Secrets of SAFE, Part 1: Look to the UK to find some of China’s Treasuries and Agencies

More on:

Not everyone who read my earlier post on China’s flight from risky assets was convinced that a large share of the UK’s (net) Treasury purchases should be attributed to China.

Talk is cheap. Mine included.

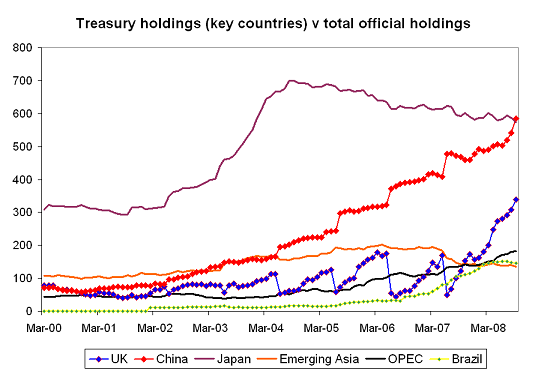

In this case, though, my argument is supported by some real data work – work that I have done in conjunction with the CFR’s Arpana Pandey for a forthcoming working paper on Chinese financing of the US. The graphs -- all derived from the Treasury’s TIC data -- should speak for themselves. Let’s start with a plot of China’s holdings of Treasuries against the UK’s holdings of Treasuries -- a chart that has been spiced up with the holdings of some other countries as well.

Three things jump out of the historical data: The UK’s holdings get revised down every June; China’s holdings get revised up every June; and in recent years, China rise accounts for a significant share of the UK’s fall.

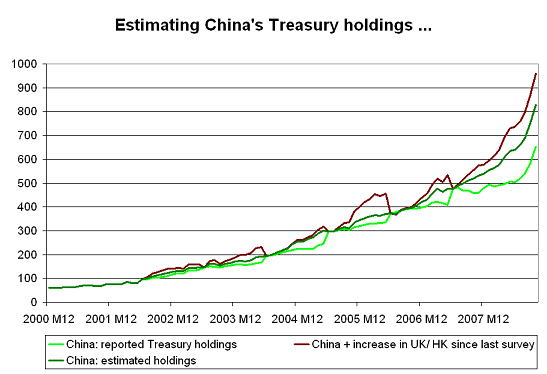

To get a sense of what share of the downward adjustment in the UK’s holdings should be attributed to China I added the change in the UK’s holdings from the last survey (the data is revised in June because the US survey of foreign portfolio holdings is done then) to China’s holdings and plotted that sum against China’s reported holding. If Chinese end-demand accounts for most (net) purchases through the UK, the increase in China’s reported holdings when the survey comes out should bring China’s holdings up to the sum of China’s known holdings and the increase in the UK’s holdings. In 2005 and 2007 (and to a lesser extent in 2006) that is exactly what happened.

On the assumption that the share of the UK’s purchases that are reattributed to China is constant over the year, Arpana and I smoothed out the path of China’s purchases (that is the “adjusted Treasuries” line) so that there isn’t a big jump in June. And if I assume that China accounts for the same share of (net) purchases through the UK recently as it did from mid 2006 to mid 2007, it isn’t hard to get a rough estimate how many Treasuries China holds right now. Try $830 billion at the end of October, and no doubt more now.

That is well above the total reported by the US Treasury. But the Treasury’s data is almost certainly wrong, as it hasn’t been revised since June 2007 and the revisions recently have been large. We just don’t know for sure how far off it is.

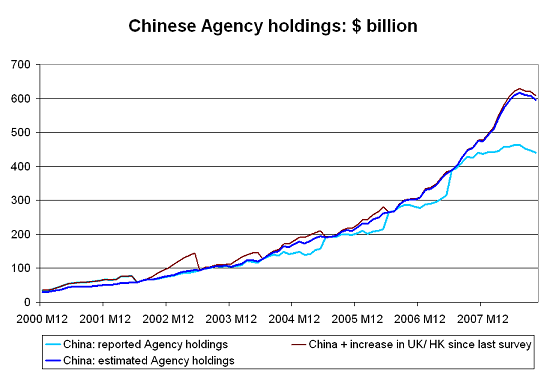

The same technique, incidentally, can be used to estimate China’s holding of US Agency bonds. In the past, China has accounted for a higher share of (net) Agency purchases through London and Hong Kong than of (net) Treasury purchases through those financial centers.

My conclusion: China had around $830 billion of Treasuries at the end of October and around $595 billion of Agencies. That works out to around $1425 billion of Treasuries and Agencies. That is a lot – but remember that China had around $2 trillion in reserves at the end of October. And if you add in the non-reserve foreign assets of the PBoC, the CIC and the funds that SAFE/ the CIC transferred to the state banks as part of their recapitalization, China’s true foreign portfolio is probably around $2.4 trillion. $1.425 trillion Treasury and Agencies works out to about 60% of China’s total foreign portfolio. It is around 10% of the United States 2008 GDP – and around 35% of China’s likely 2008 GDP. Real money.

If anyone wants to challenge that estimate – especially a SAFE insider – please do. I cannot refine my estimates without (constructive) feedback.

And for that matter, if anyone who knows ADIA well wants to challenge the Setser/ Ziemba estimates of ADIA’s size and its 2008 losses, feel free. It is far easier to get a sense of what China is doing from the US data than to get a sense of what the Gulf is doing …

One big caveat: a time will come when the UK’s purchases long-term Treasury purchases will reflect demand from European rather than demand from Chinese investors. Past patterns cannot always be projected into the future. A lot of this analysis is implicitly based on a variable that I haven’t discussed: China’s reserve growth. If I didn’t know that China was adding large sums to its reserves I would have a lot less confidence in these estimates. There is an element of judgment that enters into these calculations.

And one plea: we would all know a lot more about global capital flows if the UK published their own version of the TIC data and did a survey or too of UK custodians. The UK could do a lot to increase the transparency of the global financial system on its own, without any lengthy global negotiations ...

More on:

Online Store

Online Store