The Credit Rating Controversy

Updated

The three major credit rating agencies have been accused of contributing to the global financial crisis, drawing increased oversight from regulators in the United States and Europe. Nonetheless, investors continue to rely on the largely unchanged ratings services.

Introduction

The “Big Three” global credit rating agencies—U.S.-based Standard and Poor’s (S&P), Moody’s, and Fitch Ratings—have come under intense scrutiny in the wake of the global financial crisis. Meant to provide investors with reliable information on the riskiness of various kinds of debt, these agencies have instead been accused of exacerbating the financial crisis and defrauding investors by offering overly favorable evaluations of insolvent financial institutions and approving extremely risky mortgage-related securities.

In Europe, the Big Three garnered further controversy over their sovereign debt ratings. While the public debt of crisis-hit countries like Greece, Portugal, and Ireland was relegated to “junk” status, the agencies also downgraded the creditworthiness of France, Austria, and other major eurozone economies. EU officials argued that these moves accelerated the eurozone’s sovereign debt crisis, leading to calls for the creation of an independent European ratings agency.

Both the United States and Europe have taken steps to regulate the three main agencies and ensure more transparency and competitiveness. The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and the European Securities and Markets Authority (ESMA), created in 2011, have both sought to hold agencies accountable and protect investors. Meanwhile, agencies have faced intense legal scrutiny of their business practices, with S&P paying a record $1.37 billion in a 2015 settlement with state and federal prosecutors, and Moody’s coming under investigation by the U.S. Justice Department. However, critics say the fundamental business model of the Big Three—and their market dominance—remains intact.

The Role of Credit Rating Agencies

Credit rating agencies are meant to provide global investors with an informed analysis of the risk associated with debt securities. These securities include government bonds, corporate bonds, certificates of deposit (CDs), municipal bonds, preferred stock, and collateralized securities, such as collateralized debt obligations (CDOs) and mortgage-backed securities. The riskiness of investing in these securities is determined by the likelihood that the debt issuer—be it a corporation, bank-created entity, sovereign nation, or local government—will fail to make timely interest payments on the debt.

Ratings are usually characterized by a letter grade, the highest and safest being AAA, with lower grades moving to double and then single letters (AA or A) and down the alphabet from there. The ratings handed out by each of the Big Three have widespread implications for investors and global markets. Together they control nearly 95 percent of the credit ratings market, in large part because their status was enshrined in the original 1975 Securities and Exchange Commission (SEC) regulations of the sector.

Rating agencies were accused of misrepresenting the risks associated with mortgage-related securities.

As such they also strongly influence investor perceptions of the creditworthiness of global governments. This power over markets has drawn strong criticism. “We can’t have private companies, whose primary goal is maximizing profit, behaving like sovereign judges passing down opinions that are binding for disinterested third parties,” argued Thomas Straubhaar, the director of the Hamburg Institute of International Economics, in Deutsche Welle.

Industry Structure: ’Issuer Pays’ vs. ’Subscriber Pays’

Most criticism of credit raters centers on the “issuer pays” model—employed by each of the Big Three—whereby a bond’s issuer pays the rating agencies for the initial rating of a security, as well as ongoing ratings. The public (and investors) can then access these ratings free of charge. The popularity of this model grew in the 1970s, following years of “subscriber pays” dominance, in which investors paid for the ratings instead. Issuers, who needed certain ratings in order to sell their bonds to regulated financial institutions, may have been more willing to pay for these services than investors were, according to a 2010 OECD report [PDF].

Subscriber-pays raters have used the recent controversy surrounding the issuer-pays firms to tout the virtues of their model. Representatives from Egan-Jones Ratings Company, a subscriber-pays firm based in Haverford, PA, for instance, alleged in numerous congressional hearings that the Big Three behaved as monopolies and enabled biased ratings. Egan-Jones, however, was also penalized by the SEC for exaggerating its ratings record during the financial crisis.

Role in the Financial Crisis

In 2008, at the height of the global financial crisis, rating agencies were accused of misrepresenting the risks associated with mortgage-related securities. Critics alleged that they created complex but unreliable models to calculate the probability of default for individual mortgages as well for the securitized products created by bundling these mortgages. Raters deemed many of these structured products top-tier AAA material during the housing boom, only to sharply downgrade them when the housing market collapsed. In 2007, as housing prices began to tumble, Moody’s downgraded 83 percent of the $869 billion in mortgage securities it had rated at the AAA level in 2006.

Critics argue that the ratings agencies failed to take into account the potential for a decline in housing prices and its effect on loan defaults. The agencies’ inflated ratings also failed to account for the greater systemic risks associated with structured products, and they were accused of sacrificing quality ratings to win a bigger share of the lucrative sector. By 2006, Moody’s had earned more revenue from structured finance—$881 million—than all its 2001 business revenues combined.

