What Is the Fiscal Cliff?

Published

Updated

While congressional action lags, a series of year-end fiscal measures could derail the U.S. recovery.

This publication is now archived.

Introduction

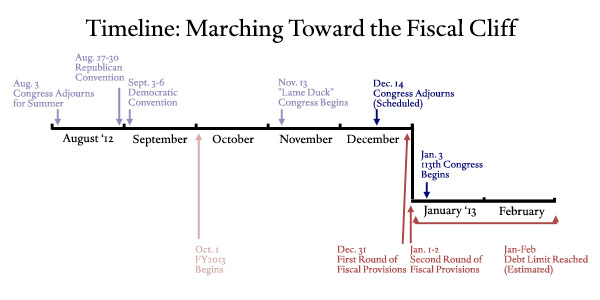

The “fiscal cliff” is a term used to describe a bundle of momentous U.S. federal tax increases and spending cuts that are due to take effect at the end of 2012 and early 2013. In total, the measures are set to automatically slash the federal budget deficit by $503 billion between FY 2012 and FY 2013, according to the most recent Congressional Budget Office (CBO) projections [PDF]. If these numbers are converted to calendar year 2013, however, this contraction would be substantially higher, close to 4 percent of GDP. The abrupt onset of such significant budget austerity in the midst of a still-fragile economic recovery has led most economists to warn of a double-dip recession and rising unemployment in 2013 if Washington fails to intervene in a timely fashion.

But many analysts question what action, if any, will be taken either in the lame duck session of the 112th Congress or in the early days of 2013. While legislative inaction could have deleterious economic effects in the short term, analysts say putting off or cancelling all of the measures without a longer-term deficit deal in place would be equally dangerous for the U.S. economy.

What are the components of the fiscal cliff?

The following set of revenue and spending measures are set to expire or take effect at year’s end, representing an acute fiscal consolidation that could be further intensified by a potential showdown over the debt ceiling.

Revenue Increases

- 2001/2003/2010 Tax Cuts & AMT Patch. This series of legislation, often referred to collectively as the “Bush tax cuts,” will expire on December 31, 2012, raising all income tax rates (top will go from 35 to 39.6 percent), as well as rates on estate and capital gains taxes. The alternative minimum tax (AMT) will also automatically apply to millions more citizens.

- Payroll Tax Cut. The Social Security payroll tax holiday will expire December 31, raising the rate from 4.2 to 6.2 percent.

- Other Provisions. Several other policies such as the Research and Experimentation tax credit, many of which are typically enacted retroactively, are due to sunset at years’ end.

- Affordable Care Act Taxes. Some provisions in the Obama health-care legislation, including increased tax rates on high-income earners, are set to take effect in January 2013.

Spending Cuts

- Budget Control Act. The automatic spending cuts, or sequester, legislated by the Budget Control Act of 2011 will hit January 2. Half of the scheduled annual cuts ($109 billion/year from 2013-2021) will come directly from the national defense budget, half from non-defense. However, some 70 percent of mandatory spending will be exempt.

- Extended Unemployment Benefits. The eligibility to begin receiving federal unemployment benefits, last extended in February, will expire at year’s end.

- Medicare “Doc Fix.” The rates at which Medicare pays physicians will decrease nearly 30 percent on December 31.

Debt Ceiling

The debt limit, which sets the maximum amount of outstanding federal debt the U.S. government can incur by law, is currently capped at $16.39 trillion. Treasury is expected to hit this borrowing capacity again sometime in early 2013. Analysts fear another protracted debate over the debt ceiling could bring repercussions similar to those that followed the debt battle in summer of 2011, which rattled financial markets and, according to a study from the Government Accountability Office, raised the cost of Treasury’s borrowing by $1.3 billion for FY2011.

How did it come to this?

