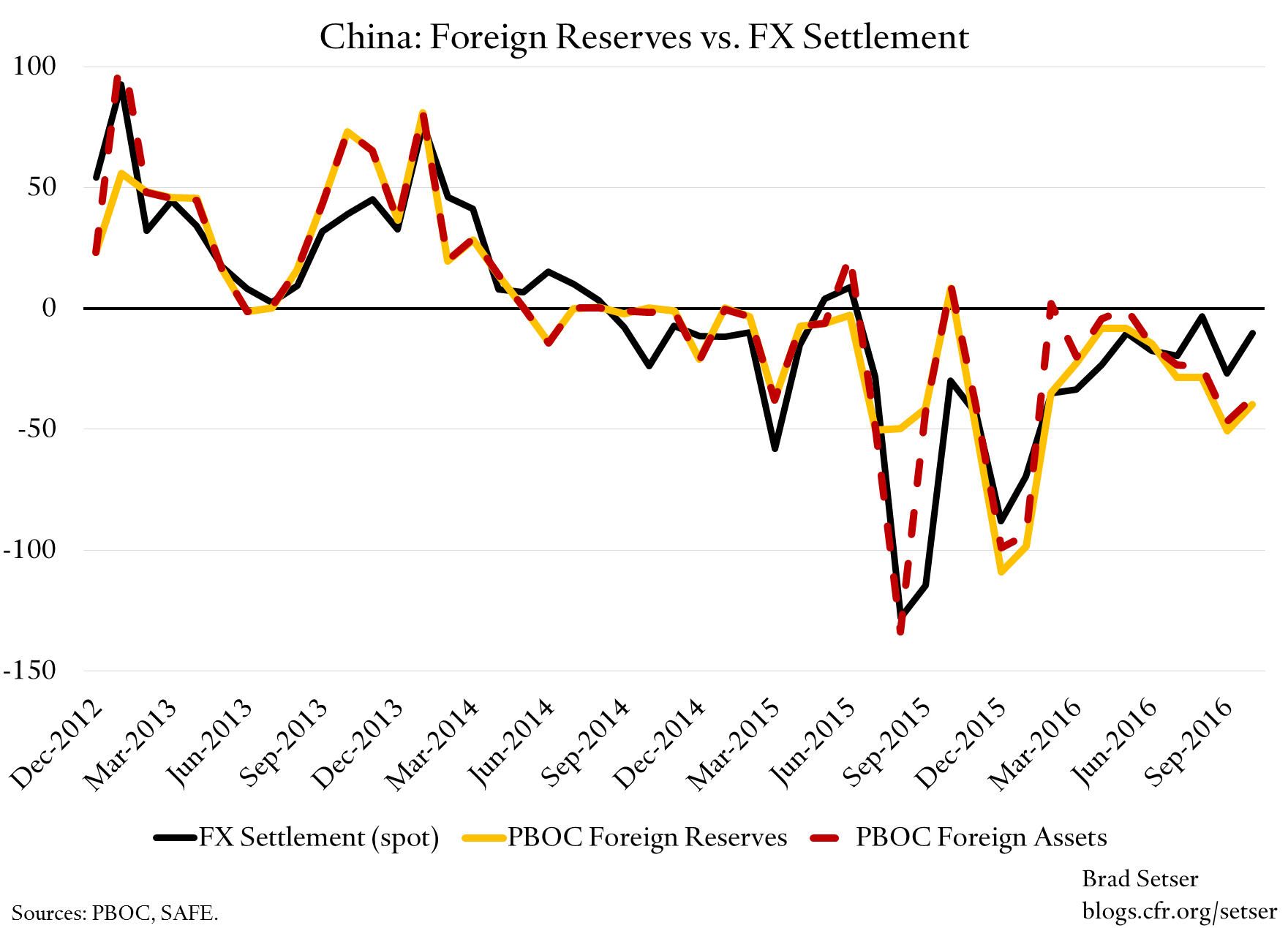

My preferred indicators of Chinese intervention are now available for October, and they send conflicting messages.

