Foreign Direct Investment and Jobs in Latin America

More on:

In 2012 Latin America received its largest amount of foreign direct investment (FDI) to date: $170 billion or 12 percent of global flows. These flows went into a range of sectors from mining and petroleum production to high skilled and low skilled manufacturing to telecommunications and electricity.

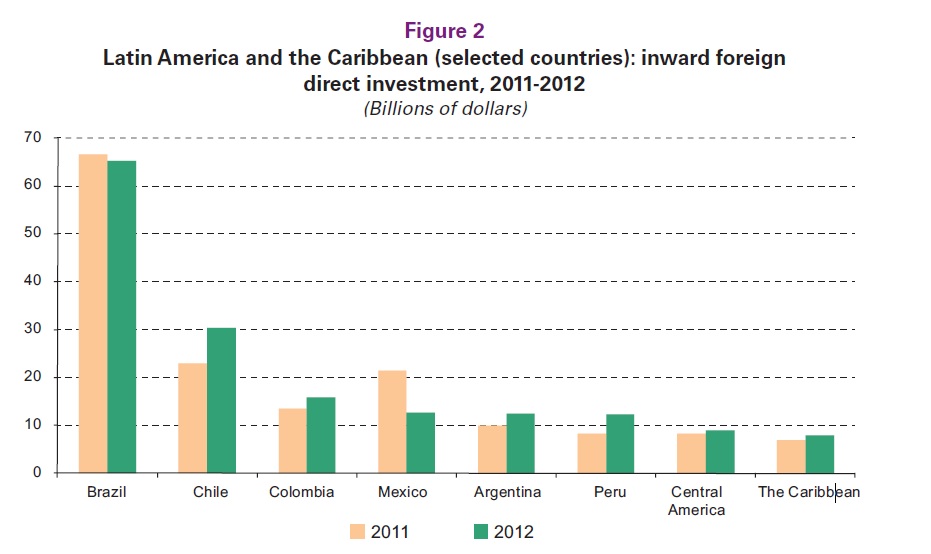

In absolute terms Brazil came out the winner—receiving some $65 billion, followed by Chile, Colombia, and Mexico—totaling roughly $55 billion combined.

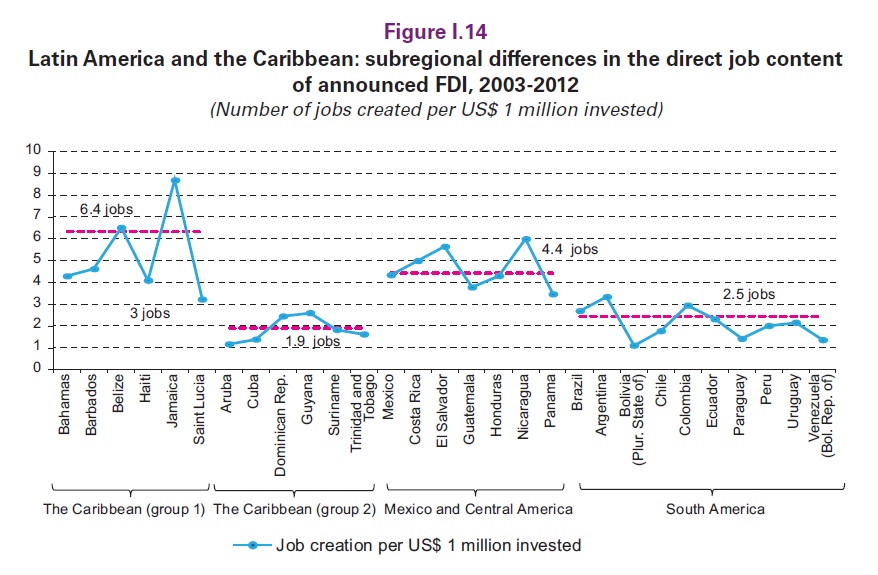

But in measuring the effects of FDI on the host economy, the receiving sector or industry can be as important as the sheer dollar amount. A big difference can be seen in job creation. Investments in construction, commerce, and certain types of manufacturing in Latin America create the most jobs, on average some seven for every US$1 million invested. Investment in engineering intensive manufacturing (such as the automobile industry) and the food industry creates a lesser but still respectable four jobs for every US$1 million invested. The employment benefits of mining and petroleum FDI, however, are much lower, creating just one job for every US$2 million invested on average.

On these measures, the biggest winners are the Caribbean (group one in the chart below), where the concentration of investment in tourism and call centers created over seventy jobs for every US$1 million invested. Mexico and Central America come next, due to the heavy investment in manufacturing. In South America much of the foreign investment went into mining and petroleum, diminishing its benefits for the broader population. This suggests, for instance, that though Colombia received a fifth more in FDI in 2012 than Mexico, it created some 9,000 (15 percent) fewer jobs, as Colombia’s investment went largely into natural resources while Mexico’s headed to its manufacturing sector.

There are other benefits of course, many harder to quantify. One is the “quality” of the jobs created. Most scholars agree that foreign direct investment creates “good jobs” for both workers and host countries. Studies show that foreign firms pay on average 10 to 70 percent more than domestically owned firms (especially true in developing countries and for highly educated workers). And foreign-owned firms are more likely to provide training for employees compared to their domestic counterparts.

Surveys show that multinational companies spend some 28 percent of their R&D budgets abroad, beefing up technology and skills along the way. And foreign-owned firms on average are more productive. Though largely benefiting the companies and their bottom lines, there are channels through which this can “spill over” into the domestic market—as these business link up with others in the economy through supply chains and as trained workers switch jobs (one study shows workers trained by foreign firms contribute 20 percent more to the productivity of their new plant than those who lacked the multinational training).

Foreign direct investment is not an unencumbered good—stories abound about foreign-owned companies flouting domestic laws, exploiting labor, and degrading the environment. But it remains an important and sought after tool for economic expansion. What these studies show is that when focusing on economic development more broadly, not all money is created equal.

More on:

Online Store

Online Store