- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedRush Doshi is senior fellow for China and Indo-Pacific studies and director of the initiative on China strategy at the Council on Foreign Relations (CFR). His expertise includes China’s foreign polic…

April 15, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

December 13, 2007

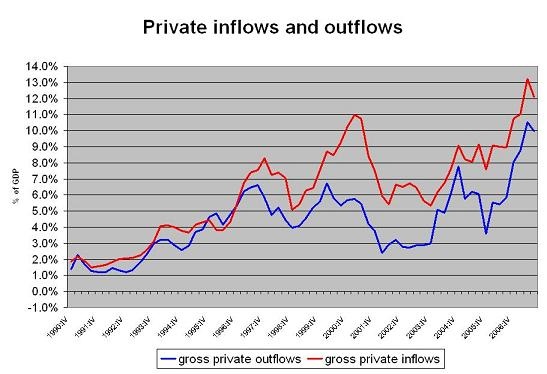

United StatesRichard IleyBrad Setser: Richard Iley of BNP Paribas – the author, with Mervyn Lewis, of a new book on the US current account deficit --- doesn’t see the world quite the way I do. I put a l…

December 18, 2007

United StatesBack in the summer of 2004, Nouriel Roubini and I published a paper arguing that large trade deficits implied a deteriorating US net international investment position and a deteriorating “income” bal…

March 1, 2009

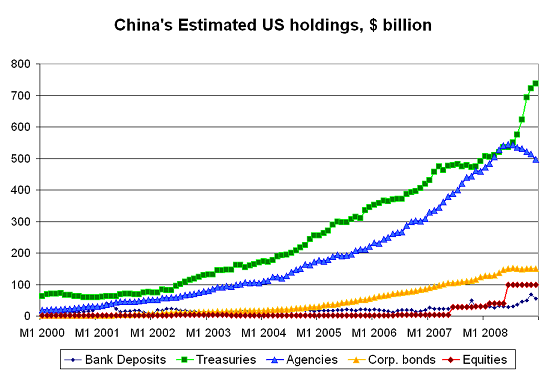

Monetary PolicyLate on Friday, the US Treasury released the preliminary results of its annual survey of foreign portfolio investment in the US. That always makes for an interesting weekend. The survey offers …

November 28, 2007

Financial MarketsOil and the dollar have not consistently moved in the same direction over the past ten years. In 1997/1998, oil tanked and the dollar soared.In 2000, oil and the dollar both rose – in large par…

January 28, 2009

Monetary PolicyRicardo Caballero argues that the current crisis stems from (flawed) efforts to construct safe assets out of risky assets in order to meet a surge in investor demand for safe assets. He is on to som…

Online Store

Online Store