China’s September Reserves, and Q2 Balance of Payments

China’s headline reserves dipped by about $19 billion in September, dropping below $3.2 trillion. Adjust for foreign exchange changes, and the underlying fall is widely estimated to be a bit more—around $25 billion.

Press coverage emphasized that the fall “exceeded expectations.” To me that suggests “expectations” on China’s reserves aren’t formed in all that sophisticated a way.

More on:

$20-30 billion in sales is in line with the change in the PBOC’s balance sheet in July and August (the FX settlement data, the other key proxy for intervention, suggests more modest sales in August). Throw in the September spike in the Hong Kong Inter-bank Offered Rate (HIBOR) —which suggested a rise in depreciation pressure on the CNY and CNH —and $25 billion in sales is if anything a bit smaller than I personally expected.* Of course, some of the sales could be coming through the state banks; time will tell.

Even if the pace of sales did not pick up in September, there is is an interesting story in the Chinese data. The $75 billion a quarter and $300 billion a year pace of sales implied by the July-September monthly data aren’t anything like the pace of sales at the peak of pressure on China’s currency. But $75 billion a quarter is a still bit higher than the underlying pace of sales in Q2.

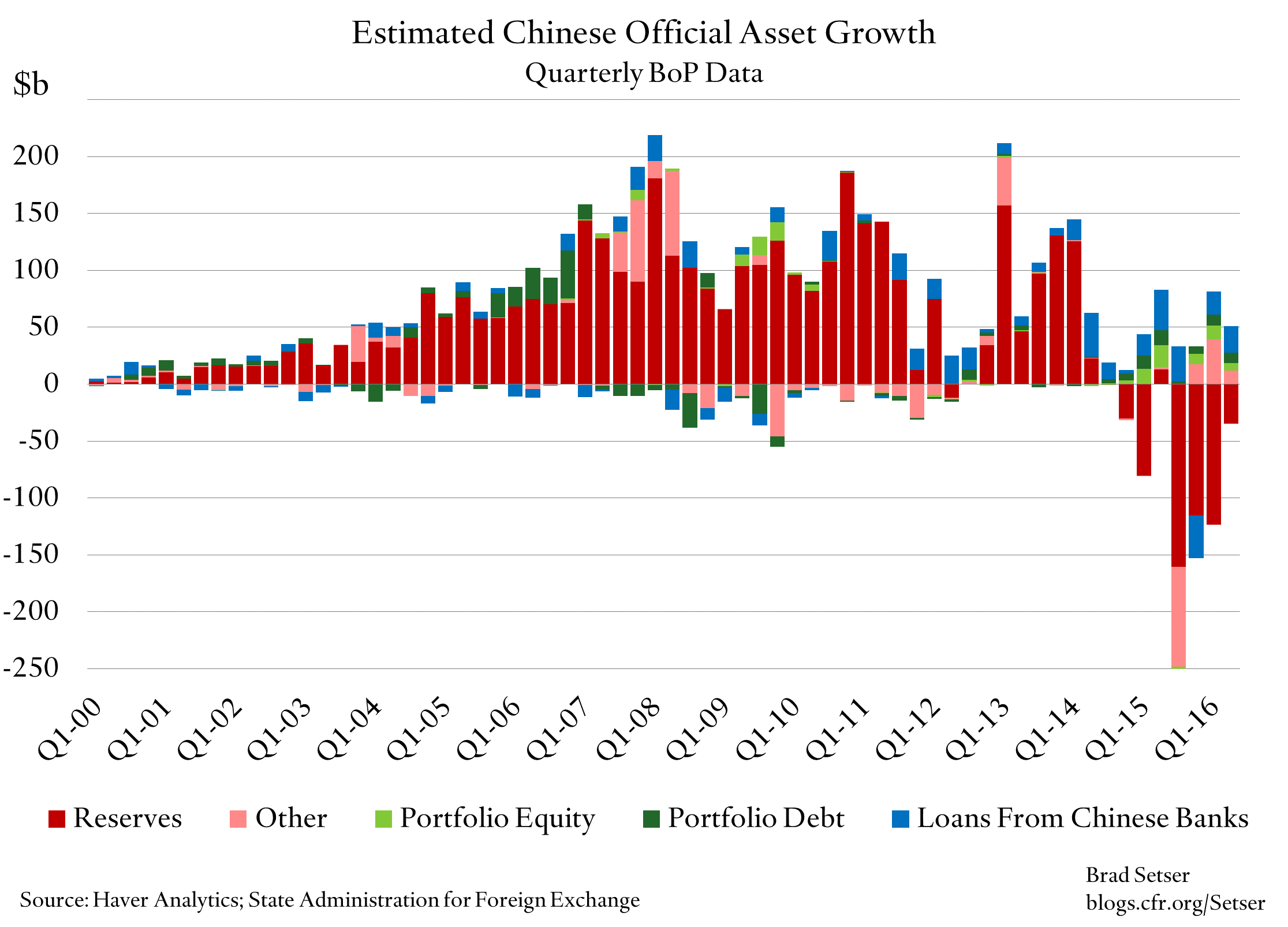

The balance of payments data show Q2 reserve sales of about $35 billion (the change in the PBOC’s balance sheet reserves was $31 billion). But other parts of China’s state added to their foreign assets in Q2. In fact, counting shadow intervention (foreign exchange purchases by state banks and other state actors), I actually think the government of China’s total foreign assets may have increased a bit in the second quarter.

