RealEcon

RealEcon is made possible by the generous support of the Amy Falls and Hartley Rogers Foundation.

The initiative’s initial focus is on three areas of international economic policy: trade and investment, development, and economic security. Through research projects, convenings, publications, and outreach to policymakers, experts, and the public, RealEcon aims to promote a durable new consensus on American economic leadership.

Trade-Offs

A regular series on the choices faced by international economic policymakers.

Domestic Foundations

Trade, Tariffs & Trumponomics

On our new trade hub, CFR experts provide timely analysis on the goals, trade-offs, and costs of U.S. President Donald Trump’s economic policies.

Perspectives

Featured Analysis From the CGS

The Greenberg Center for Geoeconomic Studies works to promote a better understanding of how economic and geopolitical forces interact to shape the world.

Launched in April 2024

As an initiative of the Greenberg Center for Geoeconomic Studies at the Council on Foreign Relations (CFR), RealEcon: Reimagining American Economic Leadership works to assess the role of the United States in the international economy, analyze what is at stake for the American people, and identify the trade-offs in different policy approaches.

Subscribe to the RealEcon Newsletter to get the latest insights:

Archive

278 results

![<p>U.S. President Donald Trump, Secretary of Commerce Howard Lutnick and Solicitor General D. John Sauer at a White House press briefing following the Supreme Court’s ruling, February 20, 2026.</p>]() By Michael Froman

By Michael Froman![<p>A woman uses her Apple iPhone and laptop in a cafe in lower Manhattan in New York City</p>]() By Inu Manak and Allison J. Smith

By Inu Manak and Allison J. Smith![A shopper walking past a partially empty dairy section of a grocery store]() By Rebecca Patterson, Allison J. Smith and Ishaan Thakker

By Rebecca Patterson, Allison J. Smith and Ishaan Thakker![Trump signs trade deal]() By Inu Manak and Allison J. Smith

By Inu Manak and Allison J. Smith![Kevin Warsh, Fellow in Economics at the Hoover Institution and lecturer at the Stanford Graduate School of Business, speaks during the Sohn Investment Conference in New York City.]() By Roger W. Ferguson Jr. and Maximilian Hippold

