The AI Bubble Is Getting Closer to Popping

AI’s success or failure will depend on whether it can start to show the worth of massive investments. And today, the Trump administration’s tariffs and immigration policies are a big part of what’s holding back U.S. models and companies.

By experts and staff

- Published

Experts

![]() By Shannon K. O'NeilSenior Vice President of Studies and Maurice R. Greenberg Chair

By Shannon K. O'NeilSenior Vice President of Studies and Maurice R. Greenberg Chair

AI is driving the S&P 500 index and the broader US economy forward. The CEOs of a handful of few dominant firms have become celebrities, with groupies and markets alike hanging on their words and earnings reports. The line between hype and reality has blurred. But what may burst the AI bubble are not the flagged worries over circular financing, growing debt or Chinese competition. Instead, the unanticipated drag of tariffs and fall in the number of migrants in the US may be what brings these AI champions back down to earth.

President Trump has promised to do “whatever it takes” to lead the world in AI, mobilizing the federal government and pulling its industrial policy levers. His administration is opening up federal lands for data centers and power plants and fast-tracking permitting and environmental reviews. It has taken equity stakes in the chip giant Intel Corp. and the start-up lithography equipment maker x-Light Inc., as well as in critical minerals firms for the raw materials that go into the electronics at the heart of the sector. It is taking on state-level AI regulations and laws, using executive authority to clear away regulations and oversight. And his administration has exempted servers, semiconductors, circuit boards and many of the other electronics that make up roughly a third of data center costs from tariffs (though they still pay the levies on imported building materials).

