- Iran

- Israel-Hamas

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Violence around U.S. elections in 2024 could not only destabilize American democracy but also embolden autocrats across the world. Jacob Ware recommends that political leaders take steps to shore up civic trust and remove the opportunity for violence ahead of the 2024 election season.Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

March 17, 2009

Financial MarketsThe FT’s Gillian Tett makes a simple but important point: AIG’s role in the credit default swap market meant that a lot of risk that the bank regulators thought had been dispersed into many strong ha…

October 27, 2008

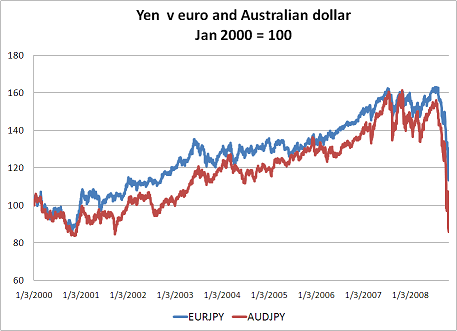

Financial MarketsBack when it was fashionable to talk about the end of macroeconomic volatility, it was also common to note that volatility had disappeared from the currency market. The FT’s resident financial anth…

September 27, 2006

Financial MarketsIt is perhaps a sign of the times that the US is encouraging China to provide the US with a bit less financing (the US of course, has a strong RMB policy, not a weak dollar policy) and New Zealand’s …

August 30, 2007

Financial MarketsOr perhaps – with a bit of reverse financial engineering – into “apples, pears, strawberries and all the rest.” Martin Wolf is the latest observer to note that the US has created a lot of financial l…

August 17, 2007

Financial MarketsYves Smith of Naked Capitalism is right – If Gillian Tett of the FT disappeared, we would be in a whole lot of trouble. I wouldn’t be surprised if a lot of central bankers rely on her reporting to…

Online Store

Online Store