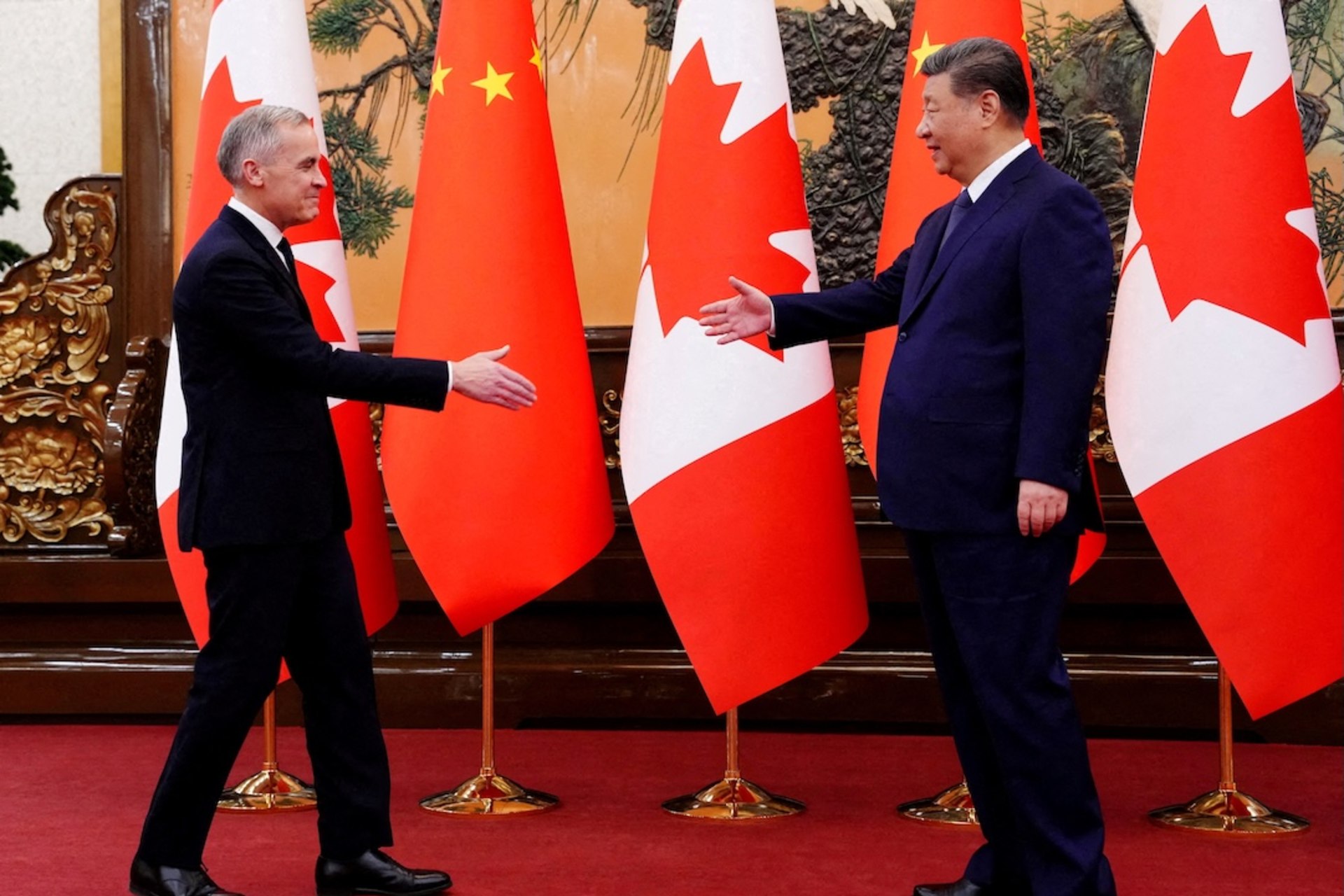

By Roger W. Ferguson Jr. and Maximilian Hippold![<p>Canadian Prime Minister Mark Carney meets with President of China Xi Jinping at the Great Hall of the People in Beijing, China on Friday, Jan. 16, 2026.</p>]() Featuring Edward Alden

Featuring Edward Alden- By Allison J. Smith and Ivana Lefebvre d'Argence

![<p>A semi-truck drives past Chinese shipping containers at the Port of Los Angeles in Wilmington, California, U.S., November 5, 2025.</p>]() By Inu Manak, Edward Alden, Thomas J. Bollyky, Chris McGuire and Chloe Searchinger

By Inu Manak, Edward Alden, Thomas J. Bollyky, Chris McGuire and Chloe Searchinger![<p>A cargo ship full of shipping containers departs the port of Oakland at the San Francisco Bay, California, U.S., August 4, 2025.</p>]() By Rebecca Patterson and Ishaan Thakker

By Rebecca Patterson and Ishaan Thakker- Featuring Jonathan E. Hillman

![<p>An American flag hangs on the U.S. Department of Labor headquarters, in Washington, D.C., U.S., September 16, 2025. </p>]() Featuring Benn Steil

Featuring Benn Steil![<p>Chinese cars are parked at China’s Port of Nanjing as they wait to be exported, April 16, 2025.</p>]() By Shannon K. O'Neil, Julia Huesa and Gabriela Paz-Soldan

By Shannon K. O'Neil, Julia Huesa and Gabriela Paz-Soldan![<p>Members of the public walk outside the U.S. Supreme Court to attend oral arguments on U.S. President Donald Trump’s bid to preserve sweeping tariffs after lower courts ruled that Trump overstepped his authority, in Washington, D.C., U.S., November 5, 2025</p>]() By John K. Veroneau

By John K. Veroneau![<p>The United States Supreme Court building is seen as in Washington, U.S., October 4, 2023.</p>]() By James Wallar

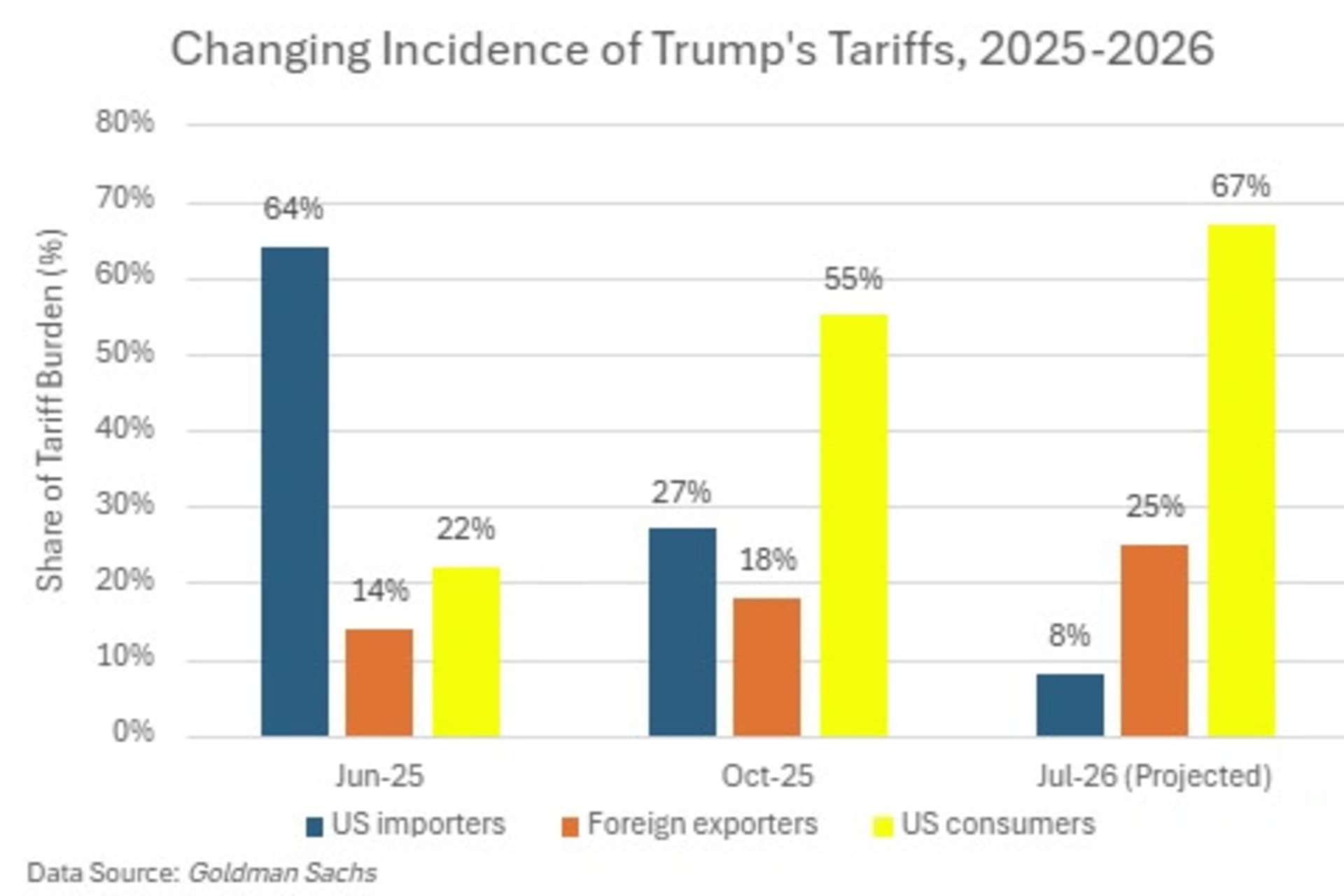

By James Wallar![CITT June GS Gray]() By Benn Steil

By Benn Steil![<p>President Donald Trump and other U.S. officials meet with their Chinese counterparts on the sidelines of the APEC summit in Busan, South Korea, October 30, 2025.</p>]() By Zongyuan Zoe Liu, David Sacks, Stephen Sestanovich, Joshua Kurlantzick and Will Freeman

By Zongyuan Zoe Liu, David Sacks, Stephen Sestanovich, Joshua Kurlantzick and Will Freeman![<p>A miner stands among copper production at El Teniente mine, the world’s largest underground copper mine in Machali, near Rancagua, Chile, on April 2.</p>]() By Will Freeman

By Will Freeman![<p>Thai Prime Minister Anutin Charnvirakul addresses the opening ceremony of the Thailand-China Cooperation Expo 2025 in Bangkok, Thailand, September 26, 2025. </p>]() By Joshua Kurlantzick

By Joshua Kurlantzick![<p>Russian President Vladimir Putin takes part in the BRICS Summit held in Rio de Janeiro, Brazil, via videolink, July 6, 2025.</p>]() By Stephen Sestanovich

By Stephen Sestanovich![<p>People walk past a brokerage house as an electronic board displays stock index information graph, in the Central Business District in Beijing, China, October 13, 2025.</p>]() By Zongyuan Zoe Liu

By Zongyuan Zoe Liu