Harvey Lessons for U.S. Export Role: Public-Private Stockpiles

By experts and staff

- Published

By

- Amy M. JaffeDavid M. Rubenstein Senior Fellow for Energy and the Environment and Director of the Program on Energy Security and Climate Change

Inventories play a crucial role in oil and gas commodity markets by smoothing out short term dislocations and sudden changes in demand. The historically high inventory levels lingering from the after effects of a global market share war that has been raging since 2014 helped mute potential shortages from emerging in the wake of Hurricane Harvey. The hurricane initially knocked out roughly four million barrels a day (b/d) of U.S. refining capacity, pipelines, and over a million b/d in U.S. domestic oil production, including offshore output as well as 300,000 to 500,000 b/d from south Texas onshore fields inhibited by flooding for several days. Oil and gas infrastructure requires electricity, workforce availability and safety conditions to operate. While some of the shuttered oil and gas facilities are now coming back on line, the broad physical toll of Harvey’s severe weather event warrants revisiting of the policies surrounding both commercial and strategic inventory management.

Just over half of all U.S. refining capacity is located on the U.S. Gulf coast, which is seasonally prone to hurricanes. A reevaluation of inventory policy is particularly important given the United States’ newfound role as a major exporter of oil and gas. In preparation for the storm, close to fourteen refineries fully shut down production around the Houston area. The geographic range of the shutdowns ranged from Corpus Christi, where five refineries were shut down, to Beaumont and Port Arthur, where three refineries went offline. This included Motiva’s 603,000 b/d Port Arthur facility, which is the nation’s largest refinery. As of September 7, the U.S. Department of Energy [PDF] reported that six refineries in the Gulf coast were still shut down and five were just in the process of restarting. At least two ExxonMobil refineries suffered structural damage during the hurricane.

U.S. national security can be enhanced by embracing the country’s emerging export role. The Donald J. Trump administration is looking to leverage the opportunity created by U.S. oil and gas exports to assert global energy “dominance.” But for U.S. industry and the United States to benefit to the fullest from its status as a major global oil power, it needs to shore up its bonafides as a secure and reliable supplier. That means forging a stronger link between private and public management of inventories needed to keep oil and gas flowing even in the face of natural disasters and other kinds of supply emergencies. My research with co-authors Colin Carter and Daniel Scheitrum shows that there has been a significant substitution effect between private commercial crude oil inventories and public inventories over the past two decades in the United States. We also found that inventory patterns are changing rapidly as the shale revolution and related export flows have altered oil, gas, and refined products pipeline flows around the United States in ways that are changing the calculus between public and private oil stockpiling activities. For example, reversed pipelines to bring U.S. domestic production down to Gulf coast refiners have meant that access to the Strategic Petroleum Reserve (SPR) for mid-continent refineries is now limited, propelling local refineries to carry higher working inventory. California’s pipeline access to SPR releases is similarly inhibited and has been under study at the federal level. California’s refiners have not increased inventory holdings to sufficiently cover for occasional accidental supply outages, leading to billions of dollars in burdensome fuel premiums being paid by the public.

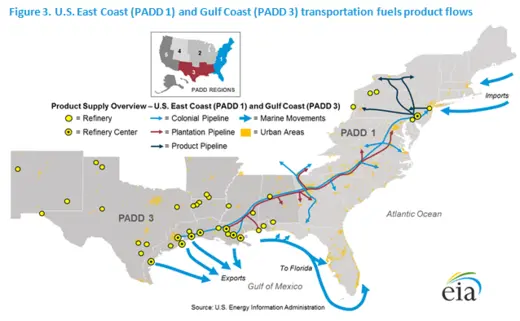

The brief Harvey-related cut off of the Colonial Pipeline, a main artery to bring gasoline to the northern United States from the Gulf coast, turned out to be less severe than similar problems during Hurricane Rita and Katrina partly due to its brevity and availability of local buffer commercial inventories but also given changing trade flows. Earlier this summer, Colonial Pipeline was experiencing lower than usual shipments to the U.S. Northeast as rising oil demand from Mexico and Latin America pulled more U.S. Gulf coast gasoline and diesel exports southward. In other words, a significant portion of the U.S. Gulf coast refining disruption affected U.S. refined product export volumes, which had been averaging 532,000 b/d for gasoline and 1.1 million b/d for diesel in July.

The U.S. Department of Energy (DOE) and the General Accounting Office (GAO) have been studying how best to upgrade current SPR infrastructure given changes in the U.S. oil industry and the fact that some of the SPR’s current surface equipment is approaching its technical end of life, raising the chances of equipment failures. Among the questions being asked are: what is the appropriate size for the SPR over time as U.S. oil import levels shrink and also what kinds of upgrades are needed to maintain the system’s broader regional effectiveness. What will help the Trump administration in its current efforts to rethink SPR policy will be the fact that industry now has a greater incentive to ensure that its global image as a secure and reliable supplier is not damaged by poor logistics planning. In other words, policy makers may now have a unique opportunity to reshape the public-private partnership role in inventory management, taking into account the rising importance of the United States’ new role as a global energy exporter. A 2014 National Petroleum Council study entitled Enhancing Emergency Preparedness for Natural Disasters highlighted the importance of coordination between government and private sector leadership in emergency fuel preparedness and implementation.

An important lesson from Hurricane Harvey may be that the U.S. emergency preparedness system, including the SPR, needs more flexibility, regional diversity, and enhanced private sector participation. As the Trump administration looks to consider how privatization could best be applied to emergency fuel management, it can look to Europe’s paradigm of combining coordinated mandated requirements for minimum private sector holdings of refined product stocks with more limited public holdings of crude oil for insights on how the SPR system could be reformed to meet the changing U.S. energy outlook. The European system allows for a more interactive coordination between private industry holdings and public policy. There is no question that a more flexible system that combines refiner products stocks and federal government crude oil stores would be beneficial, especially if U.S. import levels decline as expected. The Trump administration could also investigate whether any shale producers around the country could serve as flexible suppliers during a long term national emergency, perhaps through a public tender pre-payment system to purchase incremental local production for emergency release through a funding system for incremental drilling and well completions.

Flexibility and public private partnership should be important elements to improving the SPR system. The current Congressional authorization targets up to one billion barrels to be held in the SPR, a level which may now seem arbitrary in light of changing market dynamics. The Trump administration has proposed selling off 270 million barrels of the reserve’s current 687.7 million barrels over the next decade as part of a budget plan. The ultimate size of emergency stocks must represent enough to replace U.S. oil imports for 90 days in order to meet its obligations—together with U.S. allies such as Europe, Canada, Japan, and South Korea—under the International Energy Agency’s (IEA) coordinated emergency response measures for the Organization for Economic Cooperation and Development (OECD) membership. There is currently much uncertainty about what level U.S. imports will average in ten years.

In light of recent experiences from natural disasters, which can range from hurricanes to flooding events to wildfires, geographic distribution of national emergency stockpiles needs to be given higher consideration in any revamp of the future U.S. preparedness system. Upgrades to the existing public-private emergency preparedness partnership should also consider how to protect the United States’ oil and gas export role to avoid losses in market share during outages. By thoughtfully rejiggering the existing system, the Trump administration might be able to save the tax-payer money, protect U.S. export market share, and wind up with a better, more reliable emergency response.