Greek Drachma: Not an Option

More on:

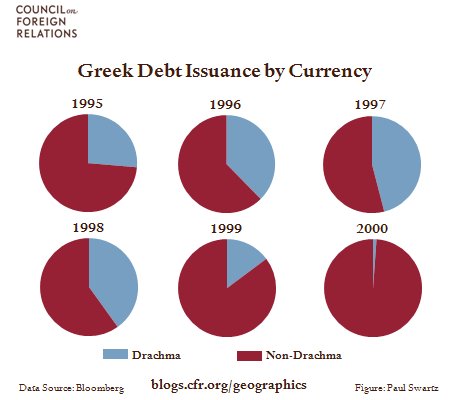

On April 26th, Standard and Poor’s downgraded Greece’s credit rating, and Greek sovereign credit default swaps (CDS) climbed to 825 basis points - far higher than before the IMF and European Council of Ministers announced a support package. The Greek crisis is clearly unresolved. Some have argued that if Greece had never switched from the drachma to the euro it would have been able to pursue a fiscal policy that fit its domestic needs without depending on international capital markets. Yet Greece consistently relied on non-drachma debt issuance well before it adopted the euro in 2001. In the six years before joining the euro, only 27% of Greek debt was issued in drachma. At the end of 2000, just before Greece joined the eurozone, 79% of its outstanding debt was already denominated in euros, and a mere 8% in drachmas. Even if Greece had remained outside the eurozone, its dependence on euro borrowing would only have increased. A falling drachma would merely have brought the current crisis to a head earlier by accelerating the rise in Greece's debt-to-GDP ratio (think Iceland). The fact that the euro is not an "optimum currency" for Greece, or any other eurozone country for that matter, is not the main problem. That problem is excessive foreign borrowing, a problem with which Greece has struggled since the early 19th century.

Steil: Don't Blame the Euro for Greece's Woes

More on:

Online Store

Online Store