- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedRush Doshi is senior fellow for China and Indo-Pacific studies and director of the initiative on China strategy at the Council on Foreign Relations (CFR). His expertise includes China’s foreign polic…

April 15, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate change.

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

March 4, 2011

Elections and VotingNewt Gingrich addresses the 38th annual Conservative Political Action Conference in Washington. (Larry Downing/courtesy Reuters) Someone had to go first. So Newt Gingrich did. While the other major …

April 14, 2015

Politics and GovernmentLong shots sometimes pay off. Just ask Senator Marco Rubio. He won his first race for political office at age 26 by beating an incumbent county commissioner. A year later he won a seat in Florida’s s…

February 26, 2008

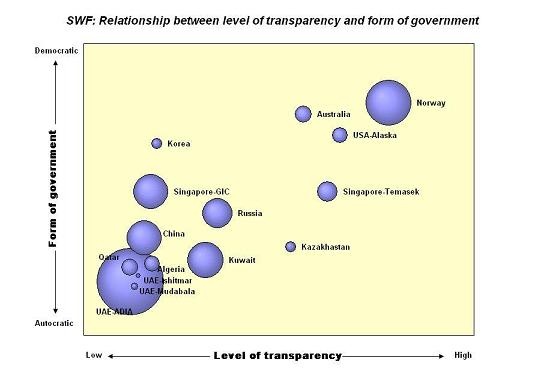

Capital FlowsBob Davis’ Wall Street Journal article - which reports that the US Treasury is pushing Singapore and Abu Dhabi to increase their transparency and to signal that their funds will be managed commercial…

June 15, 2016

Fossil FuelsThis guest post is authored by Jason Bordoff, professor of professional practice and founding director of the Center on Global Energy Policy at Columbia University’s School of International and Publi…

Online Store

Online Store