How to Hide Your Foreign Exchange Reserves—A User’s Guide

A deep dive into the techniques China used to hide its foreign exchange reserves over the last twenty years

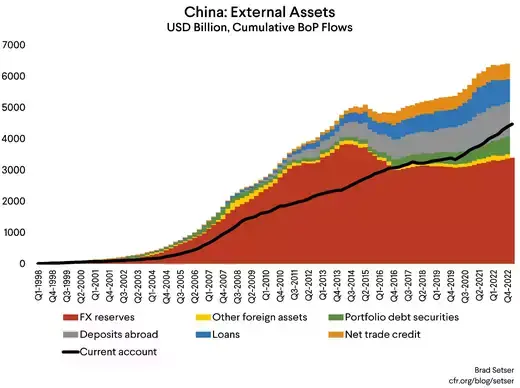

I have a new article in the China Project laying out China’s shadow reserves—foreign exchange either bought by the People’s Bank of China (PBOC) and then moved off its balance sheet, or foreign exchange bought by the state banks who act in the market as if they are working to stabilize the exchange rate. The non-reserve foreign assets of institutions controlled by China’s central government—the large state commercial banks, the state policy banks, and China’s sovereign wealth fund—are now substantial. The balance of payments data implies that the foreign assets of China’s state institutions that are not counted in China’s formal reserves are almost equal to China’s reported foreign exchange reserves.

This matters for a number of reasons.

Technically, it means that changes in China’s reserves aren’t a good measure for China’s actual intervention in the market. China often seems to have bought foreign currency in the market and then lent it to domestic institutions who then invested abroad—at times, on a rather significant scale. That process removes the foreign exchange out of reported reserves, as the PBOC ends up funding foreign loans or foreign asset purchases by other state actors.

It also suggests that China itself has concluded that it doesn’t need more formal reserves, even as its reserves have shrunk relative to measures of reserve need linked to the domestic money supply (reserves remain far larger than total external debt, let alone short-term external debt). Many of the hidden reserves were invested in illiquid assets, and they won’t magically become liquid in a shock. But China’s underlying capacity to generate foreign exchange is far stronger than the growth in its reported reserves implies.

Finally, and perhaps most importantly, it suggests the PBOC has substantial leverage over the institutions that have been at the center of China’s Belt and Road Initiative, as many have been funded directly out of China’s reserves—and thus the PBOC may have latent capacity to do more to contribute to a constructive resolution of the debt difficulties of several low-income countries.

A bit of throat-clearing: this piece is about how China has managed the foreign assets of its state over the past twenty years, not about how the PBOC and the state banks have acted in the foreign exchange market over last twelve months.

China is currently suffering from a crisis of confidence, with a weaker than expected post-COVID bounce as well as ongoing difficulties in the property market and with local government finances. Weak investment has kept Chinese policy rates down, and the interest rate differential and geopolitical risks have generated substantial outflows that are, for now, absorbing the current account surplus without a substantial buildup of assets in the state banks over the last year.

But over a longer period, China’s balance of payments hasn’t balanced without the buildup of state assets abroad. Private outflows haven’t consistently offset the inflow from the current account. During periods of strong Chinese growth, China has often intervened in the market, and by more than a simple examination of the central bank’s reported foreign reserves would suggests.

The PBOC talks about how the exchange rate is now mostly market-determined. I don’t think that is quite true though— as recently as 2020 and 2021, the state banks were adding to their foreign assets at a rapid clip and certainly seemed to be pushing back against pressure on the yuan to appreciate. And last fall there were widespread reports that the state banks stepped in on the other side at the request of the PBOC, reducing their net foreign asset position to support the yuan amid broad dollar strength.

Why would China want to hide its reserves?

At some point, China likely found that holding more reserves was more trouble than it was worth. Lots of reserves meant lots of scrutiny of its activity in the foreign exchange market. And lots of reserves managed in traditional ways raised questions in China about why it was putting so much money into Treasures (and Agencies) rather than contributing more to its own development—and why it was funding a country that in China’s eyes wasn’t a strategic friend. Channeling funds through the China Development Bank (CDB) and China’s Export-Import Bank (EXIM) delivered more visible benefits to Chinese firms, and—at least when the money was flowing out—more political influence globally than just buying Treasuries.

