More on:

This post is co-written by Ben Armstrong and Varun Sivaram. Ben is a Ph.D. Candidate at MIT focused on Political Economy and a researcher at the MIT Governance Lab.

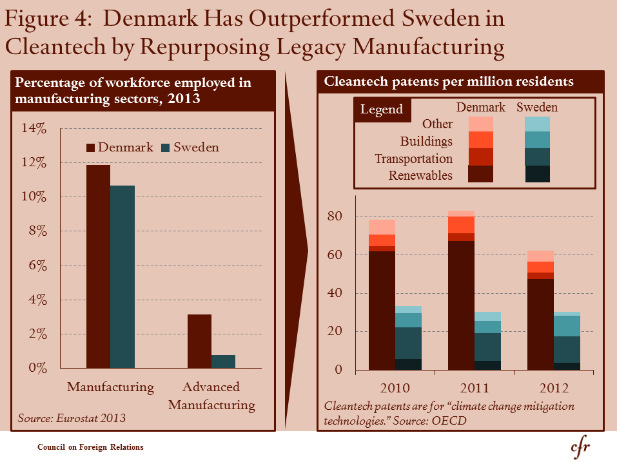

In Part 1 of this series, we posed a puzzle: why has Denmark had more success at clean tech innovation than its neighbor, Sweden? Neither demand-pull conditions, which provide a sales environment that invites innovation, nor technology-push factors, which directly support technology research, development, and demonstration, appears to favor Denmark over Sweden. Both countries have similar environmental policies and environmentally conscious populaces, and Sweden has actually been more successful than Denmark in inducing other forms of innovation, especially in information and communications technology (ICT). But Denmark leads by a substantial margin in patents for climate change mitigation and the commercialization of eco-friendly technology. What explains Denmark’s outperformance in cleantech?

As the nations of the world convened in Paris last week to conclude an accord on climate change, cleantech innovation emerged as a priority. Bill Gates and 27 other billionaire investors pledged to ramp up cleantech funding for emerging technologies, and 20 countries including the United States, India, and China signed on to the “Mission Innovation” pledge to double their funding for cleantech research. As many begin chasing after capital, it becomes even more paramount for countries to figure out how to provide the best environment for a cleantech sector to thrive.

Denmark’s manufacturing revival led its success in cleantech

We argue that Denmark’s cleantech development has been led by legacy manufacturing companies that were founded decades before “cleantech” was even discussed. These corporate actors, who pivoted toward cleantech during a period of economic crisis, are the missing puzzle piece; when paired with government demand-pull and (more importantly) technology-push policies, they transformed into globally competitive cleantech firms. And this phenomenon could recur elsewhere—legacy manufacturing regions in the U.S. Rust Belt could become cleantech hubs. The lesson is that cleantech hubs require far different ingredients than those required to develop a software-led innovation economy.

Denmark’s manufacturing firms began by producing more traditional technology for energy, construction, and home appliances. But when the Danish economy struggled with high unemployment and the energy crisis of the 1970s, these companies began investing in new products that promoted alternative energy sources and increased energy efficiency. The emergence of the Danish cleantech economy was the product of repurposing from large, old companies that needed to innovate to stay relevant. These companies drew on existing manufacturing infrastructure and worker retraining programs (now part of the government’s “Flexicurity” program) to upgrade their businesses.

Five companies listed among Denmark’s top cleantech innovators follow this pattern.

- Novozymes began in the 1920s as a biotechnology company focused on detergents, but early investments in clean energy research in the 1980s helped one branch of the business transition to focus on producing biofuels.

- Grundfos began its business in the early 20th century producing electric pumps for water wells. It transitioned in the 1980s to conduct research on sensors for improving pump efficiency and solar technology that would power its pumps.

- Rockwool started in the early 20th century as a company manufacturing tiles and digging for coal. Wool was a minor part of the business that grew until the oil crisis in the 1970s when Rockwool expanded its insulation business to reduce heating costs. Today it provides stone wool products for insulation that improve energy efficiency.

- Danfoss began building small valves to control heating and cooling systems in the 1930s. Over time, they re-invested in creating electrical control technologies that help improve the efficiency of power systems. Danfoss provides a particularly clear case of repurposing. While the rest of the economy was experiencing crisis during the 1970s, Danfoss expanded its operations to factories that had been vacated by textile companies and a bankrupt telephone manufacturer. In one case, they retrained the workers previously employed in textiles and began expanding the production of coils, relays, and frequency converters to improve energy efficiency.

- Vestas is the leading provider of wind turbines in Denmark and has become a global leader in wind power. It was founded by blacksmiths in the early 20th century, then transitioned to produce household appliances in the 1940s, agricultural equipment in the 1950s, and was most successful with the production of hydraulic cranes in the 1960s. It was only when the hydraulic crane business took off that Vestas began investing in wind technology in the late 1970s. During its initial roll-out of wind technology, one of the turbines broke and the company almost went bankrupt due to uncertain quality control. Vestas later recovered by bringing the end-to-end production of the wind power system in-house. Today it exports much of its wind technology to establish on-shore and off-shore wind farms around the world.