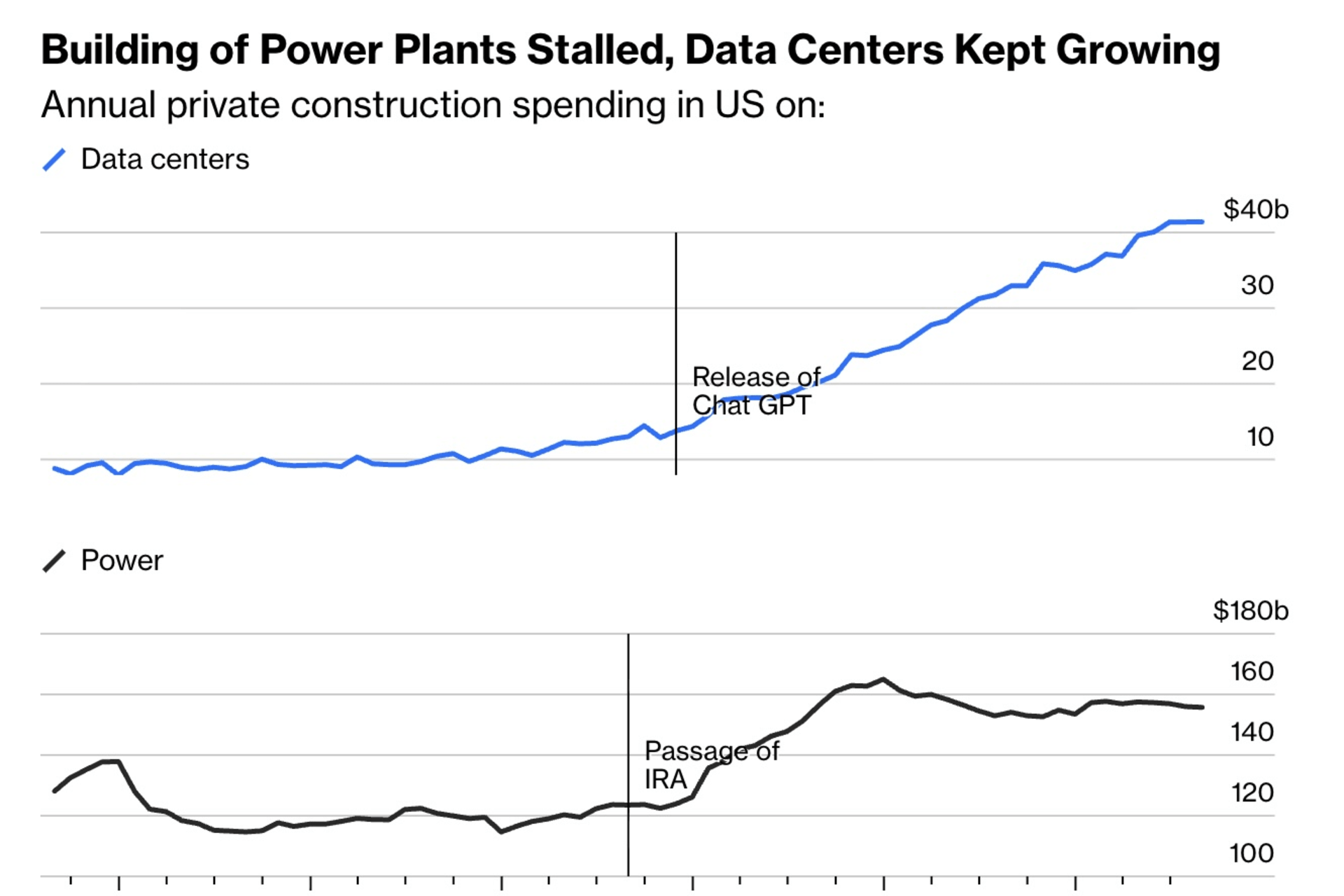

These coordinated policies advantage AI over traditional manufacturing and other economic sectors, boosting the surge in interest and announced AI capex. As a result, deep-pocketed hyperscalers are pouring hundreds of billions into thousands of rows of connected servers, cables and routers inside sprawling data centers to power their models and systems. Compute power is anticipated to double or more by 2030.

