- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Violence around U.S. elections in 2024 could not only destabilize American democracy but also embolden autocrats across the world. Jacob Ware recommends that political leaders take steps to shore up civic trust and remove the opportunity for violence ahead of the 2024 election season.Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

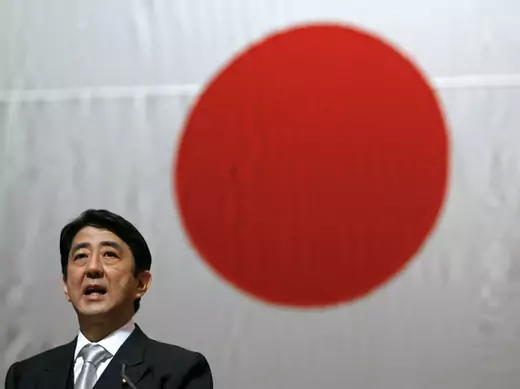

March 26, 2013

Politics and GovernmentIf at first you don’t succeed, try, try again. That old saying could be the motto of Japanese prime minister Shinzo Abe, who today marks the end of his third month in office. You see, he had this job…

July 14, 2015

Elections and VotingOne hundred and three years have passed since the last time a sitting New Jersey governor was elected president. Current New Jersey Governor Chris Christie hopes to break that streak. He announced tw…

September 18, 2005

United StatesI suspect the stock of outstanding synthetic credit derivatives -- $ 1500 b in synthetic CDOs in 2004 v. $300 b or so in 2001, according to Mark Whitehouse of the Wall Street Journal -- is the only t…

September 21, 2006

ChinaIt is rather hard to read Andrew Browne’s report of the building boom in Zhengzhou in last week’s Wall Street Journal --- or for that matter many other accounts of China’s current investment boom – a…

January 18, 2008

Monetary PolicyIn 2007: China’s government added $430b to its foreign exchange reserves. Russia’s government added $150b to its foreign exchange reserves. China’s state banks likely - this is the only…

Online Store

Online Store