- RealEcon

- Israel-Hamas

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedFollowing a long series of catastrophic misadventures in the Middle East over the last two decades, the American foreign policy community has tried to understand what went wrong. After weighing the e…

Book by Steven A. Cook June 3, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

January 5, 2005

Budget, Debt, and DeficitsIf you cannot tell from the title, this is going to be a rather wonky post. Nouriel and I are working on a paper on "Bretton Woods Two," so I have been delving into some data on the Treasury market. …

February 13, 2006

Monetary PolicySome would say it never really went away.Emerging market economies did not stop accumulating reserves in 2005. Best I can tell, adjusting for valuation effects and including all the foreign assets o…

April 6, 2008

Financial MarketsA ton, according to Morgan Stanley’s Stephen Jen and a host of Wall Street investment banks Not all that much, according to Milken Institute’s Christopher Balding (as reported by Bob Davis in the Wa…

November 17, 2008

Financial MarketsThe G-20’s communiqué offered a surprisingly robust work program for regulatory reform. MIT’s Simon Johnson even worries that it may be too robust – and push banks to scale back their lending in a …

January 18, 2017

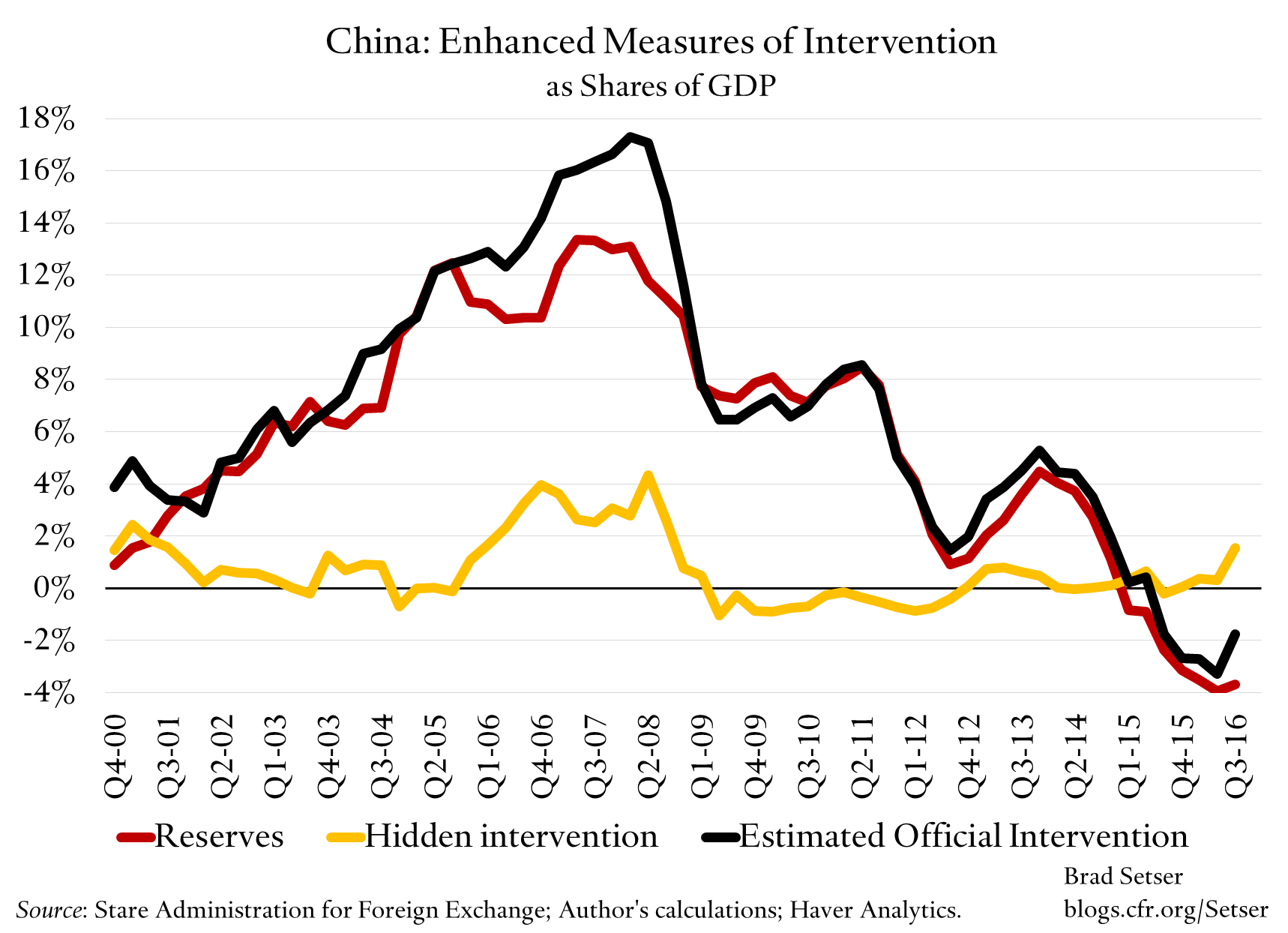

ChinaLate last year Tim Duy asked for an assessment of the decision to allow China to join the WTO, now that 15 years have passed. Greg Ip met the call well before I did, in a remarkable essay. But …

Online Store

Online Store