The agencies respond that there was no conflict of interest, since rating decisions were made by committees, not individual analysts, and that employees were not compensated based on their ratings. The agencies have further argued that the subscriber-pays system suffers from its own conflicts of interest, arguing that investors might pressure rating agencies to deem securities as risky because low-rated securities pay higher yields. Short sellers might also benefit financially from negative ratings. The real issue then, the Big Three argued, is simply one of transparency.

Impact on the Eurozone Crisis

In Europe, the criticism has focused on sovereign debt rather than private mortgage securities. EU governments and ECB policymakers accused the Big Three of being overly aggressive in rating eurozone countries’ creditworthiness, exacerbating the financial crisis. They argue that the unduly negative evaluations accelerated the European sovereign debt crisis as it spread through Greece, Ireland, and Portugal, and Spain—all of which received EU-IMF bailouts. S&P’s April 2010 decision to downgrade Greece’s debt to junk status weakened investor confidence, raised the cost of borrowing, and made a financial rescue package in May 2010 all but inevitable.

The European Union again came under pressure in 2011 during the negotiations over Greece’s second bailout, in which private creditors were persuaded to take a “voluntary” loss on their bonds in order to reduce Greece’s overall debt. This scheme—seen as necessary to restore Greece’s financial health—was complicated by S&P’s July 2011 announcement that it would consider such debt restructuring a “selective default.” Indeed, after what was considered the largest sovereign default in history, S&P lowered Greece to the second lowest rating. Despite fears of a deeper crisis, the restructuring went smoothly enough for S&P to raise Greece’s sovereign credit rating back to B- by December 2012.

In January 2012, as borrowing costs continued to rise across the eurozone, S&P downgraded nine eurozone states, leaving Germany as the only country in the bloc with a AAA rating. In December 2013, S&P downgraded EU debt as a whole, drawing strong protests from European officials who pointed to the difficult budgetary reforms being undertaken as evidence that the region would uphold its financial commitments no matter what.

Unprecedented Downgrade

In the eyes of many Europeans, the Big Three show preferential treatment to the United States, which long maintained a AAA rating despite a growing deficit and increasingly high levels of public debt. However, on August 5, 2011, S&P downgraded the U.S. credit rating for the first time in history. The move, lowering U.S. debt to AA+, came after weeks of congressional wrangling over the deficit and debt ceiling. The eventual deal to avert a default did not, in the opinion of S&P, implement adequate measures to reduce the U.S. deficit over the next ten years.

The more government has power and is meddling with rating agencies, the more the rating agencies will be brow-beaten.

Sebastian Mallaby, Council on Foreign Relations

The Obama administration lambasted the rating agency’s decision, with then-Treasury Secretary Timothy Geithner saying S&P showed “terrible judgment,” and President Obama seeking to diminish the importance of S&P’s verdict in an address to the nation. S&P defended its decision, even after admitting that it made a $2 trillion deficit projection error, a mistake that Treasury officials said should invalidate the rating. Moody’s and Fitch did not match S&P’s downgrade.

In October 2013, amid a partial government shutdown and another impasse over the debt ceiling, Fitch placed the U.S. AAA rating on negative watch, citing “political brinksmanship” and increased risks of default.

Regulating the Rating Agencies

Critics of the Big Three in the United States and Europe have long voiced concern that the monopolization of the sector by these agencies has created an uncompetitive environment that leaves investors with few alternatives. In 1975, the SEC began choosing which raters could be used to determine the minimum capital levels required for financial firms to trade certain debt securities, depending on their riskiness. The three raters initially chosen—S&P, Moody’s, and Fitch—were deemed “nationally recognized statistical rating organizations,” or NRSROs. Though the SEC has added more rating agencies to the list over the years, the original three have maintained their dominant positions.

The U.S. Dodd-Frank legislation, in addition to creating an Office of Credit Ratings at the SEC, vested the SEC with additional oversight authority. The commission is now charged with examining NRSROs on an annual basis, levying fines when necessary, and potentially deregistering agences that provide inaccurate ratings. The EU’s oversight mechanism, the ESMA, plays a similar role. Many European officials have also called for the creation of an independent, European rating agency to counter the influence of the Big Three, but efforts to obtain funding for a new firm have not been successful.

In the United States, several legal and regulatory actions against ratings agencies came to a head in 2015. In addition to to its $1.37 billion settlement in February, S&P settled two other cases, paying $125 million to the nation’s largest pension fund, the California Public Employees’ Retirement System (Calpers), while settling with the SEC for $80 million in a post-crisis fraud case. While these sums combined are more than ten times larger than any other ratings agency-related settlement, critics argue that they represent a mere slap on the wrist for S&P, which as part of the deal was not forced to admit to any criminal wrongdoing. While the Big Three now face more oversight—Moody’s too has come under Justice Department investigation since 2014—neither their market domination nor their fundamental “issuer pays” business model has been challenged.

CFR Senior Fellow Sebastian Mallaby argues that government regulation is unlikely to solve the conflicts inherent in credit rating agencies, particularly when it comes to sovereign debt. “The more government has power and is meddling with rating agencies, the more the rating agencies will be browbeaten into giving a generous rating to the sovereign,” Mallaby said.