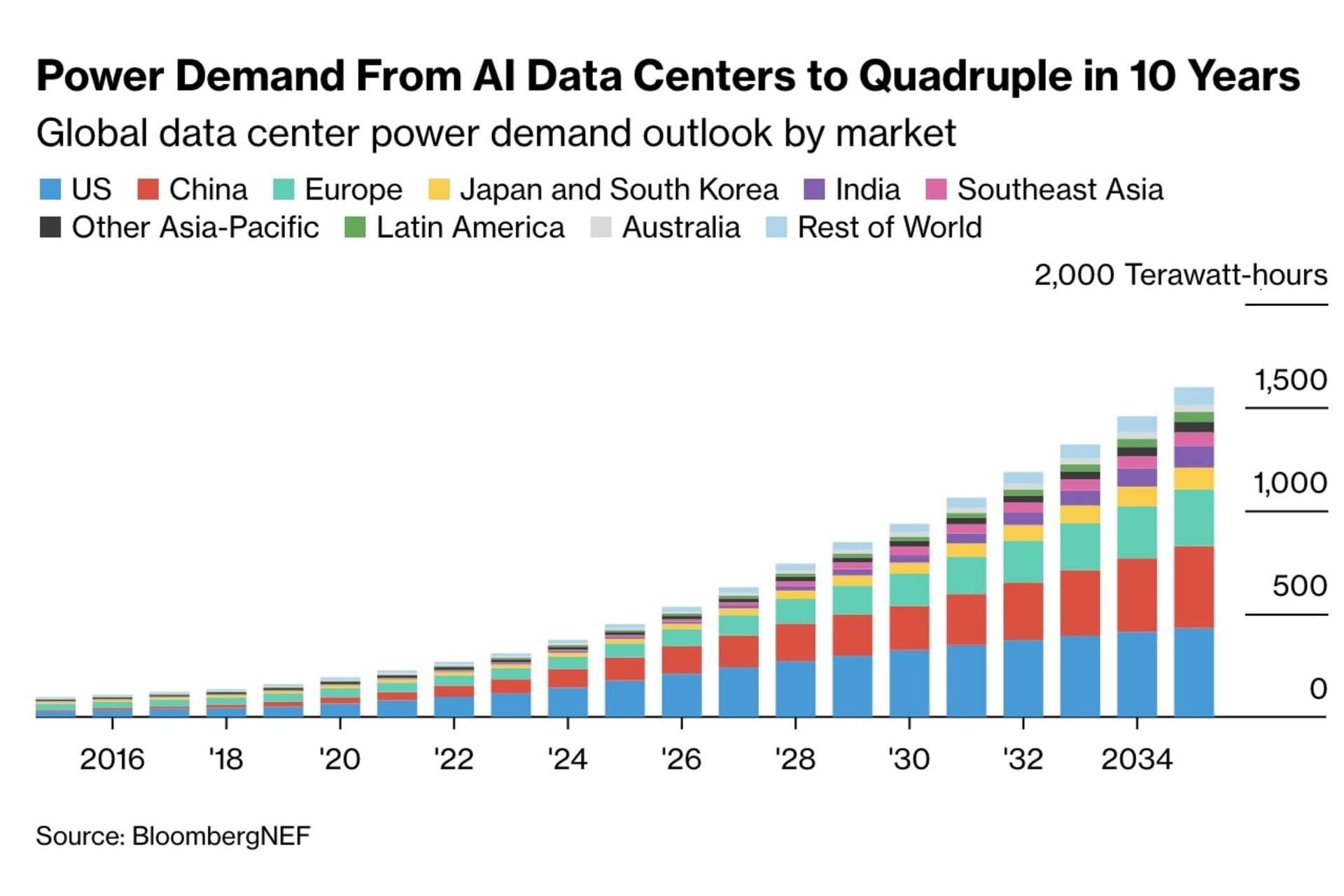

As data centers proliferate, so do their electricity demands. McKinsey projects that the new data centers coming online between now and 2030 will need more than 600 terawatt hours of electricity, enough to power nearly 60 million homes.

And as demand on electricity utilities soars, so do their building costs. Input prices were already rising for electricity generators and distributors as orders for transformers, circuit breakers and switchgear outstripped factory production after many sleepy years. In 2025, tariffs raised the cost of the many products and equipment sourced from abroad. Punitive 50% rates on steel, aluminum, and copper wires disproportionately hit metal heavy transformers, power lines and transmission towers. The electricity storage batteries that utility companies use nearly all come from China and so face even steeper levies.

Trump’s migration policies, too, are making the AI build-out slower and more costly. Tech CEOs loudly worry about not having enough scientists, AI researchers, engineers and other highly educated workers as H-1B visas are harder to come by and orders of magnitude more expensive. But AI’s labor market vulnerabilities begin at the construction site. Twenty-five percent of those in building trades come from abroad, and one in seven are undocumented. With harder borders, high-profile ICE raids and stepped-up deportations, say goodbye to the days of picking up extra skilled labor outside a Home Depot, or even of complete work crews showing up regularly in many parts of the US. Surveys of contractors suggest that more than 80% have openings for workers, and that these gaps have become harder to fill than in recent memory. Worker shortages are the number one reason today for project delays. This labor scarcity is growing even as construction outside of data centers lags. New residential housing starts are down nearly 10%, a five-year low, while commercial construction has fallen by 13%.

For AI and data center companies, the hundreds of billions of dollars in capex already don’t go as far as they might. This dynamic is likely to worsen in 2026. Affordability has taken center stage in the run-up to November’s midterm elections, and the White House is zeroing in on housing. So far, the administration’s proposals have focused on lowering mortgage rates and keeping institutional investors from buying up houses. But a home-building push is likely around the corner. Commerce Secretary Howard Lutnick met recently with big builders to hash out what the administration needs them to do. That will mean more residential projects chasing the same dwindling sets of electricians, HVAC technicians, welders and more.

The US government needs to focus as much on electricians and welders as on engineers. Sure, domestic training programs and internships could help fill the gap over time. But the crunch facing industry requires more craft workers today. That could happen by offering more general H-2B visas, expanding and speeding the application process for awarding EB-3 visas for building trades as well as creating a new construction-specific temporary work visa program that could apply to those abroad or already here in the US.

AI’s success or failure will depend on whether it can start to show the worth of massive investments. But even if it succeeds in transforming the way industry after industry works, cost and time will determine who gains, and when. And today, the Trump administration’s tariffs and immigration policies are a big part of what’s holding back US models and companies.