Still plenty to worry about ...

More on:

Macroman reports that there is a bit of optimism in the air about China right now. Loan growth was strong in January. Steel prices have picked up a bit. The latest Chinese purchasing managers survey wasn’t as bad as the last one. The fall in the pace of contraction in activity has generated hope that China’s economy will rebound later in the year. China’s stimulus will help, as will the fact that China’s state banks are liquid and have clear instructions to lend ...

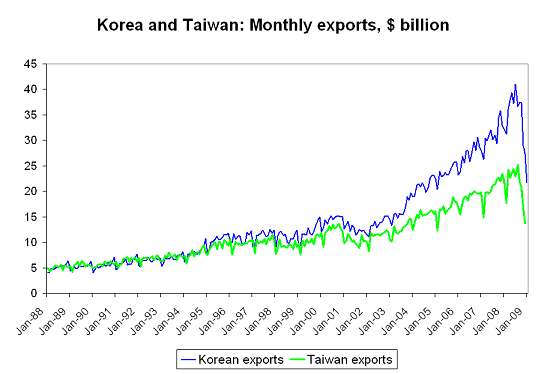

Everyone looks at China through their own lens. My lens is the trade data. And there I still don’t find much basis for optimism. China’s January trade data isn’t out, but Korea’s data is -- and it was awful. The sheer scale of the fall in Korean and Taiwanese exports shows up most cleanly if monthly exports are plotted over time.

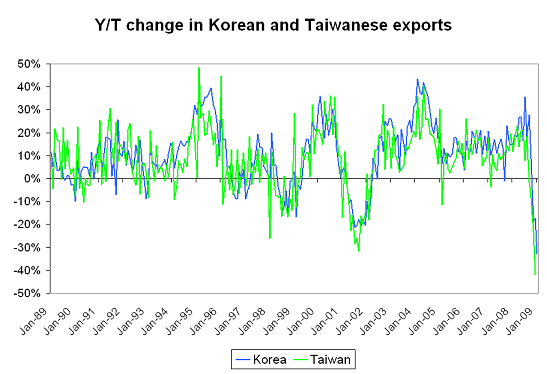

A plot of the y/y change confirms that the current slowdown is sharper than past slowdowns, and given the strong growth in exports over the past several years, a bigger percentage change interacts with a bigger base to produce a far bigger absolute fall.*

I share Paul Krugman’s and Kevin Drum’s assessment of the "Buy American" provisions in the stimulus package: the impulse behind these provisions is understandable, but their likely costs exceed their likely benefits.** But I do wish that there was a bit more recognition on the part of those bankers highlighting the risks poised by protectionism of the scale of the collapse in trade that has ensued from the collapse of the financial sector. Not all risks to the flow of goods across borders emanate from Washington DC.

Back to China. Korea’s exports to China have been falling faster than Korea’s overall exports. The same is true for Taiwan.

There are two potential explanations for these sharp falls.

-- a sharp fall in demand from the US and Europe, which is percolating back through Asia’s supply chain and will soon hit China’s exports.

-- a sharp fall in demand inside China.

Neither strike me as positive for China.

Actually there is a third explanation. The contraction in trade finance and a one-off inventory correction (the buildup of inventories in the US -- think all the cars piled up near US ports -- in q4 triggered a fall in production globally) have pushed Asia’s exports down more sharply than is warranted by the fall in underlying demand. As trade finance is restored and inventories are worked off, intra-Asian and global trade will pick up again.

I certainly hope so. But right now the trade data suggests an ongoing contraction in activity in Asia. That in some sense is the risk Asia incurred by relying so heavily on exports to support their growth. The production of tradeable goods has always been cyclical. Durables in particular. Car purchases can be deferred in a downturn. In a sense, export-based Asian economies made the same bet as the European and American financial sector: both were betting on low levels of macroeconomic and financial volatility in the US and Europe.

Asia isn’t the only source of concern either. European trade is also contracting, though not quite as rapidly as intra-Asian trade. The collapse of cross-border financial intermediation likely means that oil-importing Eastern Europe won’t be able to continue to get the loans it needs to sustain large current account deficits. Oil-exporting Russia clearly has to cut back as well. That means less demand for German -- and other -- exports.

The net result: there is plenty of spare capacity globally. Look at the graphs accompanying Martin Wolf’s commentary on Davos. They suggest, at least to me, that deflation from insufficient demand remains the key risk facing the global economy ...

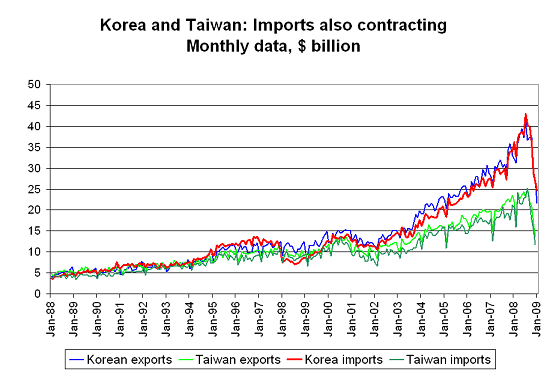

* Thanks to Paul Swartz for help with the graphs. Do check out his updated graphs comparing how the currency recession compares to other post-World War II downturns. Korean and Taiwanese imports have fallen by roughly as much as exports.

I am more surprised though by the scale of the fall in exports. I would expect a fall in commodity prices to lower Korea’s imports and to increase its trade surplus. The fact that the huge fall in imports hasn’t pushed the surplus up is striking.

** There is a real issue though, as the cost (more debt) of a stimulus are born nationally while the benefits are shared globally. But the best response remains a global stimulus, where the US stimulus creates demand for other countries’ good and other countries’ stimulus creates demand for US goods. And -- contrary to Martin Hutchinson -- it really doesn’t matter if the source of demand is "private" consumption or "public" consumption. The key is generating some kind of demand to support activity. If that comes from public spending, find. And if Asian governments prefer spur private consumption, there are a host of ways to do so ...

Bailouts of global banks pose some of the same issues, as the costs of a bailout are born by national taxpayers while some of the benefits are shared globally. A world where national governments (read national taxpayers) are the key pillar supporting demand and banks is likely to be a bit different than a world dominated by private spending and (truely) private banks.

More on:

Online Store

Online Store