By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Benjamin Della RoccaAnalyst, Center for Geoeconomic Studies

Acknowledging the enormous threat to jobs and incomes posed by the coronavirus epidemic, the Federal Reserve on March 23 pledged to use “its full range of authorities to provide powerful support for the flow of credit to American families and businesses.” Swift and bold action has backed up these words.

The Fed slashed its policy rate to zero and, more importantly, committed to buying Treasuries and mortgage-backed securities without limit. It is also putting cash directly into companies’ hands. On March 17 it restarted a financial-crisis program for purchasing commercial paper—debt that companies issue to meet short-term obligations. And on March 23 it unveiled plans to start buying corporate bonds—for the first time ever.

These moves into corporate lending are significant. With stay-at-home orders covering 150 million Americans, consumer spending has ground to a halt. This deprives businesses of the cash they need to operate—to pay for supplies, rent, wages and the like. The Fed is therefore helping businesses borrow in order to avoid mass closures and layoffs. Without unprecedented government intervention, St. Louis Fed president James Bullard believes unemployment could hit 30 percent next quarter.

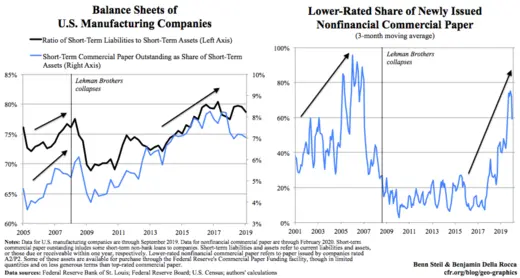

Many companies, in fact, now look more vulnerable to financing shortfalls than in the run-up to the 2008 financial crisis. The black line in the left-hand chart above shows that U.S. manufacturing firms’ short-term liabilities have been climbing steeply since 2009. Today, the ratio of their short-term liabilities to assets stands higher than pre-crisis levels. And as the blue line shows, these firms are relying more and more on commercial paper to meet short-term liabilities.

For many cash-strapped companies, however, the Fed’s interventions will be of little or no help. The central bank’s corporate-debt buying will focus on companies with high credit ratings. But it is riskier-company borrowing that has skyrocketed of late. As the right-hand chart above shows, large shares of nonfinancial commercial paper issued since 2017 have come from lower-rated companies—much like in the run-up to 2008. This mirrors the pattern in corporate-bond markets, where junk-bond issuance has soared. All this suggests that Fed buying will not stem the rising tide in corporate defaults.

Distressed companies are not completely out of lifelines. On March 26, the Senate approved $867 billion to support industries, small businesses, states and cities. Still, unless the Fed expands its lending to cover low-rated borrowers, relief from the pandemic’s economic fallout for thousands of companies, and millions of workers, appears a long way off.