Give me yield, give me leverage, give me return

More on:

“Give me yield, give me leverage, give me return” perfectly sums up how Wall Street bought itself close to financial ruin. JP Morgan’s William Winters didn’t just create help to create CDOs. He seems to have a way with words.

During the past few years, the Street bet – and bet big – on two theories in its quest for higher returns.

The first was that housing prices never fell. At least not on a nation-wide basis. That meant that lending against a diversified pool of housing collateral wasn’t that risky, no matter how risky the individual borrower might be.

The second was that macroeconomic – and financial – volatility had been vanquished. That, in effect, meant it was OK to try to improve returns through the use of borrowed money.

Neither assumption proved true.

As the crisis has unfolded, the different ways different institutions had bet on a low-volatility-home-prices-only-rise world gradually became clear. Gretchen Morgenson – in her big Sunday New York Times article-- delves into how Merrill Lynch in particular got caught up in the excesses of the boom.

Her article -- which included the Winters quote -- didn’t just look at Merrill though. She noted that Wall Street was a big buyer of mortgages for its "private label" mortgage backed securities at the peak of the housing boom. Morgenson reports that the Street issued $178 billion of mortgage and asset backed CDOS in 2005 – and an incredible $316 billion in 2006. 2006 was when the quest for yield was at its most intense. Short-term interest rates had been raised. That should have squeezed profits. The fact that it didn’t should have been a warning sign.

It turns out that the rapid growth in CDOs stuffed with exposure to risky mortgages -- including "synthetic" exposure from writing credit default swaps on bonds backed by subprime debt* -- was facilitated by the broker-dealers willingness to hold more credit risk on their own balance sheets. If you have any doubts, read Gillian Tett’s reporting from over a year ago.

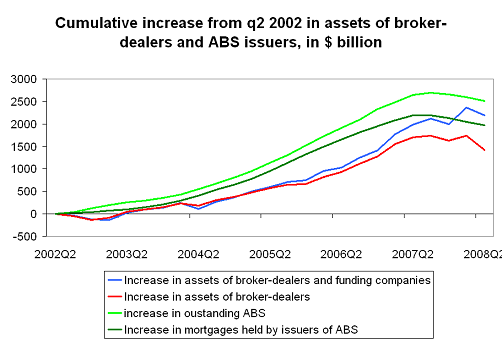

There were clues that this was happening in the Federal Reserves’ flow of funds data. Working off an earlier tip, I added the assets of the “funding companies” to the assets of the broker dealers (see the note in the update; I am not convinced that I consolidated the balance sheets of the broker dealers and funding companies correctly -- I have consequently updated the graphs to show the broker dealers on their own as well as to do a better job of netting out obvious cross investment) The Fed data indicates that the broker-dealers (the big investment banks) increased the size of their aggregate balance sheet from around $1.5 trillion in mid 2002 to around $3.2 trillion in mid 2007 – with close to $800 billion of the increase coming from mid-2006 to mid 2007. That growth corresponds well with the increase in the outstanding stock of asset-backed securities – which increased from $0.8 trillion in mid 2002 to $3 trillion in mid 2007. Roughly $550 billion of the increase in the outstanding stock of asset-backed securities also came late in the cycle, from mid 2006 to mid 2007. To illustrate the correlation, I plotted the increase in the outstanding of the broker dealers and the increase in the outstanding stock of ABS from mid 2002 on.

Correlation doesn’t imply causation, but in this case we have discovered that at least some of the broker dealers were holding a lot of asset-backed securities on their balance sheets -- so there was at least a bit of direct causation.

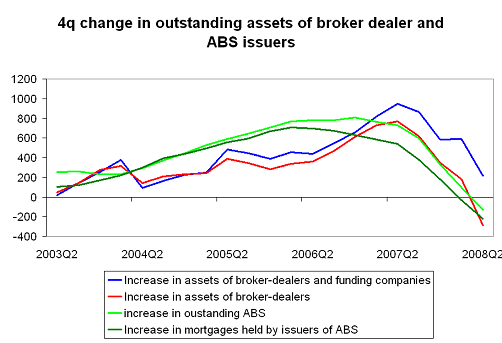

Hints of a relationship between the expanding balance sheets of the broker dealers and the growth in asset backed securities also show up in a plot comparing the 4q increase in the assets of the broker dealers with the 4q increase in the outstanding stock of asset backed securities.

