Is the BRICS Contingent Reserve Arrangement a Substitute for the IMF?

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Dinah WalkerAnalyst, Geoeconomics

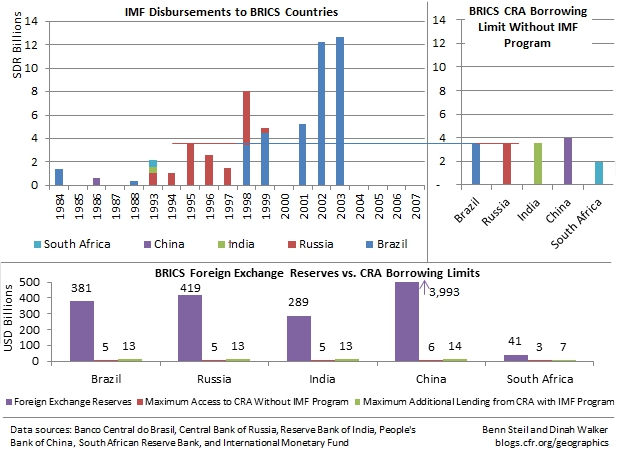

Russian President Vladimir Putin has hailed the new BRICS contingent reserve arrangement (CRA) as a substitute for the IMF, saying that it “creates the foundation for an effective protection of our national economies from a crisis in financial markets.“ But does it?

Under the terms of the arrangement, China can, without being on an IMF program, borrow up to $6.2 billion; Brazil, Russia, and India $5.4 billion; and South Africa $3 billion. But this is chicken feed compared to Russia and Brazil’s crisis-borrowing from the IMF over the past twenty years, as we show in the top figure above. The IMF approved lending to Russia of $38 billion (SDR 24.786 billion) in the 1990s. In 2002 alone, the IMF approved a 15-month stand-by credit arrangement of about $30 billion for Brazil. Net private financial flows to emerging markets today are roughly 10 times what they were in 2002, meaning that the size of the loans necessary to address balance of payments financing problems would be even larger now.

The BRICS countries know this, which is why they maintain such vast pools of foreign exchange reserves, as we show in the bottom figure.

The notion that $5.4 billion from the BRICS CRA would make a difference to Russia in a genuine financial crisis is ridiculous. Putin’s statement is clearly political hyperbole, which is why Russia currently holds over $400 billion in reserves.

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”