- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedRush Doshi is senior fellow for China and Indo-Pacific studies and director of the initiative on China strategy at the Council on Foreign Relations (CFR). His expertise includes China’s foreign polic…

April 15, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

March 15, 2013

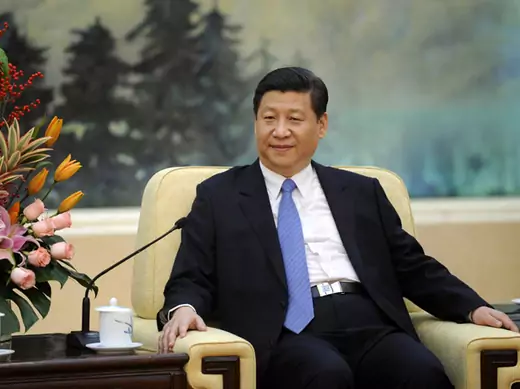

Politics and GovernmentGood news comes in threes. Just ask Xi Jinping. Back in November he was named Secretary General of the Communist Party of China and Chairman of China’s Central Military Commission. Yesterday he picke…

December 30, 2013

Diplomacy and International InstitutionsTen people who passed away this year who shaped world affairs for better or worse.

July 30, 2007

Monetary PolicyBoth the Financial Times and the Wall Street Journal have done a great job reporting on the rise of sovereign wealth funds. Joanna Chung and Tony Tassel’s nuanced analysis of the impact of sovereig…

July 30, 2008

Monetary PolicyRussia’s central bank has indicated that it has cut its holdings of Fannie and Freddie debt by about half since the beginning of the year. Russia’s central bank claims its $100 billion portfolio …

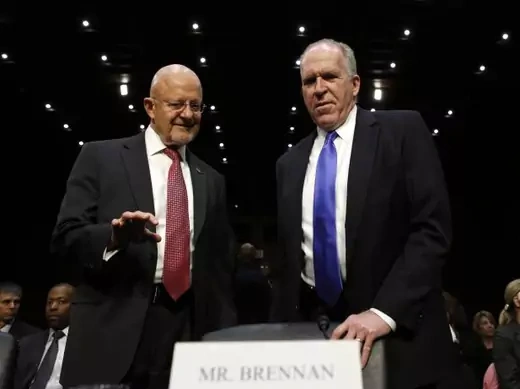

March 13, 2013

Defense and SecurityYesterday, the Senate Select Committee on Intelligence (SSCI) held its annual open hearing on “National Security Threats to the United States.” First started in 1994, the hearing is the rare instance…

Online Store

Online Store