The fiscal cliff is in many ways the culmination of a series of increasingly contentious fiscal showdowns between the Democratic and Republican parties over the last few years. The most noteworthy, the debt-ceiling fight of August 2011, threatened the country’s ability to meet its financial obligations and resulted in an unprecedented downgrade in the U.S. credit rating by Standard and Poor’s. The subsequent failure of the bipartisan supercommittee to reach a deal on $1.2 trillion in targeted budget savings over ten years unleashed automatic spending cuts for both defense and non-defense spending.

Most critics believe that the lack of a comprehensive, long-term deal on deficit reduction—one that addresses the need for major tax and entitlement reform—has propelled the use of short-term political expedients like the “doc fix” and other extenders. Meanwhile, the nation’s debt soars on an unsustainable path, according to most projections.

The fiscal cliff is in many ways the culmination of a series of increasingly contentious fiscal showdowns.

Taxes and the role of government lie at the heart of the debate. Generally speaking, Republicans favor spending cuts as a primary means to achieve deficit reduction. Most have also publicly pledged to oppose all tax hikes, suggesting, rather, that tax cuts boost economic growth and, in turn, government revenue. Democrats typically believe tax increases should be part of any bargain to reduce long-term entitlement spending, and have generally supported greater reductions in the defense budget.

This philosophical rift is on display in the debate over the fiscal cliff. In particular, the two parties are divided over how to extend the Bush-era tax cuts, the largest single component of the fiscal cliff. Republicans are pushing for all cuts to be extended, while many Democrats, led by President Obama, would extend all cuts except for the wealthiest 2 percent of taxpayers.

GOP leaders have said they are willing to accept more government revenues—through limiting tax deductions and closing loopholes—but have stressed they are not open to raising individual rates. However, some analysts speculate that a December letter to Congress from the conservative-leaning Business Roundtable, a coalition of Fortune 500 executives, may provide Republicans with some political cover on this issue. “Compromise [on the fiscal cliff] will require Congress to agree on more revenue—whether by increasing rates, eliminating deductions, or some combination thereof,” said the missive.

The fight over taxes is also very much part of the sequester debate, with Democrats pushing for more revenue as part of any deal to avert the drastic mandatory cuts.

What are the domestic consequences?

A $503 billion budget contraction in 2013—the result of complete legislative inaction on the fiscal cliff—would likely send the United States into another recession in the first half of the year, according to CBO. [A previous version of this article estimated fiscal cliff measures at $607 billion; however, the CBO has since amended these projections.] In such a scenario, analysts project real economic output to decline by 0.5 percent from the fourth quarter of 2012 to that of 2013. Furthermore, economists say the dip in GDP would precipitate a commensurate rise in unemployment to over 9 percent.

But CFR’s Robert Kahn notes that “there is a lot of uncertainty around [CBO’s] number: If there is a broad deal after a few months, the effects will be less; conversely, if the shock is permanent, the estimate looks low.” He adds that recent work from the IMF and others suggests that fiscal multipliers could be “substantially larger than CBO assumes, given the weakness in the global environment and the limited ability of the Fed to ease policy to offset the fiscal tightening.”

International shipping giant UPS, which is often considered a bellwether for the business community at large, has reduced its growth forecast for the second half of 2012 to just 1 percent, citing the climate in Washington. “[Our] customers are concerned. They’re not going to invest. They’re not going to hire people. They’re not going to stock inventory with all that uncertainty,” said CEO Scott Davis.

Moreover, a report from the bipartisan Committee for a Responsible Federal Budget (CRFB) suggests CBO projections “may underestimate the pain associated with the fiscal cliff since they do not fully account for the continued market uncertainty or the potential ’hysteresis’ associated with continued long-term unemployment” [PDF]. In economic theory, labor market hysteresis occurs when persistently high unemployment fosters even higher levels of joblessness in the long term due to a number of causes (i.e., the skills of long-term unemployed diminish, thereby reducing the chances of becoming re-employed.)

In October 2012, the National Association of Manufacturers, a Washington-based advocacy group, offered a stark prognosis if lawmakers fail to act, predicting an unemployment rate of 11 percent and a nearly 13 percent drop in GDP over three years.

