- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Violence around U.S. elections in 2024 could not only destabilize American democracy but also embolden autocrats across the world. Jacob Ware recommends that political leaders take steps to shore up civic trust and remove the opportunity for violence ahead of the 2024 election season.Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate change.

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

July 22, 2014

Politics and GovernmentSometimes sure things turn out not to be so sure. Just ask Joko Widodo, who is better known to his fellow Indonesians as “Jokowi.” At the start of 2014 he was expected to win Indonesia’s presidential…

March 4, 2011

Elections and VotingNewt Gingrich addresses the 38th annual Conservative Political Action Conference in Washington. (Larry Downing/courtesy Reuters) Someone had to go first. So Newt Gingrich did. While the other major …

April 13, 2015

Politics and GovernmentPakistan has had one. So have Great Britain, Indonesia, Poland, Ukraine, and four dozen other countries. Argentina, Brazil, and Germany have one right now. But the United States has never had a woman…

April 18, 2011

Politics and GovernmentRick Santorum speaks during the Iowa Faith & Freedom Coalition's Spring Event in Waukee, Iowa March 7, 2011. (Brian Frank/courtesy Reuters) Pennsylvania State University can claim many accomplishmen…

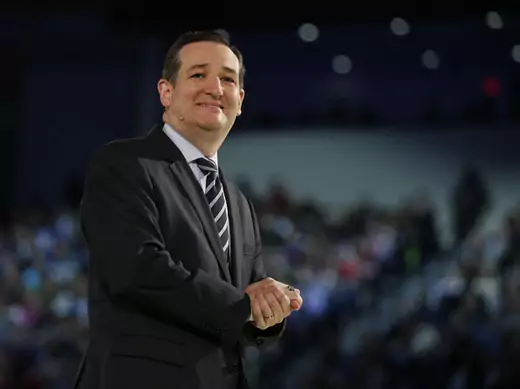

March 24, 2015

Politics and GovernmentSomeone had to be first. When it comes to the 2016 presidential campaign, that person is Senator Ted Cruz (R-TX). Yesterday, he formally announced that he is running for president. Cruz’s rise to nat…

Online Store

Online Store