A truly global slump. Do not look to the emerging economies for good news ...

More on:

Only a few months ago it was common to argue that growth in the emerging world would prevent a global recession. That forecast looks increasingly wide of the mark. The slowdown in the emerging world now looks to be as severe – and potentially more severe – than the slowdown in the advanced economies.

Morgan Stanley’s currency team recently observed that "Brazil’s growth collapsed in 4Q08, with several activity indicators displaying the worst decline on record." Earlier this year Brazil was growing strongly on the back of both strong domestic demand and strong global demand for its commodities. The domestic growth dynamic (and the improved state of the balance sheet of Brazil’s government) made me think it might be able to ride out this crisis relatively well. Guess not.

Russia is in even worse shape. Output is poised to fall sharply. Danske Bank expects a 3% fall. That might be optimistic. Moving from a budget that balances at $70 oil to a budget based on $41 a barrel isn’t fun even if Russia uses its fiscal reserve to adjust gradually. Eastern European economies that relied on large capital inflows rather than high commodity prices to support their growth aren’t doing any better.

The Gulf is in better shape than Russia, but that isn’t saying all that much. $40 a barrel oil requires the Gulf to dip into its foreign assets, but most countries still have plenty of spare cash (though not as much as before). Still, all of the Gulf is slowing. And the most exuberant bits of the Gulf – Dubai in particular – are in real trouble. Most of the Gulf’s sovereign funds under-estimated their countries need for emergency liquidity. They aren’t quite in the same position as Dubai’s Istithmar (looking to sell Barneys for cash as demand for luxury goods falls), but they presumably do wish that they had more liquid assets -- and more assets that weren’t correlated with oil.

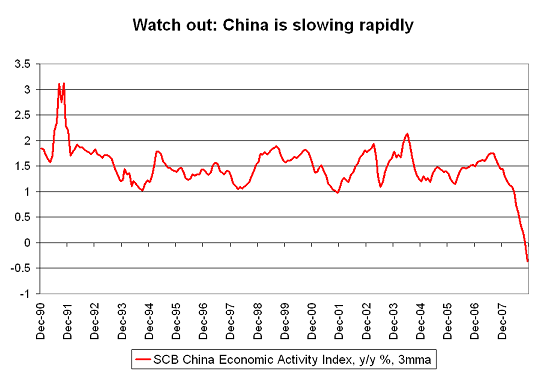

The commodity-importing BRICs aren’t doing much better. India is slowing. And China is really slowing. Stephen Green of Standard Chartered has constructed an indicator of Chinese economic activity that isn’t based on the government’s reported GDP data. It suggests a far bigger fall in Chinese output than in 1998.*

Chinese output shrank in the fourth quarter. The first quarter isn’t going to be any better.

China isn’t alone. The fall in Korea’s output in the fourth quarter was quite large. Even larger than the fall in output in UK, or Japan. Yuka Hayashi of the Wall Street Journal:

South Korea’s economy last quarter shrank 5.6% from the July-September period, or an annualized rate of 20.8%, according to J.P. Morgan, the sharpest contraction since the Asian financial crisis a decade ago.

Singapore and Taiwan are also contracting sharply. Singapore’s economy contracted an annualized rate of 12.5% in q4, and the huge fall in Taiwan’s exports cannot be good for its economic performance. Japan isn’t an emerging economy, but it too saw a sharp fall in output. It isn’t a stretch to think that Asian output could fall more in 2009 than in the 1997-98 Asian crisis.

Emerging economies who thought that they had protected themselves from sudden swings in capital flows by maintaining large reserves and running large external surpluses are discovering that their efforts to reduce their exposure to volatile global capital flows added to their exposure to a global slump in trade.

Emerging economies were growing faster than the mature economies prior to the crisis. But at this stage I wouldn’t rule out the possibility of an outright contraction in the output of the emerging world in 2009. And that could imply that a crisis in the US and Europe could end up producing a bigger absolute swing in activity in the emerging world than in the world’s mature economies …

* This graph was reproduced with permission from Stephen Green.

More on:

Online Store

Online Store