Trump Steel Tariffs Could Kill Up to 40,000 Auto Jobs, Equal to Nearly One-Third of Steel Workforce

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Benjamin Della RoccaAnalyst, Center for Geoeconomic Studies

“I want to bring the steel industry back into our country,” declared President Trump last month. “Maybe [things] will cost a little bit more, but we’ll have jobs.”

Tariff opponents in Congress and industry, however, have argued that what may be good for steel won’t be good for other industries. Asked why auto manufacturers are so opposed to tariffs if the impact on their costs is minimal, as the administration is arguing, newly elevated Trump trade adviser Peter Navarro was dismissive. “Look, they don’t like this. Of course they don’t,” he said. “What do they do? They spin. They put out fake news. They put all this hyperbole out.”

Is Navarro right? To answer, we’ve analyzed historical data to estimate the impact of Trump’s proposed 25 percent steel tariffs on auto sales and employment. For the technically minded, you can follow the details of our calculations in the endnotes.

We estimate that an average car requires roughly 1.2 tons of steel to build.1 Given that tariffs tend to increase import prices (which determine domestic prices) by at least as much as the tariff, we calculate that a 25 percent steel tariff will increase the price of new passenger vehicles manufactured in the United States between 0.5 and 0.8 percent.2

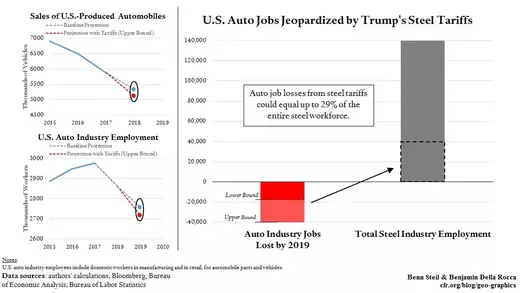

Now, based on calculations for the sensitivity of auto sales to price, we estimate that such price rises of American-made cars would translate into a decline of between 1.6 and 3.6 percent in global sales.3 This we illustrate in the top left figure above, which shows our sales projections with and without the Trump tariffs.

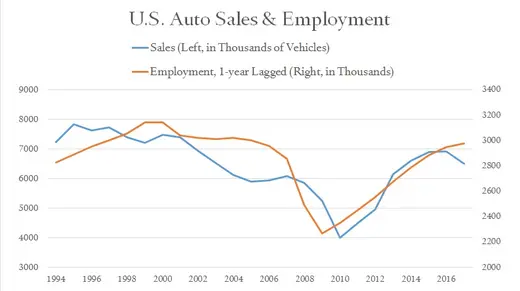

But what does this mean for American auto jobs? The historical relationship between U.S. auto sales and employment is tight, as shown below.

Based on this relationship, we would expect declining sales to result in auto-industry job losses ranging from 18,000 to 40,000 by the end of 2019.4 This we illustrate in the bottom left figure above.

Given that employment in the U.S. auto industry is vastly higher than in the U.S. steel industry, such job losses would swamp any possible increase in steel employment. As we show in the right-hand figure above, the total amount of jobs at risk from Trump’s steel tariffs in the U.S. auto industry alone is equivalent to almost one-third of the entire U.S. steel industry workforce.

In short, Navarro is wrong—deeply so. Employment in the U.S. auto industry will suffer from Trump’s tariffs to a vastly greater degree than it could possibly benefit in the U.S. steel industry.