Could Trump’s Tariffs Replace Income Tax for the Bottom 90%?

President Trump wants to eliminate income tax for Americans earning less than $150k. Could his tariffs offset that?

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Elisabeth HardingAnalyst, Greenberg Center for Geoeconomic Studies

President Trump has many times suggested that tariff revenue could replace the federal income tax. This claim is absurdly off-base, since it is mathematically impossible for tariffs, even at current levels of imports, to generate the $2.4trn in revenue that would be necessary. Commerce Secretary Howard Lutnick, however, has said that the president only aspires to eliminate income tax for Americans earning less than $150k. Could tariffs cover that?

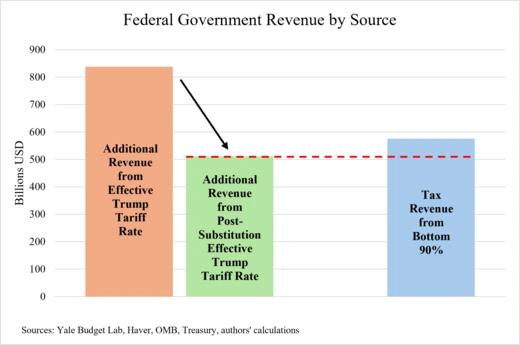

As shown in the figure above, annual tariff revenue from the current effective Trump tariff rate of 28% would—assuming that imports stayed constant— amount to $838bn more than that collected in 2024, under Joe Biden. But the constant-imports assumption is clearly ludicrous, as imports are bound to shift away from China. We therefore calculate the post-substitution additional tariff revenue, after the shift, at only $511bn.1 This figure falls $65bn short of 2024 estimates of income-tax revenue garnered from the bottom 90 percent of U.S. earners—those earning under $169k.

Trump’s tariffs, however, are likely to significantly dent income-tax receipts from corporations, employers, and higher earners. If the IMF is right in lowering its 2025 growth forecast from 2.7 percent in January to 1.8% this week, based on Trump’s tariff orders, we calculate that income-tax receipts from corporations, employers, and the top 10% of earners will be $62bn lower than they would otherwise have been.2 This means that Trump’s tariff revenue will actually fall a massive $127bn short of covering those lost tax receipts plus the tax that would have been paid by the bottom 90 percent in the absence of the new tariffs.

In short, Trump cannot come close to fulfilling his ambition of substituting tariff revenue for income tax—even it’s just for those earning under $150k. More importantly, the economic damage those tariffs will inflict on the economy make the ambition foolhardy and irresponsible.