Section 232 Tariffs and the Relentless Rise of U.S. “National Security” Protectionism

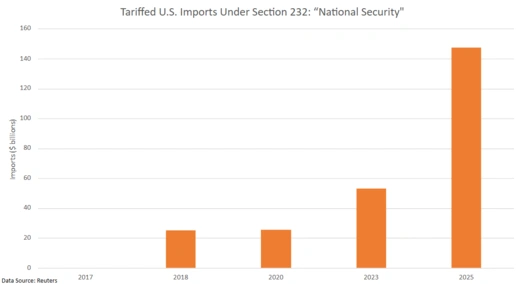

Since President Trump’s first term, U.S. imports subject to tariffs under Section 232 national-security authority have soared. They are set to soar further.

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

In an earlier Geo-Graphics blog post, I argued that the soaring use of “national security” notifications to justify new import barriers at the WTO was a sign that the multilateral trading system was effectively dead and buried. In today’s post, I look at the domestic U.S. counterpart to such notifications—tariffs imposed by the president under Section 232 of the 1962 Trade Expansion Act.

Since President Trump’s first term, imported goods (based on prior-year values) subject to tariff under Section 232 have soared. 232-based tariffs now cover nearly $150 billion worth of goods—up from nothing at the start of Trump’s first term. Steel and aluminum, and items made from them, represent the longest-standing and largest parts. But in March of this year, Trump added autos and auto parts to the mix.

The use of 232 to justify auto tariffs appears to be driven by the president’s nostalgia for days before half of the U.S. population was born—before Japan became a major producer of U.S. cars. How exactly American national security has been harmed by such cars has never been explicated.

The claim that steel imports harm American national security is more plausible on its face, since steel is clearly needed to build myriad items used for military and defense purposes. Yet the blanket tariffing of steel imports from allies and adversaries alike represents a clear and present harm to the U.S. economy, and its capacity to produce a vast range of goods at minimal resource-cost. U.S. steel-using industries employ roughly 50 times the number of workers employed by steel-making ones, and earlier steel tariffs have seriously damaged the industry’s productivity at home. As I showed in this recent post, U.S. steel output per hour has fallen 32 percent since 2017—a period during which output per hour broadly has increased by 15 percent. Instead of investing in automated production, U.S. steel firms have simply sheltered behind the ever-rising protectionist taxes. Slamming allies with 50 percent tariffs, as Trump did earlier this month, is particularly misguided, given the illogicality of retooling a fully employed U.S. economy to produce an over-glutted global commodity.

Unfortunately, 232-based tariffs are set to balloon even more rapidly. Given the Court of International Trade’s recent decision (temporarily stayed) to strike down Trump’s “Liberation Day” reciprocal tariffs and fentanyl-smuggling tariffs, which had, it said, been improperly levied under the International Emergency Economic Powers Act (IEEPA), the administration may well need alternative authority for mass tariffing. Just as “national security” has proven an effective trump card for bypassing WTO rules, 232 has proven a foolproof one for arrogating Constitutional tariff-setting authority from Congress.