The same cleantech innovation probably did not happen in Sweden because large Swedish businesses did not experience the same pressure; unemployment stayed low through the 1970s, and Sweden’s energy giant Vatenfall made an early investment in nuclear energy in the 1960s that locked Swedish power generators into a particular energy path. When Sweden faced its crisis in the early 1990s, it implemented a sweeping transition into services that gave birth to its more recent success in ICT. It makes sense, then, that manufacturing in Copenhagen is nearly twice as large as a portion of the economy as it is in Stockholm. Advanced manufacturing is four times as prevalent in Copenhagen (again as a proportion of overall employment).

Sweden’s large diversified firms include Electrolux, which produces home appliances like Vestas did, but continued along the same product trajectory for decades without changing course to focus on cleantech. Atlas Copco is a large Swedish producer of power tools that continued to upgrade and produce the same types of products over the course of the 20th Century. Sweden’s largest energy providers include Vattenfall, mentioned above as an early investor in nuclear, which has since diversified into wind and solar—as well as E. On Sverige, which is a subsidiary of the German energy conglomerate E. On. Although there are numerous startups in Sweden investing in improving its renewable energy portfolio and upgrading existing clean technologies, none of them has had the impact that any one of these large Swedish producers might have had if they diversified and invested in clean technology innovation.

Your turn: Most readers support a demand-pull solution to the puzzle

In the previous post, we invited reader comments, and below we’ll feature some of your explanations for Denmark’s comparative success. In contrast to our manufacturing revival theory, several readers described a more straightforward demand-pull story to explain Denmark’s comparative success over Sweden in cleantech and in wind energy in particular.

David B. Benson notes that the wind from the Atlantic Ocean not only keeps Denmark warm but also “goes a long way towards explaining the Danish interest in wind derived power.” Similarly, Anonymous argues that Denmark is “windier than Sweden, which is more protected [from ocean winds].” And since “Denmark is right next to massive energy user Germany, which…if happy to buy the power from Denmark,” wind power in Denmark can serve both domestic and foreign markets. Ola proposes that higher electricity prices in Denmark compared with Sweden made renewable energy more competitive in Denmark. Geoff Dabelko suggests that Denmark’s choice to forego domestic nuclear power freed up resources for “state subsidies for renewable energy internally.” Echoing this policy argument, Fionn Rogan contends that favorable public opinion in Denmark has supported aggressive domestic procurement of clean energy technologies “so that the wind turbine that’s invented and developed in Denmark gets bought in Denmark too. At least initially, until there’s enough of an export market to take it to the next growth stage.”

Indeed, Denmark is a leader in wind energy, and on some days the 4.8 GW of installed wind capacity in Denmark account for over 100 percent of Danish electricity consumption (the surplus is exported to neighbors). But the domestic market for wind turbines does not neatly explain the rise of Denmark’s globally competitive wind industry—not even initially. In particular, the ascent of Danish wind turbine manufacturer Vestas, which has the largest share of the global wind market, depended on its international expansion much more than its domestic sales. Vestas’ first major order came from California in 1985, when its transition to producing wind turbines rather than agricultural machinery was incipient. By the early 1990s, through exports, joint ventures, acquisitions, and subsidiaries around the world, Vestas was selling turbines to the United States, the United Kingdom, Germany, Spain, Australia, New Zealand, and—yes—to Sweden.

Although the Danish government did support the deployment of wind at home—from 1981 to 2000, Denmark installed 1.4 GW of wind thanks largely to domestic mandates—the domestic market always accounted for a minority of Vestas’ sales (for reference, Vestas sold around 1.3 GW in 2000 alone, a third of the global market). And domestic policy support was far from unwavering in creating demand for wind turbines. The steady progress that Denmark made in sustaining a growing domestic market from 1981 to 2000 was abruptly undone by the incoming Conservative Party government, which slashed support from 2001 to 2007. Nevertheless, companies like Vestas continued to expand internationally, despite waning support at home; this suggests that its ability to capitalize on favorable policy toward wind abroad, in much bigger markets than Denmark (like the United States, Spain, and Germany), drove its success.

Our favorite reader comment: Cleantech ≠ software

The only technology-push explanation came from Graham Pugh (which is fitting since he was formerly a director at the Department of Energy, which implements technology-push policy in the United States). Graham “would posit that a combination of support for hardware startups from universities like DTU [Danish Technological University] and perhaps incubators has made the difference.” Moreover, he argues, “I think hardware IS different and requires different strategies [from supporting software].”

We agree with this view, and we concede that in addition to our manufacturing revival theory, targeted government support for hardware-specific innovation in Denmark could help explain why Denmark has succeeded in cleantech.

Importantly, we do not contend that Denmark is more innovative than Sweden. After all, Sweden benefitted from the success of high-growth software companies like Ericsson and Spotify and successful global producers like IKEA. Rather, both Denmark and Sweden boast innovative economies, but Graham pushes us to disaggregate what we mean by innovation—success in cleantech looks very different from success in other sectors. And the surprising conclusion from the Danish example is that the intuitive demand-pull and technology-push levers that policymakers have to support the cleantech sector may not suffice to make it globally competitive. Danish environmental regulations, labor market reforms that improved job retraining, and early-stage research support for hardware innovation helped to varying degrees. But the crucial factor that differentiates Denmark from neighboring Sweden is that Danish business captured an opportunity during crisis to reorient their business to focus on an emerging industry. And it paid off.

So, who’s next?

More on: