Mercosur: South America’s Fractious Trade Bloc

Published

Updated

Three decades after its founding, Latin America’s largest trade bloc continues to seek new agreements. The recent conclusion of a deal with the European Union comes as both regions look to diversify economic ties amid intensifying global trade tensions.

- Mercosur is an economic and political bloc consisting of Argentina, Bolivia, Brazil, Paraguay, and Uruguay. Venezuela was suspended indefinitely from the group in 2016, predominantly for failing to meet its democratic and trade commitments.

- Founded in 1991 to create a common market, spur development, and bolster democracy, Mercosur saw early successes—including increased regional economic integration in its first decade—but those gains have since faded.

- In January 2026, European Union lawmakers voted to approve a landmark trade agreement with Mercosur, ending more than two decades of negotiations. However, several hurdles, including significant opposition, remain.

What are backgrounders?

Authoritative, accessible, and regularly updated Backgrounders on hundreds of foreign policy topics.

Who Makes them?

The entire CFR editorial team, with regular reviews by fellows and subject matter experts.

Introduction

Mercosur, or the Southern Common Market, is an economic and political bloc originally comprising Argentina, Brazil, Paraguay, and Uruguay. Initially created during a period when longtime rivals Argentina and Brazil were seeking to improve relations, the bloc saw some early successes, including a doubling of intraregional trade as a share of total exports, which rose [PDF] from 11.1 percent in 1991 to 25 percent by 1998, before starting to decline.

In recent years, Mercosur has increasingly pursued trade agreements with other countries to diversify its economic partnerships. In early 2026, after more than two decades of on-and-off negotiations, European Union (EU) member states approved ;a long-sought trade agreement with the bloc. The deal, if ratified by the European Parliament and the legislatures of Mercosur member states, would create the world’s largest free-trade zone, covering a market of more than seven hundred million consumers. However, ratification of the deal is significantly delayed after the European Parliament asked the bloc’s top court to weigh in on the agreement’s legality.

Meanwhile, Mercosur still faces other major divisive challenges, including internal political friction, disagreement over China’s growing influence in Latin America, and concerns over how to accommodate differing national interests with persistent economic inequality.

Which countries are in Mercosur?

Argentina, Brazil, Paraguay, and Uruguay—Mercosur’s founding countries—are full members. Venezuela joined as a full member in 2012, but was suspended indefinitely in late 2016 for failing to comply with the bloc’s democratic principles. In 2024, Bolivia, previously an associate member, completed the accession process to become a permanent member after Brazil’s Congress approved the country’s admission the previous year.

In 2024, the group had a combined gross domestic product (GDP) of roughly $3 trillion, according to World Bank data, making Mercosur one of the world’s largest economic blocs.

Chile, Colombia, Ecuador, Guyana, Panama, Peru, and Suriname are associate members of Mercosur. They receive tariff reductions when trading with permanent members but do not enjoy full voting rights or free access to members’ markets.

Why was Mercosur created?

Mercosur was created in 1991 when Argentina, Brazil, Paraguay, and Uruguay signed the Treaty of Asunción, an accord calling for the “free movement of goods, services, and factors of production between countries.” The four countries agreed to eliminate customs duties, implement a common external tariff (CET) of 35 percent on certain imports from outside the bloc, and adopt a common trade policy toward outside countries and blocs. (Today, the CET averages 11.5 percent.) The charter members hoped to form a common market similar to that of the EU to increase business and investment opportunities for regional industries and encourage local development. Some members of the bloc have previously proposed adopting a common currency to reduce dependence on the U.S. dollar, but some skeptics say member countries’ economies are too different to share a single monetary policy.

“Mercosur had grand ambitions,” said Shannon K. O’Neil, a Latin America expert and senior vice president at CFR. “It was going to be a customs union with a political side.” The Mercosur stamp is emblazoned on member countries’ passports, and license plates display the Mercosur symbol. Residents of the bloc are authorized to live and work anywhere within it. In 1994, the group signed the Protocol of Ouro Preto, formalizing its status as a customs union.

Mercosur was created in large part to cement a rapprochement between Argentina and Brazil, whose relationship had long been defined by rivalry. Together, the two countries account for about 94 percent of the bloc’s GDP and 92 percent of its population. Some critics say Argentina and Brazil wanted Mercosur simply as a trade shield. The bloc often “is less about opening up but actually about protecting Brazilian and Argentine industries from global competition,” said Oliver Stuenkel, an associate professor at the Getulio Vargas Foundation in São Paulo.

How does Mercosur work?

The bloc’s highest decision-making body, the Common Market Council, provides a high-level forum for coordinating foreign and economic policy. The group consists of the foreign and economic ministers of each member state, or their equivalent, and decisions are made by consensus. The group’s presidency rotates every six months among its full members, following alphabetical order; Paraguay currently occupies the position. Other bodies include the Common Market Group, which coordinates macroeconomic policies; a trade commission; a parliament, known as Parlasur, which serves an advisory role; and the Structural Convergence Fund (FOCEM), which coordinates regional infrastructure projects.

FOCEM projects, such as building highways and bridges and developing waterways, are funded by member-country contributions determined by a formula that accounts for each country’s GDP. Brazil, with a GDP of more than $2 trillion, contributes 60 percent, Argentina 30 percent, and Paraguay and Uruguay 5 percent each. For 2024, FOCEM’s budget was roughly $300 million [PDF]; Paraguay has received the largest amount [PDF] of funding, followed by Uruguay, while most of the funds have gone toward infrastructure projects. In 2025, the fund became the subject of internal debate after Brazil proposed reducing members’ annual contributions and revising the allocation formula—a move that some members resisted.

How has Mercosur performed economically?

Mercosur spurred significant economic integration in its first decade. Internal goods trade grew rapidly, rising from $4.1 billion in 1990 to $19 billion in 1998, while its share of the bloc’s total trade increased from 11 percent to an all-time high of 25 percent [PDF].

Regional integration began to stall, however, after Brazil’s currency devaluation in 1999 and Argentina’s financial crisis in 2001, and it never fully recovered, said O’Neil. In the wake of the Brazilian real’s devaluation, member countries introduced numerous exemptions to the CET: Argentina and Brazil each maintained 100 tariff lines on their national exception lists, Uruguay 225, and Paraguay 649. These exemptions eroded the bloc’s customs union, even as trade among member states continued growing, eventually peaking at $54 billion [PDF] in 2011.

After 2011, intra-bloc integration weakened further. Countries increasingly turned away from each other and never developed deep supply chains beyond the auto industry and a few other sectors, said O’Neil. In 2024, intra-Mercosur trade remained around $47 billion [PDF] in absolute terms; however, it accounted for only 11.7 percent of total exports, falling back to its 1990 share.

Trade disputes and other tensions have continued to flare between member countries. Recent efforts by Uruguay to establish a free trade agreement (FTA) with China and join the Trans-Pacific Partnership have also been a source of tension between bloc members. While Brazil supports pursuing an FTA with China, Argentina has publicly opposed it, citing concerns that a trade deal could lead to an influx of cheap Chinese imports to the region.

Meanwhile, the bloc has sought to expand external partnerships, inking economic cooperation agreements with Bolivia, Chile, Israel, and Peru, and in 2004, it signed a preferential trade agreement with India. The bloc has had an FTA with Egypt since 2017, and in 2023, it concluded an FTA with Singapore, its first with a Southeast Asian country. But other deals have proved elusive. Negotiations with Canada and South Korea remain underway. Talks with the EU, which began in 1999, repeatedly faltered due to concerns about an influx of cheap South American products undermining European farmers and Brazilian illegal logging in the Amazon Rainforest.

However, a breakthrough came in 2026, when Mercosur and the EU reached a comprehensive trade agreement that, once fully implemented, would eliminate tariffs on more than 90 percent of goods traded between the two blocs over fifteen years. The deal opens Europe’s consumer market of 450 million people to Mercosur’s agricultural exports—including beef, poultry, and soybeans—while providing access to European machinery and technology. The Inter-American Development Bank projects [PDF] the agreement would boost Argentina’s exports by 10 percent and Brazil’s by 6.3 percent, while Bloomberg Economics estimates a 0.7 percent GDP increase for Mercosur member states by 2040.

In contrast, there are currently no trade deals between the United States and the bloc itself, and relations have at times been strained. In 1994, U.S. President Bill Clinton proposed the Free Trade Area of the Americas (FTAA), which would have eliminated or reduced trade barriers among the countries in the Western Hemisphere, excluding Cuba. The FTAA was to be completed by 2005, but by 2004, negotiations had stalled as several Latin American nations, including Mercosur members Argentina and Brazil, opposed the deal [PDF], and it was never finalized.

In 2019, U.S. President Donald Trump imposed steel and aluminum tariffs on Argentina and Brazil, though he signed a limited trade deal with Brazil the following year. On so-called Liberation Day on April 2, 2025, his administration imposed a baseline 10 percent tariff on virtually all countries’ imports, with higher rates on about sixty countries. It has also wielded economic leverage to influence political outcomes across the region, tying U.S. aid and loans to electoral results in Argentina and Honduras, imposing tariffs on Brazil to halt legal proceedings against former President Jair Bolsonaro, and forcibly removing Venezuelan leader Nicolás Maduro in a January 2026 raid. Analysts and officials in Mercosur countries say this cumulative pressure has accelerated approval of the EU-Mercosur agreement, reinforcing South American countries’ determination to strengthen partnerships with Europe and China rather than rely on their dependence on the United States.