There are a couple of line items in the balance of payments that seem to me to be under the control of the state and state actors. Most obviously, the line item that corresponds with the PBOC’s other foreign assets ("other, other, assets" in balance of payments speak: up $12 billion in q2, after a bigger rise in q1). But most portfolio outflows are likely from state-controlled institutions (portfolio debt historically has been the state banks, portfolio equity historically has been the China Investment Corporation and the state retirement funds in large part). If these flows are netted against reserve sales, there wasn’t much of a change in q2. In my view, shifts in assets within the state should be viewed differently than the sale of state assets to truly private actors.

More on:

To get a positive number in q2, though, you need to add in the buildup of foreign assets associated with the increased foreign lending of the state banks (this adjustment is the most debatable). I suspect that the bulk of the China Development Bank’s outward loans are in the banking data, and thus the loan outflow should be viewed as a policy variable (China for example looks to have shut down this channel in q4 2015). Offshore loans were up about $25 billion in q2—a bit over the five year (2011 on) average of around $15 billion a quarter. That pushes my estimate for the total accumulation of foreign assets by China’s state, counting policy lending, into positive territory.

Q2’s balance of payments data paints a picture of relative stability. I suspect that my broader metric for Q3 will show a fall in q3. And if that fall is eventually confirmed,** there is a question of why pressure picked up.

China’s trade accounts show a substantial surplus (a very substantial surplus on the goods side, and a decent surplus on goods plus travel and tourism—the non-tourism service account is close to balanced). In volume terms, Chinese export growth has picked up—with y/y growth since April on average of 5 percent.*** That is better than the overall expansion of global trade.