Why does this matter? Accrued Interest – in a recommended post -- explains:

In the period leading up to this recession, we had a overinvestment in housing. Even if nothing else had happened, the adjustment in housing probably would have resulted in a recession. Loans were made that shouldn’t have been made. Houses were built that shouldn’t have been built. We need to clear the excess investment (houses).

However, we also had a financial economy which had become reliant on low volatility and continuous access to liquidity. After the failure of Bear Stearns, Wall Street was forced to decrease their leverage positions. ... This added to the already painful economic adjustment underway.

Then came September.

One last point:

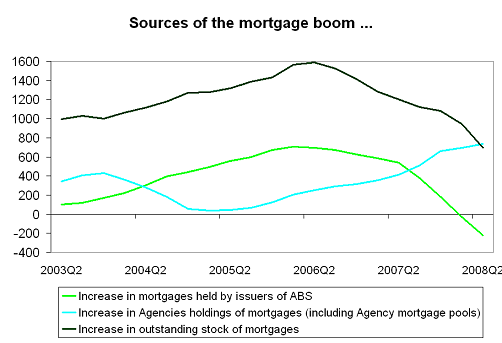

At the peak of the mortgage boom (q2 2006), the fed’s flow of funds data indicates that the growth in the mortgages held by issuers of asset-backed securities, not by growth in the stock of mortgages held by the Agencies, drove the overall growth in mortgage lending.

Agency demand increased in early 2007 -- and then increased even more after last August.

Absent a second source of demand for mortgages, the collapse of the private label securitization business would have led to an even bigger downturn than we have seen to date. However, it also left the US in a position where it was relying heavily on the Agencies to support the mortgage market. Over the last four quarters, the growth in the Agencies mortgage portfolio accounts for the full increase (through q2) in the outstanding stock of mortgages. That is why the willingness (or right now, the unwillingness) of central banks to buy Agency debt matters: it feeds directly into the cost of borrowing to buy a home. That in turn, feeds into home prices – and ultimately the losses the financial sector will take on the risky mortgages that were extended during the boom …

UPDATE. Based on the discussion the comments, I lost confidence in my initial methodology for aggregating the assets of the funding corporations and the assets of the broker-dealers. I adjusted the methodology to do a better job of netting out cross-holdings, but I am still not sure that I got it right. To compensate, I also plotted the growth in the reported assets of the broker dealers alone. The basic story doesn’t really change.

* Yves Smith is skeptical that Merrill was as interested in synthetic CDOs as Morgenson claims. I am not as skeptical – largely because Morgensen’s story matches up with earlier reporting by the Wall Street Journal (see their reporting on "Norma") and the Financial Times.

Synthetic CDOs were composed out of CDS rather than actual bonds. Selling insurance against default on a bond has many of the same characteristics as actually owning the bond. Both are bets that pay off if nothing goes bad. If you own the bond, you get paid back in full with interest. If you sell insurance you collect the insurance premium and never have to pay out. Clever financial engineers substituted one for the other, as for a while, there was more demand for subprime exposure than actual subprime loans from investors eager for big returns (helped along by investment banks willing to take the parts of the structure that investors didn’t want on their own balance sheets) …

The Wall Street Journal wasn’t sure whether the "protection" v default on subprime bonds that Merrill sold to Norma (the CDO) was kept on its balance sheet or sold to other investors. The Journal (Mollenkamp and Ng) wrote:

For Norma, N.I.R. assembled $1.5 billion in investments. Most were not actual securities, but derivatives linked to triple-B-rated mortgage securities. Called credit default swaps, these derivatives worked like insurance policies on subprime residential mortgage-backed securities or on the CDOs that held them. Norma, acting as the insurer, would receive a regular premium payment, which it would pass on to its investors. The buyer of protection, which was initially Merrill Lynch, would receive payouts from Norma if the insured securities were hurt by losses. It is unclear whether Merrill retained the insurance, or resold it to other investors who were hedging their subprime exposure or betting on a meltdown.

Many investment banks favored CDOs that contained these credit-default swaps, because they didn’t require the purchase of securities, a process that typically took months. With credit-default swaps, a billion-dollar CDO could be assembled in weeks.

With the benefit of hindsight, it is pretty clear that Merrill resold the insurance it sold to its CDO machine to other investors -- and that it also bought a lot of the tranches of the CDOs like Norma. The overall result was that Merrill ended up holding a lot of subprime exposure ...

More on:

Online Store

Online Store