Why the Fed Should Stop Forward Guidance

If the Fed can’t predict the future path of the economy, it shouldn’t be predicting its own policy decisions.

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Elisabeth HardingAnalyst, Greenberg Center for Geoeconomic Studies

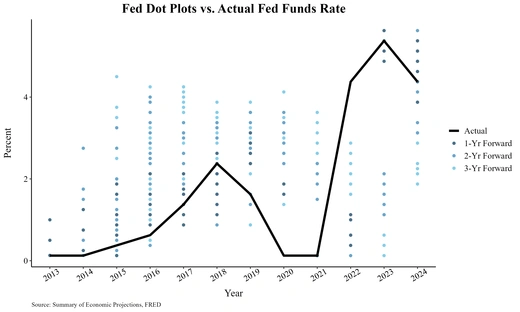

In our Barron’s column of January 29, we argued that the Fed’s macro-forecasting prowess was poor—that is to say, no better than the market’s—and that forward guidance on rate-setting was therefore, outside of deflationary settings, pernicious. As shown in the figure above, FOMC members’ 1-year, 2-year, and 3-year “dot plot” rate projections are lousy guides to actual rate-setting. But to the extent that some members feel obliged to validate their past forward guidance, irrespective of actual macro developments—a phenomenon we document in our column—forward guidance actually conflicts with the Fed’s dual mandate of price stability and maximum employment. We therefore believe that forward guidance should give way to reaction-function guidance—that is, clarity on how the Fed will respond to changes in economic conditions, irrespective of whether such changes are anticipated.