How do you hide reserves?

The answer is pretty simple: you can sell them to another part of the government (typically a sovereign wealth fund) or lend them to a bank or other investment fund. Those loans can be formally off the balance sheet—a swap is basically a loan of dollars (with the PBOC getting yuan as collateral) but it registers as a spot sale of dollars and a forward purchase and need not be disclosed. A simple loan of foreign currency to a domestic bank effectively moves it out of disclosed foreign exchange reserves as well as out of the public eye. The only complex part comes when the state banks act as a stabilizing force in the foreign exchange market using their own balance sheet.

Alas, these simple techniques have often been effective in masking the true scale of China’s intervention in the market over the past twenty years as well as the true role of China’s state in moving funds out of China and into global markets.

Where concretely has China hidden its reserves?

The China Investment Corporation—China’s SWF

The transfer of funds from SAFE to the China Investment Corporation (CIC) is the best documented use of China’s spare reserves, but the mechanics of the transfer of reserves over to the CIC are now largely forgotten and at times mischaracterized. Back in 2007, the CIC was announced with an initial size of $200 billion. But it didn’t immediately get $200 billion of China’s reserves, rather it was authorized to issue bonds domestically sufficient to buy $200 billion of assets from SAFE.

Nor did all of the $200 billion go into buying foreign exchange off the balance sheet of the PBOC. The CIC actually used a big chunk of that borrowing to buy Central Huijin, the vehicle that the PBOC set up to manage the equity it got in the state commercial banks in exchange for injecting reserves into the banks as part of their recapitalization and listing way back when. Those stakes were bought at cost, so the CIC got a bargain.

The CIC is thus mostly a bank holding company. It owns the big five state commercial banks and has a large stake in the China Development Bank. Those equity stakes (long-term equity investments in its annual disclosure) account for $875 billion of its $1.35 trillion in assets. As a result, its foreign assets are only a fraction of its total disclosed portfolio (they would mostly be in “financial assets at fair value through profit and loss”). Sadly, folks often get this wrong and use total assets as a proxy for foreign assets. For example, the FT’s otherwise excellent story on China’s state investment in private equity made this error; it is so common as to be routine.

While the CIC was formally started in 2007, the balance of payments data suggests that the bulk of the funds were not transferred out of reserves until 2009 and 2010. That is when “portfolio equity” outflows surged—and, at the time, truly private Chinese investors didn’t really have access to foreign equity markets.

The CIC’s own reporting is consistent with the balance of payments data.

The CIC’s 2009 Annual Report disclosed that it had $55 billion in investment assets at the end of 2008—but $45 billion of those were in cash management products (such as money markets funds—including reserve primary) and only $3 billion were invested in equities or private equity. By the end of 2009, the CIC had over $45 billion in equities and alternatives and by the end 2010, the CIC has $133 billion in “financial assets at fair value”—including $66 billion in equities and $29 billion in alternatives.

The CIC also set up a Hong Kong office in 2010 that ramped up in 2011 and 2012. SAFE’s 2020 Annual Report suggests that it contributed to CIC investments—as seen in the CIC annual reports—which show an initial $30 billion contribution in 2011.* By the end of 2012, that contribution rose to $49 billion. That brought the CIC’s disclosed “financial assets at fair value” up to around $190 billion (the CIC also reported $57 billion in other liabilities at the end of 2012, a total that likely include funds transferred from SAFE’s reserves).

That initial pool, plus accumulated returns, is likely the core of the $365 billion in financial assets reported in the CIC’s 2021 Annual Report. The CIC reports about half of that is in alternatives, and the Financial Times marshalled evidence suggesting that it is mostly in private equity funds. That keeps it out of the spotlight and certainly keeps it out of a lot of data sets.

But in China—unlike say Norway or Singapore—the sovereign wealth fund hasn’t been the main way of moving spare foreign exchange out of formal reserves. The creation of the CIC, in my view, turned out to be a red herring. It didn’t in the end turn out to be China’s main channel for moving reserves off the balance sheet of the State Administration of Foreign Exchange.

The real action has always been with the banks, not with CIC.