Has Mercosur promoted democracy?

One of Mercosur’s early aims was to cement the region’s return to democracy since all of its founding members had emerged from dictatorships in the 1980s. In 1998, the group signed the Ushuaia Protocol on Democratic Commitment, affirming that democratic institutions are essential to the integration of Mercosur states and that a “rupture in democratic order” would be cause for a member’s suspension.

Mercosur members invoked the protocol for the first time in 2012 to suspend Paraguay, claiming that President Fernando Lugo had been unfairly removed from power after his domestic opponents accused him of mishandling a deadly clash between farmers and law enforcement. Some experts say Paraguay’s suspension, which was lifted in 2013, was politically motivated, since Brazil’s then left-wing government was seeking Venezuela’s admission to the bloc and Paraguay’s new, center-right government opposed it.

Why was Venezuela suspended?

Venezuela joined the bloc in 2012, with Brazil arguing that including the oil-rich country would make Mercosur a “global energy power.” But falling oil prices, economic mismanagement, and an increasingly authoritarian government have pushed Venezuela into a prolonged economic, political, and humanitarian crisis. As a result, nearly eight million Venezuelans have fled to neighboring countries and beyond since 2014.

Mercosur suspended Venezuela in late 2016, citing violations of human rights and the bloc’s trade rules by the Maduro government. In August 2017, the group made Venezuela’s suspension indefinite. (There are no provisions for permanent expulsion.)

“A reformist desire to deepen trade within the bloc, as well as genuine horror at Venezuela’s descent into an economically dysfunctional dictatorship, has helped galvanize the four original members’ willingness to slowly inch Venezuela out of the bloc,” said American University’s Matthew Taylor, an expert on Latin America’s political economy.

What other challenges is Mercosur facing?

In recent years, Mercosur countries have experienced economic and political turmoil, complicating efforts to deepen regional integration. Corruption probes launched in Brazil in 2014 have spread, implicating hundreds of the region’s political and business elites. At the same time, falling commodity prices and what critics describe as economic mismanagement have contributed to recessions in the region. In 2020, Latin America’s GDP fell by 7 percent, the worst of any region in the world. Return to growth has been slow amid high inflation and rising global interest rates.

Meanwhile, Mercosur continues to face internal division. Like his predecessor Bolsonaro, Brazilian President Luiz Inácio Lula da Silva (Lula) has expressed a desire to “modernize” the bloc, including by allowing for bilateral deals with third-party countries. Argentine President Javier Milei, who took office in December 2023, initially threatened to withdraw Argentina from the bloc entirely and has called for greater autonomy to pursue extraregional trade agreements (though he has also signaled strong support for the EU-Mercosur deal). Uruguay’s ongoing efforts to ink an FTA with China—which would require leaving the bloc due to its CET commitments—have likewise created tension, and Bolivia’s recent accession while in an economic crisis could add to the pressure.

Reforms have been modest. A 2022 tariff revision reduced the average common external tariff from 8.5 percent to 7.1 percent across roughly 6,900 product codes—the first comprehensive adjustment since 1995—but experts say the bloc’s protectionist policies [PDF] and reluctance toward creating value-added supply chains or regional production hubs continue to stifle deeper integration.

Managing the trade relationship with China will also continue to test the bloc’s unity. China’s goods trade with Latin America surged to $518 billion in 2024, and cumulative Chinese direct foreign investment projects in the region topped $180 billion by the third quarter of 2025. While there is no FTA between China and Mercosur, Lula has said he supports eventually pursuing such a deal. Additionally, Argentina and Uruguay are participants in China’s Belt and Road Initiative, the world’s largest infrastructure program.

For Mercosur countries, the EU agreement offers an alternative to dependence on either China or the United States. The deal could strengthen Europe’s economic foothold in a region where China has rapidly expanded and the Trump administration—which explicitly calls for denying rival powers control over strategically vital assets in the Western Hemisphere—has employed increasingly coercive tactics.

Experts broadly agree, however, that Mercosur’s future will hinge on decisions made in Brasília and Buenos Aires. “Brazil and Argentina are two of each other’s most important trading partners. But both countries—especially because they’re going through a difficult economic time—would benefit from opening their markets more generally,” said CFR’s O’Neil. “The challenge is whether they can do it together.”

Recommended Resources

For the Atlantic Council, three experts unpack what’s next for the EU-Mercosur trade agreement.

For the Center for Strategic and International Studies, Lauri Tähtinen explores what’s at stake in the EU-Mercosur trade deal.

For Americas Quarterly, Felipe Larraín B. and Carmen Cifuentes V. propose ASEAN as a blueprint for overcoming Latin American trade fragmentation.

This CFR backgrounder examines China’s growing influence in Latin America.

The Inter-American Development Bank’s 2025 Macroeconomic Report [PDF] examines regional opportunities amid global shifts. t

Colophon

Staff Writers

- CFR Editors

Additional Reporting

Ivana Lefebvre d’Argence, William Rampe, Diana Roy, Claire Klobucista, Danielle Renwick, Andrew Chatzky, Anshu Siripurapu, and Rocio Cara Labrador contributed to this report. Will Merrow created the graphics.

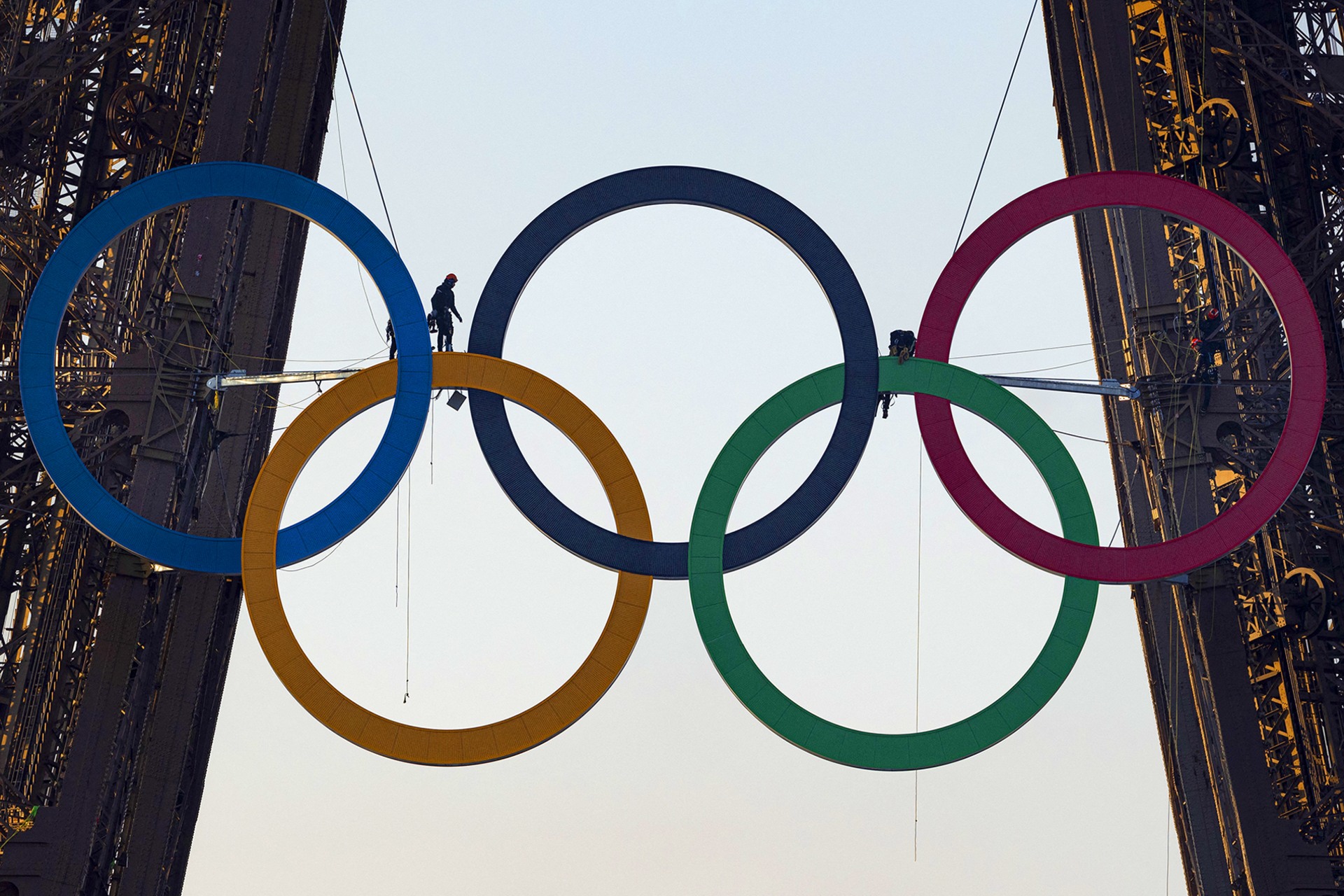

Header image by Tobias Canales/Hans Lucas/AFP/Getty Images.