The best way to counter the monopolistic power of the Big Three, he argued, is for investors to stop giving their ratings so much weight. “The reason why the subprime bubble could happen, or the reason why the European sovereign debt crisis can happen is, largely, that very blind investors bought bonds relying on ratings, and [didn’t do] their own homework about what the real credit risk was in the bonds,” said Mallaby.

Recommended Resources

This Congressional Research Service report [PDF] explains credit rating agencies and their regulations.

George Mason University’s Mercatus Center provides this Brief History of Credit Ratings Agencies.

The Financial Crisis Inquiry Report [PDF],commissioned by the U.S. government, explores the role of ratings agencies in contributing to the U.S. economic crisis.

Bloomberg reported in 2013 that bond issuers have returned to practice of “exploiting credit ratings by seeking firms that will provide high grades on debt.”

New York University professor Richard Sylla explains the business of credit ratings in this World Bank report [PDF].t

Colophon

Staff Writers

- CFR Staff

Additional Reporting

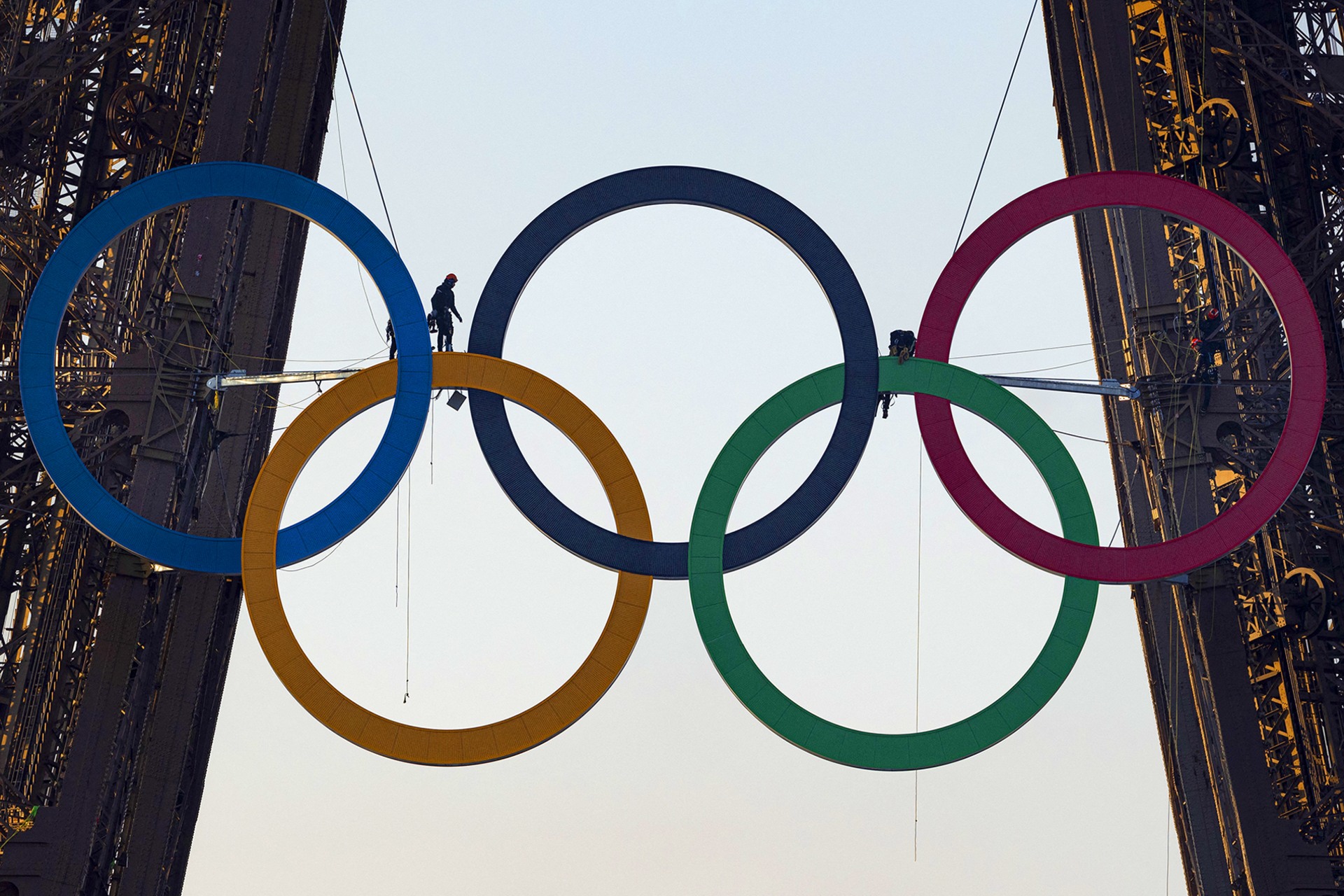

Header image by Shannon Stapleton/Reuters.