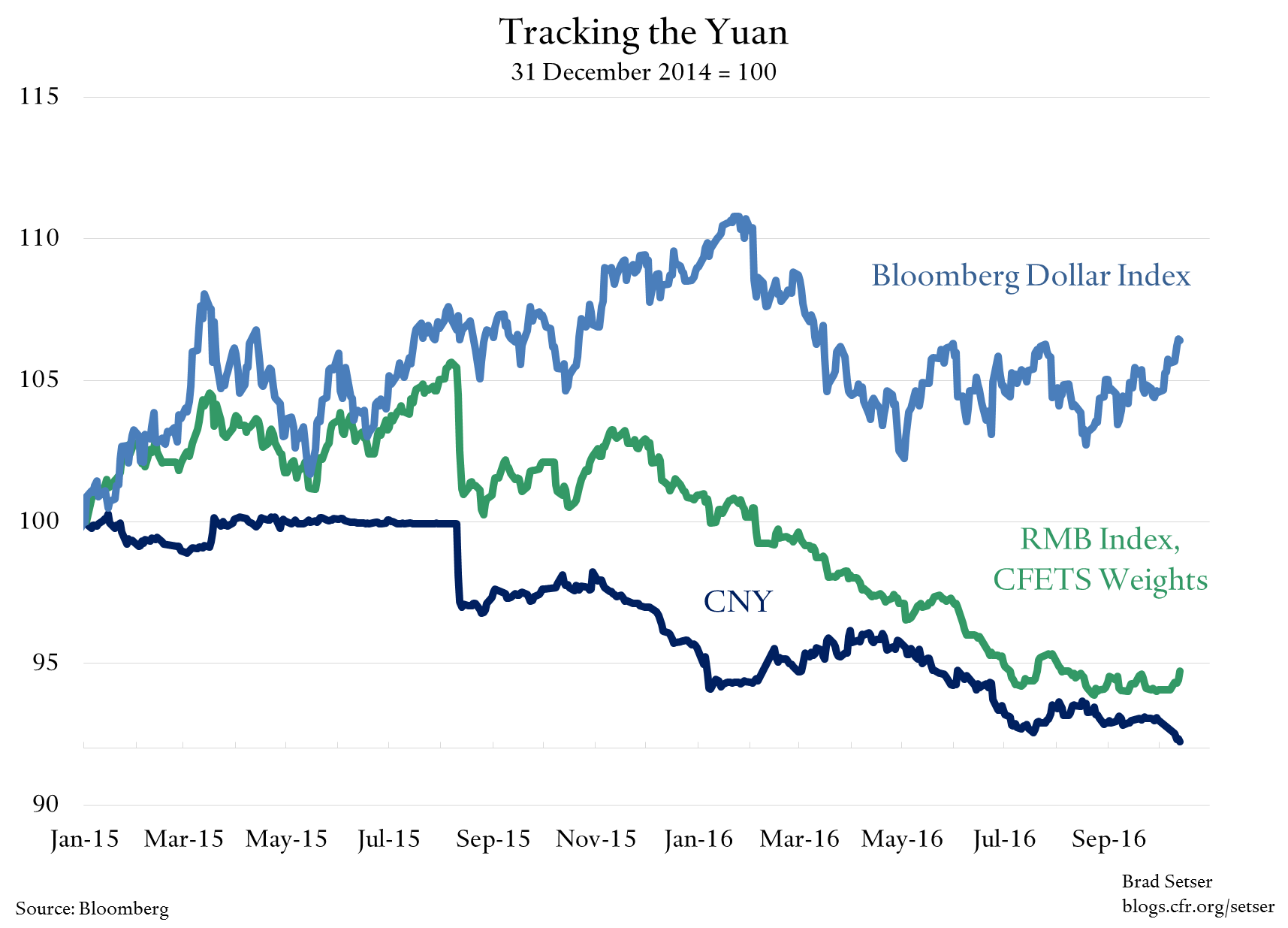

The pressure is all from the financial account. Interest rate differentials have shrunk, but are still in China’s favor. But the interest rate differential now can easily be dwarfed by exchange rate expectations. Over the past 14 months, the yuan has fallen by 8 percent against the dollar.

My guess is that expectations for further depreciation picked up over the course of q3.

The yuan appreciated a bit against the dollar from February through May (while depreciating against the basket). But the yuan depreciated against the dollar after the Brexit vote —and ticked down again a bit in late August. That, in my view, contributed to the expectations that China’s authorities are looking to continue the yuan’s depreciation—at least against a basket—after a temporary pause around the G-20 Hangzhou summit and the final SDR decision. Moves against the dollar still seem to have a disproportionate impact on expectations.

Note: This chart has been updated to reflect data through 10/13/2016

It is not unreasonable for the market to think that the yuan’s future moves against the dollar will be asymmetric. If the dollar weakens against the major floating currencies, China may want to follow the dollar down. And if the dollar strengthens, maintaining stability against the basket—let alone maintaining a depreciating trend against the basket—implies a further depreciation in the yuan against the dollar.

The implication of this view is that the market is (still) betting on where it thinks Chinese policy makers want the currency to go. As long as the market thinks China wants to depreciate one way or another against a basket after Hangzhou and the SDR decision, outflow pressure will continue.

The alternative view is that Chinese residents want to get out of Chinese assets independently of the expected path of the yuan, and that the controls put in place in the spring are starting to show a few more leaks.

The weaker fix on Monday doesn’t really settle this debate; the fix was below the symbolically important 6.7 level against the dollar, but was also broadly consistent with maintaining stability against the CFETS basket. There isn’t yet enough information to determine if China’s current policy goal is stability, or a stable pace of depreciation.

* We don’t know the currency composition of China’s reserves, or the precise way changes in the value of China’s bond portfolio enter into headline reserves. The noise in headline reserves goes up when the expected change is small v the size of the stock, given all the other moves that can impact the stock. Plus or minus $10 billion in headline to me is noise. I prefer the proxies for intervention, which are less influenced by valuation.

** I am waiting for broader measures of sales for September; all analysis for now is contingent on confirmation by subsequent data releases.

*** The simple average of monthly y/y changes in export volumes for 2016 is just below 4 percent; a bit higher than than the simple average of monthly changes in import volumes. Data is for goods only, and the y/y changes are distorted in q1 by the lunar new year. Export volumes are up even with softness in U.S. imports from China (setting finished autos aside)

Online Store

Online Store