French Banks Play Russian Roulette

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Dinah WalkerAnalyst, Geoeconomics

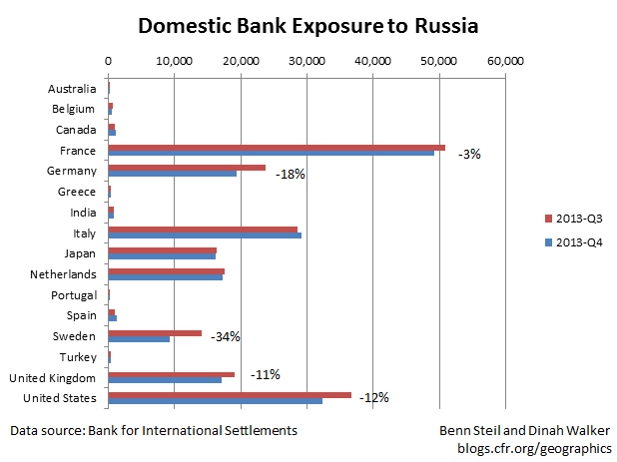

In the fourth quarter of last year, with tensions rising between Russia and the West over Ukraine, U.S., German, UK, and Swedish banks aggressively dialed down their credit exposures in Russia. But as the graphic above shows, French banks, which have by far the highest exposures to Russia, barely touched theirs. At $50 billion, this exposure is not far off the $70 billion exposure they had to Greece in 2010. At that time, they took advantage of the European Central Bank’s generous Securities Market Programme (SMP) to fob off Greek bonds, effectively mutualizing their Greek exposures across the Eurozone. No such program will be available for Russian debt. And much of France’s Russia exposure is illiquid, such as Société Générale’s ownership of Rosbank, Russia’s 9th largest bank by asset value ($22 billion). With the Obama Administration and the European Union threatening to dial up sanctions on Russia, is it time for U.S. money market funds and others to start worrying about their French bank exposures?

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”