Power and Financial Interdependence

So long as China runs a large trade surplus, Chinese residents (either the government or Chinese firms typically) will need to accumulate financial claims on the rest of the world. Conversely, so long as the United States runs a large trade deficit, the rest of the world will accumulate, in aggregate, claims on the United States. China need not directly finance the U.S. (though it did for a time), but Chinese offshore asset accumulation is necessarily a part of any global equilibrium that sustains U.S. deficits in a world still marked by large Chinese surpluses and large U.S. deficits.

Trade imbalances thus imply financial interdependence and linkage of one form or another. In today’s world, the risk that such interdependence can be “weaponized” is a very real.

More on:

In my new paper for the Institut Français des Relations Internationales (Ifri), specifically for their new initiative on Geoeconomics and Geofinance, I explore the history of the Sino-American financial relationship – and in particular, try to highlight how perceptions of which country truly holds the leverage within the financially unbalanced relationship have evolved over time.

Two incidents are, I think, especially important.

One is the runup in China’s holdings of Agencies and (less visibly) other forms of credit to U.S. financial institutions in years prior to the global financial crisis. Prior to the global financial crisis, reserve growth (by China and others) was massive, both absolutely and relative to Treasury issuance. This squeezed big sovereign investors (and private investors) into close substitutes for Treasuries. Synthetic AAA didn’t work out well, but it was a real part of global finance for a while.

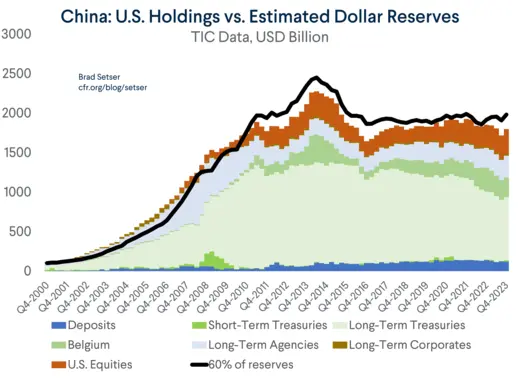

China’s exposure to the Agency market and other less visible exposures to the U.S. banking system (the China Investment Corporation’s investment in the Reserve Primary money market fund for example) taught China of the dangers of excessive exposure to the U.S. well before the current wave of sanctions against sovereign risk. China had more exposure to Agencies than Treasuries in the summer of 2008 – which wasn’t a comfortable position for China.

It also gave China a bit of leverage over the U.S., at least at the time. This leverage was not directly exercised, but the perception at the top of the U.S. Treasury that China’s actions could determine the success or failure of attempts to stabilize financial markets (notably the Agency market) clearly had an impact on U.S. policymakers. At a minimum, it raised the priority that the U.S. attached to its financial dialogue with China. At a maximum, it put pressure on the U.S. to respect China’s core financial interests, which included assuring the safety and liquidity of its holdings of Agencies. Then again, the need to support the Agency market was wildly overdetermined; the U.S. banking system was far more exposed than China.

More on:

At the end of the day, the fact that the U.S. stabilized the Agency market even as China reduced its exposure quite rapidly (whether by roll-off or outright sales) illustrated that the Fed, far more than China, has the decisive vote when it came to U.S. financial stability. The U.S. has learned, I think, that the Fed can buy more than China can sell.

The second episode is China’s decision after the global financial crisis to reduce its exposure to Treasury bonds – at least its visible holdings of Treasury bonds. China’s flight out of the Agencies was initially a slight back into Treasuries (and supply of Treasuries expanded rapidly after the crisis, making this an easy choice). Visible holdings of Treasuries soared from $500 billion in mid-2008 to $1.3 trillion by mid-2010, and from 2010 on China was a significant user of Euroclear’s custodial service.

China found this risky – partially because of the domestic “optics” of having so much of Chinese savings in a country that, even then, was viewed as a less than ideal custodian of China’s wealth. China thus has been looking for alternatives to Treasuries for far longer than most contemporary accounts recognize.* The G7’s immobilization of Russia’s risk crystallized the risks of holding large reserve balances in strategic adversaries in the public eye. But China had been thinking about those risks for many years.

