Italian Banks, Pre-Stress Test

From afar, it seems like the wheels of European policy may be moving towards some kind of near-term fix for either Italy’s banks—or, more likely, for the specific problems of Monte dei Paschi di Siena.

The risk here is obvious. The intersection of Italian politics and European rules is pushing for the most narrow of solutions, one that will not recapitalize the broader Italian banking system. At least not quickly.

The recapitalization need even under pessimistic assumptions is actually fairly modest, as such things go. Less than Spain spent on the two rounds of recapitalization that were required to solve Spain’s banking crisis. Maybe less than the €30 billion Germany injected into Commerzbank and a few others in 2009, or the massive “bad” bank it set up for Hypo Real Estate (Hypo Real Estate was not retail funded, and even now, it seems like it has some performing subordinated debt—who knew). Probably less, relative to the size of Italy’s economy, than the €22 billion that the Dutch put into ABN-Amro.

But Italy’s government clearly doesn’t want to bail-in the heavily retail holders of Italian subordinated debt. Monte alone has about €5 billion in subordinated debt, and over 60 percent of that seems to be held by retail investors. A smaller subordinated debt bail-in late last year was politically controversial.

And Europe wants Italy to respect the banking and competition rules, which have been interpreted to require some form of subordinated debt bail-in. There are ways around the ”banking union” Bank Recovery and Resolution Directive (BRRD) bail-in requirement (8 percent of liabilities, a sum that implies a substantial write down of the subordinated debt). Europe’s rules already include an exemption for a precautionary recapitalization to address difficulties identified in a stress test. Getting around the state aid requirements seems harder, though perhaps not impossible if some of the flexibility used in the global financial crisis remains.*

The easiest way to protect the retail investors in the subordinated debt and to avoid violating any European rules, obviously, is for the banks to continue to carry the bad loans on their books at an inflated mark. There is a reason why nothing much has been done.

The current stress tests are rather narrow. They only will cover a subset of the Italian banks now supervised by the ECB. On their own, they will not force a broader solution.

The FT has reported that the Italians are working on an “Italian” solution that would both recapitalize Monte Dei Paschi and avoid triggering the state aid rules. The Atlas fund would be reinforced (in part with funds from the state owned Cassa Depositi e Prestiti) and used to purchase a slug of Monte’s bad loans at a higher price than a private equity fund would, and a convoy of Italian financial firms would participate in an equity infusion.

The problem with any narrow fix is that it will not really change Italy’s basic dynamics. The combination of banks that are too weak to lend and pressure to do more fiscal consolidation doesn’t provide an obvious path out of Italy’s prolonged slump.

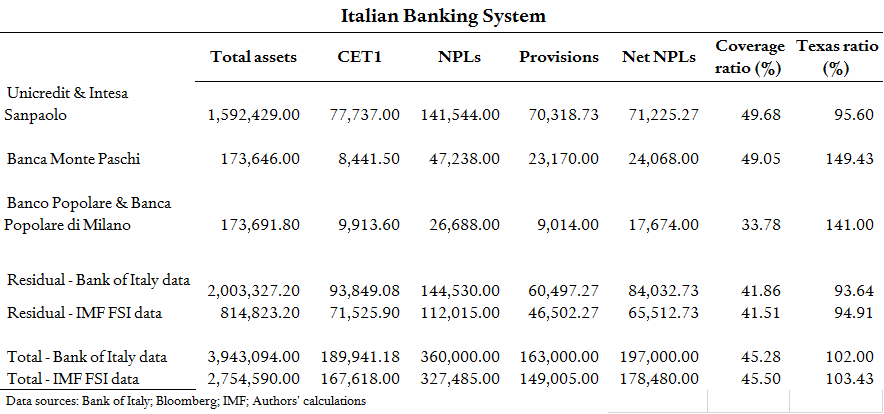

Monte alone accounts for about one seventh of Italy’s bad loans (€50 of €360b), so solving Monte’s problems isn’t irrelevant. The big two (Intesa and Unicredit) hold another €140b or so. Unicredit is expected to face pressure to build up provisions or capital after the stress tests as well.

But that leaves another €170b or so outside of the top three institutions.

Emma Smith of the CFR’s Greenberg Center for Geoeconomic Studies prepared the following table, based on publicly available information and the data in the Bank of Italy’s financial stability report. For this analysis, Emma and I combined the provisioning on bad loans with the provisioning on other impaired exposures.

The good news is that the “tail” of smaller institutions in aggregate looks to be in somewhat better shape than Monte. The bad news is that the smaller institutions are not in great shape. A Texas ratio (common equity and provisions v bad loans) of around 1 for the smaller institutions isn’t good.

Banco Popolare and Banca Popolare di Milano—who are now seeking to merge—have a relatively low level of provisions relative to their bad loans. Maybe their bad loans are of better quality. Who knows. Their relatively low level of provisioning isn’t new. It will have to be addressed as some point.

The best solution here would be fairly clear. A public recapitalization that covers the full banking system and lets the banks mark down their impaired exposure to a reasonable level and move forward. Italy didn’t do a major recapitalization immediately after the crisis, as its crisis has been more of a slow burn. It is now paying a price.

Spain’s banking system in 2010 actually had some similarities to Italy’s structurally, even though Spain’s risky exposure was more concentrated in real estate. The two bigger, more international banks that were in relatively better shape. Some mid-sized troubled institutions, created through perhaps unwise mergers (Bankia most obviously). And lots of small institutions. Not as many as Italy. But lots.

In the first round of Spain’s recapitalization, which consolidated a number of the cajas, I do not think there was any subordinated debt bail-in. In fact, it seems like some subordinated debt was paid down during the initial recapitalization phase, and there was certainly a rotation away from institutional investors and toward retail investors as some of the subordinated debt issued before the crisis was replaced by new retail placements (see this study).

During the second round, in 2012 and 2013, there was a bail-in. But the bail-in requirement was interpreted fairly flexibly if my memory holds. Bankia’s capital need was such that I think you could easily have argued both the preferred equity and the subordinated debt should have been more or less completely wiped out to limit the amount of needed state aid. Counting both rounds of recapitalization, it received close to €20 billion in state aid. Subordinated debt (at least the subordinated debt with a defined maturity) only took a nominal 13 percent haircut**—though investors were given the option of not swapping into Bankia equity and instead getting a bond or a time deposit (for some smaller banks, the government facilitated a clean exit into cash).

There are models here if Europe wants to use them. Most pre-date the BRRD, but the stress test already allows Italy to skirt the 8 percent bail-in requirement.

And, well, my personal view is that the transition to a banking union based on uniform resolution and recapitalization rules, consolidation of supervision for large banks at the ECB, and no real fiscal risk sharing (there is no common deposit insurance, and the resolution fund is in practice a network of national funds) was a bit premature. A banking union with limited risk sharing will only work if the rules initially are applied with a lot of flexibility. Especially as it is now clear that the initial round of stress tests didn’t clear away all legacy loan exposures, or put to rest concerns that many of Europe’s banks are under-capitalized.

Right now Italy effectively needs to solve for Italian banks who have raised funds from Italian depositors and investors, not for European banks who happen to have their headquarters in Italy.

Portugal will be more complicated.

[*] For the recapitalization of a solvent institution that is not being wound down; for Monte this means that the “stressed” losses cannot exceed its capital of around €8 billion. Stricter bail-in rules apply for “resolution.”

[**] The preferred equity took a larger haircut, but it wasn’t wiped out. In the capital stack, senior bonds rank higher than subordinated debt and subordinated debt ranks higher than preferred equity.