The changes in the balance sheet of the People’s Bank of China (PBOC) point to significant reserve sales (the data is reported in yuan, the key is the monthly change). PBOC balance sheet foreign reserves fell by around $40 billion, the broader category of foreign assets, which includes the PBOC’s "other foreign assets"—a category that includes the foreign exchange the banks are required to hold as part of their regulatory requirement to hold reserves at the central bank—fell by only a bit less. $40 billion a month is around $500 billion a year. China uniquely can afford to keep up that pace of sales for some time, but the draw on reserves would still be noticeable.

More on:

The foreign exchange settlement data for the banking system—a data series that includes the state banks, but historically has been dominated by the PBOC—shows only $10 billion in sales, excluding the banks sales for their own account, $11 billion if you adjust for forwards (Reuters reported the total including the banks activities for their own account, which raises sales to $15 billion). China can afford to sell $10 billion a month ($120 billion a year) for a really long time.

The solid green line in the graph below is foreign exchange settlement for clients, dashed green line includes an adjustment for the forward data, and the yellow line is the change in PBOC balance sheet reserves.*

![]()

As the chart illustrates, the PBOC balance sheet number points to a sustained increase in pressure over the last few months after a relatively calm second quarter. The PBOC balance sheet reserves data also corresponds the best with the balance of payments data, which showed large ($136 billion) reserve sales in the third quarter.

Conversely, the settlement data suggests nothing much has changed, and the PBOC remains in full control even as the pace of yuan depreciation against the dollar has picked up recently and the yuan is now hitting eight year lows versus the dollar (to be clear, the recent depreciation corresponds to the moves needed to keep the yuan stable against the basket at this summer’s level; the yuan is down roughly 10 percent against the basket and against the dollar since last August).

More on:

The balance sheet data suggests pressures are building, the settlement data suggests tighter capital controls are working. The Wall Street Journal reports that the state banks are suspected of intervening to limit yuan depreciation on behalf of the central bank on Wednesday, so this isn’t entirely an academic debate.

At this stage, the gap between changes in reserves and the settlement data is getting to be significant. Over the last four months of data (July through October), PBOC balance sheet reserves are down $148 billion while the FX settlement data shows only $60 billion of sales. if you include "other foreign assets" together with PBOC reserves, the gap only shrinks a bit -- the PBOC’s foreign assets are down $130 billion over four months, still way more than $60 billion.

The recent monthly gaps, in annualized, would imply a $200 to $300 billion gap between the PBOC balance sheet data and the settlement data. That is big money, even for a country as large as China.

And to be honest I cannot currently explain the gap. I generally trust the settlement data more, in large part because it historically has shown more volatility, and with hindsight the signal sent by settlement was the right signal. Back in early 2013—when China was struggling with inflows—the settlement data suggested much faster reserve growth than the PBOC reserves data. And last August and September, the changes in settlement were larger than the changes in balance sheet reserves.

In January 2013 and in August 2015 cases, changes in the amount of foreign exchange that the banks held as part of their regulatory reserve requirement turned out to be part of the explanation for the gap between the settlement data and the reserves data (in extremely technical terms, there wasn’t much of a gap between the monthly change in the PBOC’s total foreign assets and the settlement data). The state banks helped the PBOC out, so to speak, and adjusted their foreign exchange holdings so the PBOC didn’t have to buy or sell quite as much.

The most logical explanation of the current gap is that the state banks are buying foreign exchange, so some of the apparent fall in reserves is a shift within Chinese state institutions. But changes in the reserve requirement do not appear to explain the move. For now, it is a real mystery, at least to me.

Help is always appreciated! A key part of reserve tracking is keeping track of the things that you do not quite understand.

* PBOC balance sheet reserves are reported at historical cost in yuan; the PBOC series is thus different from the "headline" foreign reserves that SAFE reports monthly in dollars.

Online Store

Online Store