You know it is a crisis when the trade deficit could have been financed just by selling t-bills to China and European banks

More on:

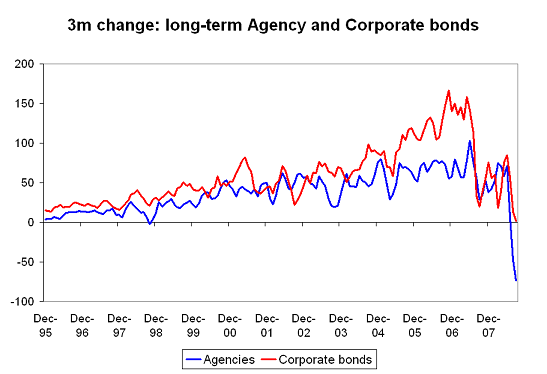

This is an example of what Calculated Risk calls cliff-diving. Foreign demand for any US bond with a smidgen of credit risk has disappeared. Indeed, the fall in demand for Agencies over the past three months is more severe than the fall in demand for US corporate bonds (think securitized subprime mortgages and other securitized housing and consumer debt) last August.

Normally, this kind of fall-off in foreign demand would be associated not just with a credit crisis but also with a currency crisis. A country cannot finance a trade and current account deficit without financing, and two big sources of financing for the US deficit -- foreign purchases of Agencies and foreign purchases of US corporate bonds -- have disappeared. The US, though, isn’t a normal country. The fall in demand for risky US assets was offset by a rise in demand for Treasuries and the sale of foreign assets by Americans.

The numbers here are striking. In September, China bought nearly $40 billion of short-term Treasury bills ($39.3b). Foreign banks (there is a small risk of double counting, as this could include Chinese banks) bought nearly $60b of t-bills ($58.8b). Americans sold $35b ($35.4b) of foreign assets. All told, the US sold $111 billion of Treasuries to foreign investors in September -- throw in the sale of foreign bonds by American investors you get a net inflow of $146b. That is more than enough to cover the deficit. Indeed, it goes a long way to making up for last month’s financing short-fall. (all data comes from the Treasury)

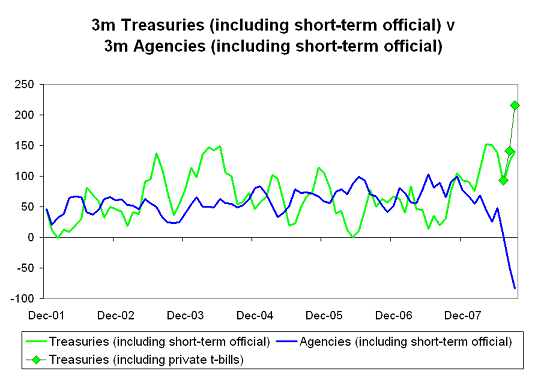

Because most private purchases of long-term Treasuries and Agencies have been revealed to be -- in the course of time -- official purchases, I generally add all long-term Treasury and Agency purchases to recorded short-term official purchases of Agencies to get a measure of official flows. This data clearly shows a massive shift from Agencies to Treasuries.

To complete the picture I added short-term t-bill purchases by private investors to the long-term purchases and short-term official purchases. Total Treasury purchases over the last 3 months totaled $214 billion. That’s huge.

Combining that inflow with $92 billion in net sales of foreign assets by American investors implies that the "flight to Treasuries" and "deleveraging" combined to provide about $300 billion in net financing to the US. That, in broad terms, allowed the US to run a roughly $175-200b current account deficit and cover a huge outflow from the Agency market.

China is particularly interesting case. SAFE clearly has added to the instability in the credit market over the past few months -- and equally clearly contributed to low Treasury yields. That isn’t a criticism -- it is just a statement of fact.

At the end of July, China stopped buying Agencies and corporate bonds and started to pile into Treasuries. Over the last three months of data (i.e. the third quarter), the US data indicates that China has bought $81.1 billion in Treasuries ($45 billion short-term) and added $17.4 billion to its bank accounts -- that is a flow of nearly $100 billion into the safest US assets China can find. Conversely, China sold $16 billion of Agencies, $1.8 billion of corporate bonds and a bit less than a billion of equity.

In the second quarter, by contrast, China bought only $13 billion of Treasuries and added only $2 billion to its US bank account while buying $17 billion of Agencies and $20 billion of corporate bonds.

