This post was co-written by Sagatom Saha, research associate for energy and foreign policy at the Council on Foreign Relations.

Recent headlines from the solar energy industry have been bleak. SunEdison—a solar developer which just a year ago aspired to join the ranks of multinational oil companies as an energy “supermajor”—declared bankruptcy in April, after wiping out $9 billion in market value. And the share prices of Yieldcos, the financial vehicles which promised to tap vast capital markets to finance renewable energy projects, have plummeted as well. Last year, I wrote that Yieldcos’ aggressive growth targets and financial model made them vulnerable to the vicious downward spiral that has played out.

More on:

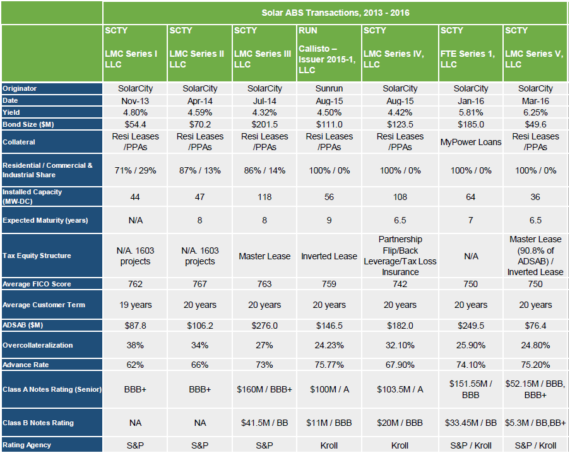

But as the focus of the industry moves beyond Yieldcos, another example of financial engineering could take center stage. Solar securitization, which dices, bundles, and sells loans for distributed solar projects to deep-pocketed investors, follows a tried-and-true model used to finance everything from cars to home mortgages. In a new MIT Energy Initiative Working Paper, Frank O’Sullivan and Charlie Warren assess the emerging class of residential solar asset-backed securities (ABS). They conclude that this approach has the potential to bring substantial low-cost capital to fuel residential solar adoption, but the model will need to evolve to surmount existing barriers. In particular, securitization could take off if smaller companies get involved and better data emerges to de-risk solar investments.

Familiar But Exotic

Securitization is probably most well-known for causing a massive recession in 2008, when the subprime mortgage bubble burst and investors realized that securitizing bad loans did not magically extinguish risk. Fortunately, solar securitization so far looks much safer, since the underlying loans are to consumers with much higher credit scores.

Although securitization has been around since the 1970s, solar securitization is relatively new—solar companies have only performed seven rounds of securitization, and the first one was in 2013. Still, all of these rounds look very similar to securitizations for other asset classes, like auto, home, or student loans, the authors explain:

The solar ABS transactions to date adhere to the general framework of most securitizations, with some important exceptions. Solar ABS use a standard legal structure—the special purpose entity—to combine thousands of rooftop solar systems generating monthly cash flows. Importantly, the special purpose entity is a limited liability company, which is designed to mitigate bankruptcy risk between the solar provider (the originator) and the issuer of the solar ABS. The special purpose entity then issues new debt securities based on the cash flows from the solar leases/PPAs or loan payments. Fixed income investors buy the solar ABS and receive the interest payments.

The big payoff from securitization is access to low-cost capital from deep-pocketed institutional investors. In theory, this would allow solar companies to accelerate the pace of solar installations and increase the size of the U.S. residential solar market. The results from the seven securitizations to date are promising—investors have agreed to purchase securities at reasonably low yields of ~4–6 percent (see table below, copied from the MIT paper).

More on:

Still, the authors note, there are a couple twists:

While solar securitization shares many similarities with other ABS, the structures have two specific nuances. First, tax equity investors are crucial because solar providers need to monetize the ITC. However, tax equity’s role in, and capital structure position among other investors, becomes more complicated during solar securitizations. Whereas tax equity investors are usually the senior claimants on the cash flows from the projects, securitization involves another class of investor seeking equally predictable returns: fixed income.

Another feature of solar securitizations is their liquidity, or lack thereof. There is little trading of existing solar ABS, indicating a “buy and hold” strategy from institutional investors. The exact number of existing solar ABS investors is not public, but the available data point to relatively small numbers. For instance, Sunrun’s only securitization involved 19 investors according to company presentations. Solar ABS are, after all, esoteric and relatively small, with no issuances above $202 million to date.

Asset-Backed Insecurities?

Those quirks of solar ABS hint at the barriers that this emerging asset class will have to overcome to fuel rapid growth in residential solar. The authors of the MIT paper cite four in particular:

- Not enough companies may offer securitizations. To date, only two companies (Solarcity and Sunrun) have performed securitizations. These companies have the scale and diversity of projects to do so on their own, because securitization needs to be done in large chunks to attract institutional investors who avoid small transactions.

- Public policies could change. The economics of residential solar depend heavily on the method by which solar is compensated by a utility. In many states, solar benefits from “net metering,” which allows a consumer to sell excess solar power back to the grid at the retail rate. Some states—notably Nevada—have started to roll back net metering, raising the specter of reforms elsewhere (Nevada’s February 2016 decision helps explain why the yield on Solarcity’s ABS jumped nearly two percentage points between August 2015 and March 2016). On top of the state policy uncertainty, federal policy could change as well, especially if the IRS makes it more difficult for tax equity investors to invest alongside ABS debt investors.

- Interest rates could rise. Low yields for solar ABS depend on low underlying interest rates. But if the Federal Reserve continues to tighten rates in coming years, solar companies could see the cost of capital that they can raise through securitization increase. Moreover, worsening market conditions can increase yields on corporate bonds that also could increase solar ABS yields.

- Solar could become very cheap. This hardly sounds like a risk, but it is in fact an important differentiating risk from other ABS classes. If solar power continues to fall in cost, solar installations might have low “salvage” value in the case of a consumer loan default.

From Esoteric to Mainstream

Many of those barriers are out of the industry’s control. But the MIT report’s authors suggest one way for the industry to accelerate securitization, especially because ABS currently account for a tiny fraction of the overall U.S. residential solar market:

One such option would be to combine transactions from multiple solar providers into a single structure, commonly known as “pooling.” Pooling securitizations across solar providers offers two opportunities in theory. First, smaller and medium-sized developers account for approximately 40 to 50 percent of the existing residential market by installed capacity. There are cash-producing, long-term contracted, and credit-worthy assets already deployed across the United States. Solving the supply problem on solar ABS could be accomplished not only through more securitizations from existing players, but also by expanding the range of originators. Second, other players in the solar ABS market would benefit from its expansion, including banks and rating agencies conducting additional transactions and applying best practices to date. If incentives are well aligned, expanding solar ABS to a new installer base could also have the added effect of increasing solar deployments writ large.

In addition, the industry can improve the availability of data to reduce the risk perceived by investors. I spoke with representatives from kWh Analytics, a company that has built a database of 70,000 operating solar projects around the United States. They stressed that databases—for example of consumer credit—have de-risked other asset classes, and the same now needs to happen for solar. If solar companies can back up their projections of solar installation performance with hard data, investors may purchase solar ABS on more favorable terms (e.g., at a higher advance rate, which is the ratio of the debt raised to the underlying collateral. The 75 percent solar ABS advance rate is well below the 92 percent advance rate for autos and 99 percent advance rate for mortgages).

And in the process, solar ABS might go from esoteric to mainstream.

Read the full MIT report here. For further reading/listening, check out Greentech Media’s excellent podcast on solar securitization here.