The State Commercial Banks (managing funds for the PBOC)

Many people still vaguely remember that the state commercial banks (two of them at least) were recapitalized using the PBOC’s reserves back in 2003. That $45 billion transaction clearly showed up in China’s reserves and in the balance of payments. It also was disclosed in the 2003 Annual Report of the State Administration of Foreign Exchange. That report makes for interesting reading; it is a testament to the real energy around the financial opening of the time.

But that transfer—and the subsequent recapitalization of the Industrial and Commercial Bank of China (ICBC), the CDB, and some smaller institutions—wasn’t the main way the PBOC shifted reserves over to the state banks.

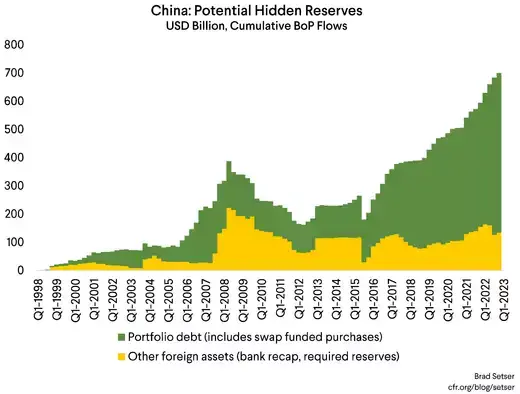

In the fourth quarter of 2005 and throughout 2006, SAFE moved close to $150 billion over to the state banks. This was done through swaps; it registered on the foreign currency balance sheet of the state commercial banks as a liability from the purchase and sale of foreign exchange. But the on-balance sheet results of the swap clearly showed in the balance of payments while “private” purchases of foreign portfolio debt soared over those quarters.

Market rumor back in 2007 and 2008 was that the state banks bought some dubious private label mortgage-backed securities— although I haven’t been able to confirm that. What is clear is that the state banks pulled back during the crisis—with the run-down of the swaps book in 2009 and 2010 helping to fund some of the foreign exchange shifted over to the CIC.

The state banks were also forced to hold $200 billion in foreign exchange as part of their required reserves—which was strange, as they didn’t have any foreign currency deposits at the time.

This too is an open secret. It is documented both in the other foreign assets on the PBOC balance sheet; the line item for other short-term assets in the legacy balance of payments; and in the size of the reported “other liabilities” on the foreign exchange balance sheet of the state commercial banks, which I wrote about back in early 2009.

China still uses changes in required foreign currency reserves as a tool of foreign exchange management—though more often now as a source of signaling rather than as a sink for foreign exchange that wasn’t reported as part of China’s formal reserves.

A couple of additional points here: China is of course not alone in using swaps to move foreign exchange off the balance sheet. Singapore did this, as well as Korea. Swaps are actually a good sterilization tool, as noted by this report from the Bank of International Settlements. Taiwan, of course, did this secretly on such a large scale it was eventually caught—and now has started to transparently disclose its swaps position (which is well over 10% of its GDP).

Many other countries force their banks to hold foreign currency deposits at the central bank as part of their required reserves. Countries with limited “true” reserves generally count the foreign assets that the central bank holds against these deposits as part of their foreign reserves (Argentina and Turkey are important examples). In fact, China is a bit strange for not counting the foreign exchange held against bank’s required reserves as part of its formal reserves.

Prior to the global financial crisis, there is no real doubt that China was hiding about $350 billion in foreign exchange reserves on the balance sheet of the state commercial banks.

And I wouldn’t assume all these mechanisms are completely dormant either, but China has gotten less rather than more transparent over time and many of the key balance sheet entries are now suppressed (the data series on purchases and sales of foreign exchange has been discontinued; it likely is in “other”).

The Policy Banks: EXIM and CDB

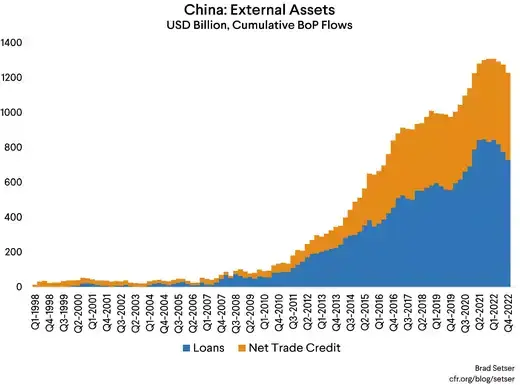

This is the big one.

The Export Import Bank of China and the China Development Bank were global minnows back in 2009. Total “loans” in the balance of payments at that time were something like $50 billion and net trade financing was $30 billion.

Now they are whales. Each individually has a larger commercial external loan book than the non-concessional loan book of the World Bank.

The big policy banks have gotten some dollar funding from the global bond market (and a little more by issuing in Hong Kong dollar) but nothing like the scale needed for a roughly $800 billion external loan book (see Aid data). But the bulk of their dollars that they raised to lend abroad appear to have been raised domestically, and there are clear signs that a lot of those funds come from SAFE.

Back in 2010, reports appeared in the press that SAFE was funding “entrusted loans” by both the CDB and EXIM (see this Caixin article). They made over $110 billion in loan commitments in a short period of time, so they clearly got some funding assurances.

it turns out, as my CFR colleague Zongyuan Zoe Liu highlights in her new book (see Chapter Four in particular) that this surge in activity followed directly from an internal decision by the PBOC to use SAFE’s foreign exchange reserves more actively to support the global expansion of Chinese state firms. SAFE’s annual reports talked about its support for “going out” (the term of art before One Belt and One Road and the current Belt and Road Initiative). The 2011 Annual Report highlighted the creation of new “co-financing” division that would help diversify China’s reserves. The 2010 Caixin article explicitly discusses this shift in approach: “The State Administration of Foreign Exchange (SAFE)… has taken initial steps toward giving policy and commercial banks authority to handle loans for intergovernmental cooperation projects. The reforms also expanded SAFE’s responsibilities beyond its traditional role of managing foreign exchange reserves, effectively turning the agency into a foreign-currency lender.”

Red Capitalism arguably plays out through a Stark v. Lannister style eternal battle between the Ministry of Finance and the PBOC for control of the commanding heights of China’s financial sector. Back in 2003 the PBOC obtained equity control over two of the state commercial banks through the use of its reserves in a recapitalization, only to lose out to the Ministry of Finance with the CIC’s purchase of Central Huijin. But then the PBOC struck back with large equity stakes in the powerful policy banks.

It isn’t clear from the reports of the equity conversion if all of SAFE’s entrusted loans were converted into equity, or just some of them. My guess is just some of them—but the financial trail has grown a bit cold after 2015. Subsequent SAFE annual reports though continue to mention entrusted loans, so they presumably remain an important source of financing for Chinese policy banks and other state institutions.

In 2014 and 2015 a set of additional funds were created under the co-financing platform with support from the policy banks and SAFE to support the Belt and Road Initiative, including The Silk Road Fund, The China Africa Fund for Industrial Cooperation, and the China-LAC Industrial Cooperation Investment Fund. This Caixin article provides the best summary of these somewhat secretive funds that I have been able to find.

Sum these funds up and they could have provided another $100 billion in financing out of reserves (assuming the initial $10 billion in the African fund was raised to $30 billion when the Latin fund grew from $10 billion to $30 billion)

None of this is exactly transparent—but SAFE did include a box in its 2020 Annual Report chalking up the progress that it had made diversifying China’s reserves over the last 10 years that name-checked all these funds.

“SAFE launched the entrusted loan business in 2010, establishing market-oriented partnerships with small-, medium- and large-sized financial institutions extensively. Subsequently, the SAFE initiated the establishment of the Silk Road Fund, the China-LAC Industrial Cooperation Investment Fund (CLAI Fund), the China-Africa Fund for Industrial Cooperation (CAFIC), and injected capital into CIC International Co., Ltd. and CNIC Co., Ltd., aiming at enhancing the financial sector’s role in channeling capital to the real economy.”

Of course, all these uses of SAFE’s foreign exchange should not count as reserve assets. They clearly aren’t liquid.

At the same time, it is clear that SAFE has a sizable quantity of foreign currency assets (entrusted loans, participation in these funds, swaps, etc.) that aren’t counted in its foreign exchange reserves and that aren’t transparently disclosed.

And it is equally clear that a part of the nearly $3 trillion in foreign assets held by state actors in China (that aren’t counted as part of China’s foreign exchange reserves) have been funded by foreign currency that the PBOC bought as part of its mission to keep the yuan “basically stable.” SAFE shifted funds to the state commercial banks before the global financial crisis. And after the global crisis, SAFE started shifting big sums over to the policy banks.

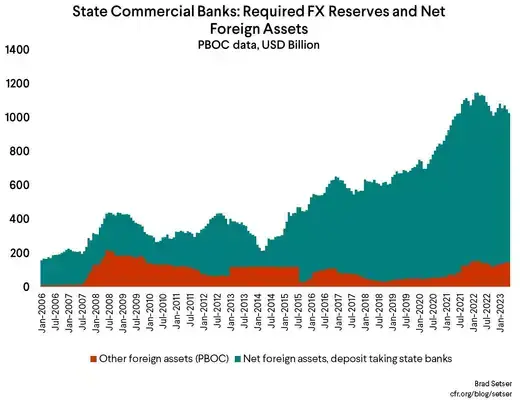

The State Commercial Banks, seemingly using their own balance sheet

More recently though, much of the activity to manage the yuan has started to appear directly on the balance sheet of China’s state commercial banks. The state commercial banks now have a larger net foreign asset position ($900 billion) than back in early 2008. And that position increased rapidly in 2020 and 2021, when China’s currency was under clear pressure to appreciate.

The available data though suggests that this position is funded by domestic foreign currency deposits, not by so-called “other” liabilities (which turned out to be SAFE using its reserves via swaps).

Domestic foreign currency deposits once funded domestic foreign currency loans. But those loans have disappeared after 2015 while foreign currency deposits grew— and clearly those foreign currency deposits have been matched for foreign assets not domestic assets.

It is all a bit of a puzzle, as China’s domestic foreign currency deposits haven’t really acted like normal commercial deposits. In fact, they have moved in a way that is contrary to standard market incentives: they rose when yuan interest rates were well above dollar rates (so the incentive should have been to keep money in yuan deposits), and they have fallen when dollar rates rose above yuan rates (when the incentive is to move into dollars, not away from dollars).

Conversely, state commercial banks’ foreign asset position has moved like one might expect the PBOC’s foreign asset position to move if it were intervening to stabilize the currency by asymmetrically resisting appreciation pressure.

Something there doesn’t quite add up. One theory is that the big Chinese SoEs—think the national oil companies, and the state grain trading company among others—have been instructed to hold foreign exchange on deposit at the state banks.

There are other things that don’t add up either, for example the dividend that SAFE paid the Ministry of Finance out of the earnings on its foreign exchange reserves, which appears in the budget but not on the PBOC’s balance sheet.

Conclusion

There is much that is still not known about the true scope of SAFE’s foreign currency assets. Three things though are certain:

1) The PBOC has quite substantial foreign currency assets (loans and swaps with Chinese state financial institutions) that aren’t counted as China’s reserves. That is the correct reserve accounting, but also a bit misleading absent real disclosure of non-reserve foreign currency assets.

2) China has become less, not more, transparent in the reporting of the foreign currency assets of the state over time.

3) Changes in China’s reported foreign exchange reserves aren’t a reliable guide to China’s actual intervention in the foreign exchange market. The Treasury has alluded to this, but it needs to go further. The IMF unfortunately is lagging well behind.

Do read my piece in the China Project. It tries to break some new ground. Also take a look at Zoe Liu’s new book on China’s Sovereign Funds, which highlights the political economy of both the CIC and SAFE’s in house funds like the Silk Road Fund.

And here is a final, somewhat explosive thought: the techniques China used to hide its true foreign exchange reserves also could apply to Russia, at least prior to the slide in the global oil price this year—the situation differs, but there are lots of ways for a determined state to hold financial assets that don’t show up in disclosed reserves.

*According to the 2011 CIC Annual Report, “In December 2011, $30 billion was injected into CIC International in a bid to enhance its role as a vehicle to diversify China’s foreign exchange holdings.”