That is a huge swing -- and frankly a destabilizing swing. The notion that sovereign investors are always and at all times a stabilizing force in the market should be put to rest. China has clearly kept the RMB dollar stable -- and been a big source of demand for Treasuries. But it has been a seller of other assets in a time of stress.

Sovereigns may have long time horizons, but they also have historically been very loss-adverse. China’s current flows suggest that it was reaching for yield in a host of markets back when the RMB was appreciating, and after getting burned it retreated from any kind of risk.

The September data also should put to rest all the talk about China retreating from Treasuries. The real issue is that China has retreated from the Agency market. True, September is a long time ago -- but the Fed’s custodial data doesn’t suggest anything has changed since then.*

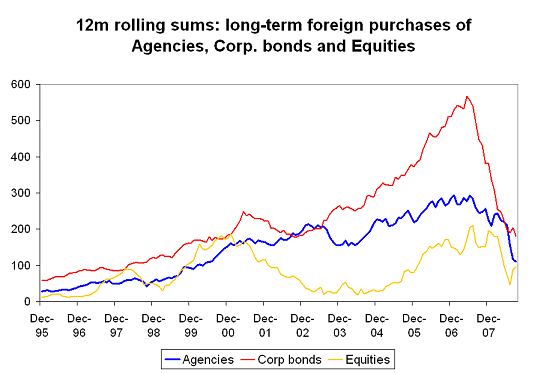

I’ll conclude by looking at trends over a somewhat longer time horizon. Starting last August, foreign demand for most kinds of risky US assets dipped. There is a clear break in a chart showing rolling 12m purchases of corporate bonds and equities back then. More recently, Agencies got reclassified as a risk asset. There was a bit of a fall off in demand for Agencies last August -- but the really big fall off has come recently.

One interesting tidbit -- and this is something I’ll return to later -- is that a lot of sovereign investors were likely starting to dabble in risky assets in the first half of 2007. If that is right, they ended up getting burned. And as a result, all the investment bank analysts forecasting that the rise of sovereign wealth funds would lead to sustained sovereign demand for risky assets proved way off. Right now foreigners don’t seem to be interested in any kind of risky US asset.

Instead they are buying Treasuries.

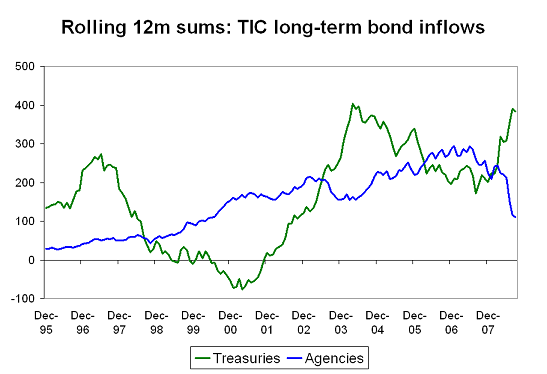

And remember this is just a chart showing foreign purchases of long-term Treasuries. In addition to buying roughly $385 billion in long-term Treasuries, foreign investors snapped up another $240 billion (gulp) in short-term Treasuries. That works out to a net inflow in the Treasury market of over $600 billion ...

Of course, Treasuries aren’t entirely risk free. I don’t believe that there is a real risk the Treasury would default. Buying credit-default swap protection on the US is something by colleague Paul Swartz calls an end-of-the-world trade. But foreign investors holding long-term Treasuries are clearly taking a lot of currency risk -- especially if they are buying in now, after the dollar has rallied ...

The US is taking a risk too. The rising stock of short-term bills held abroad does potentially leave the US more exposed to a rollover crisis.

* The Fed’s custodial data also suggests that the official private split in the TIC data shouldn’t be taken too seriously. Between September 3 and October 1, central banks added $87 billion to their custodial accounts -- far more than the $16.4 billion in recorded official inflows in the TIC data. It is quite possible that some central banks that don’t use the Fed were selling US assets while other central banks that do use the Fed’s custodial facilities were buying. But it is also likely that the September US TIC data overstates private purchases and understates official purchases. There clearly is a large gap between the TIC data and the FRBNY data. Going forward though total official flows should fall off -- as central banks reserve growth almost certainly turned negative in October.

More on:

Online Store

Online Store