China’s response to risks of a concentrated exposure to the Treasury market was partially to continue diversifying the currency composition of its foreign reserves. This process started in 2005, likely ended around 2012 and ended up costing China a bit of interest income. China accumulated large euro reserve balances just when the ECB decided to adopt negative rates.

But a big part of China’s strategy was to diversify the way it holds dollars – making more use of offshore custodians (Belgium’s Euroclear most obviously) and private fund managers, but also inching back into Agencies and no doubt other forms of dollar exposure that offer both less visibility and a small yield pickup over Treasuries. For example, Chinese institutions are believed to be active suppliers of dollars in the cross-currency swap market.

Most importantly, China decided to stop holding all its foreign assets as “liquid” foreign exchange reserves. A big part of China’s strategy is what China’s State Administration of Foreign Exchange (SAFE) calls the “diversified use” of its reserves. SAFE’s 2020 annual report, which provides a 10-year progress report on this diversification, remains essential.

Diversified use of reserves effectively meant using foreign exchange not to add to SAFE’s formal foreign exchange reserves, but rather to use China’s foreign exchange to directly fund China’s strategic goals (through what SAFE calls the co-financing platform). SAFE handed foreign exchange over to the Silk Road Fund and its close kin, it provided close to $100 billion in equity capital to the China Development Bank (CDB) and the Export-Import Bank of China (Exim), and no doubt more financing via entrusted loans, and it helped fund the offshore activity of “small, medium, and large” financial instruments. I still think my blog on this is pretty good, but would welcome a bit more competition.

Broadly speaking, shadow reserves substituted for formal reserves held in Treasuries – as the state commercial banks and the state policy banks both built up offshore assets of around $1 trillion. The Belt and Road thus should be interpreted as part of China’s reserve diversification – and an early effort at sanctions defense.

One side effect of this policy is increased capacity in the hands of the state banks: indeed, most of the responsibility for exchange rate intervention appears to have been outsourced to China’s financial institutions.

SAFE can sit serenely outside the market on its apparently static $3 trillion reserve portfolio, even as the state banks are called on to maintain the yuan inside its narrow trading band.

One key theme of the IFRI paper is that as a result of these shifts, the form of financial interdependence between the U.S. and China has changed over time.

There was an enormous increase in China’s exposure to the U.S. market between 2002 and 2008. At one time, China held 50 percent of its reported GDP in reserves, and 30 percent of its GDP in U.S. financial assets (that would be $9 trillion today, with over $5 trillion in U.S. assets). China’s visible U.S. holdings are now down to around 10 percent of its GDP. It has substantially more indirect exposure but still much less than it did immediately after the global crisis.

China’s holdings of U.S. assets also increased rapidly relative to U.S. GDP – total reserves rose over 20 percent of U.S. GDP, and U.S. holdings for a while topped 10 percent of U.S. GDP.

These holdings – while still large in an absolute sense – have fallen relative to all the available metrics: China’s GDP, U.S. GDP, and the size of the Treasury and Agency markets.

What’s interesting, at least to me, is that the recent rise in China’s trade surplus hasn’t translated into a big rise in China’s reported U.S. holdings – or into its formal foreign exchange reserves. The surge in the trade surplus coincided with a slowdown in China, and rising rates in the U.S. There no doubt has been a large increase in the offshore dollar holdings of China’s exporters. But that is a much harder flow to trace.

So financial interdependence persists, as it must in a world of chronic imbalances. But the direct financial connections between China and the U.S. have shrunk, and much of China’s exposure to the U.S. now is indirect – and hard to trace. China’s Treasury holdings are now no more than 5 percent of U.S. GDP and 5 percent of the Treasury market – levels that are much more manageable than they once were. I certainly hope there is no return to the large imbalance and associated distortions to global financial flows of the years before the global financial crisis.

My paper for IFRI is available here, in both English and French. The translation is wonderful. Alas, it was the work of Cadenza Academic Translations, not my own hand.

* Zoe Liu’s Sovereign Funds is a great reference here, it is about far more than the creation of the China Investment Corporation.

Online Store

Online Store