In December 2012, the Business Roundtable, a collective of corporate CEOs commanding some $7.3 trillion in annual revenues and more than 16 million workers, added to the gloomy forecast, noting that “the United States will suffer significant negative economic, employment, and social consequences for going over the fiscal cliff. In many cases, the damage will be long-lasting, if not permanent.”

What are the national security implications?

Automatic, across-the-board spending cuts of approximately $55 billion per year (through 2021) are scheduled to hit the Pentagon in January unless Congress steps in before the new year. Details of how the cuts will be enacted are yet to be fully worked out by the White House Office of Management and Budget, but some preliminary decisions have been made. In late July, President Obama exempted all members of the military from the potential cutbacks, an authority granted to the White House under the 2011 Budget Control Act.

The decision will likely shift the burden of automatic cuts onto other areas of the Pentagon, including weapons programs. Defense contractors have condemned the sequester as a potential “jobs killer.” A fact sheet from the Republican-controlled House Armed Services Committee describes the looming defense cuts as an “unacceptable risk” that will “severely diminish America’s global posture” and lead to the loss of more than one million private sector jobs.

Similarly, the White House has described the potential cuts as “highly destructive to national security and domestic priorities, as well as to core government functions,” and continues to push for a political compromise that would avert major cuts.

What are the global consequences if Congress fails to act?

The repercussions abroad would likely be significant if Congress is unable to at least temporarily or partially stave off the acute onset of year-end tax increases and spending cuts. An October 2012 IMF report notes that massive fiscal tightening in the United States in early 2013 is a primary risk to global economic stability [PDF]. Protracted gridlock in Washington would stall the U.S. recovery “with deleterious spillovers to the rest of the world,” the report says. In addition, “delays in raising the federal debt ceiling could increase risks of financial market disruptions and a loss in consumer and business confidence.”

What are the practical policy considerations?

Economists suggest a prudent compromise would involve extending some current provisions either indefinitely or at least temporarily in order to avoid undercutting economic growth. More importantly, policymakers should forge a credible plan to impose a requisite amount of medium- to long-term fiscal consolidation that will stabilize the federal debt. The October IMF Fiscal Monitor says, “Medium-term consolidation will need to include a reform of entitlements, the key driver of long-term spending, but must also raise revenue, given the size of the deficit and the relatively low tax ratio.”

A host of public and private policy groups has proposed more than thirty different deficit reduction approaches that address the root problems of soaring U.S. debt: an aging population, longer life expectancies, and rising health-care costs. A fiscal cliff dive, on the other hand, would significantly slash the deficit but would not address the fundamental drivers of long-term U.S. debt. A comprehensive deficit deal would map out a gradual schedule of targeted tax and entitlement reforms that businesses, individuals, and government agencies can plan for and adjust to.

A fiscal cliff dive would significantly slash the deficit but would not address the fundamental drivers of U.S. debt.

The sooner such a plan can be worked out, the better, say analysts. “Failure to make the hard but necessary choices now on our own terms will lead to much harder and more severe choices later” at the behest of the markets, says CRFB. Continuing to grow the debt at unsustainable levels threatens to trigger a sharp increase in U.S. borrowing costs and further downgrades to the nation’s credit rating.

In November 2012, both Moody’s and Fitch credit rating agencies said they will likely lower their triple-A grade of U.S. sovereign debt if policymakers fail to curb the nation’s borrowing in the medium term. While global investors may continue to fund high U.S. deficits for several more years, recent experiences of several advanced economies in Europe indicate the unpredictability and speed at which fiscal crises can come.

What are the prospects for progress over the next few weeks?

Analysts say the next several weeks offer Republicans and Democrats another opportunity to strike a balance between the short-term measures needed to feed the recovery and the medium- to long-term policies that will stabilize and eventually lower the debt. But the prospects for a significant fiscal compromise in the lame-duck session of Congress are questionable.

In the wake of President Obama’s reelection, Speaker of the House John Boehner (R-OH) indicated his party’s willingness to accept more government revenues—likely through limiting tax deductions and closing loopholes—as part of a short-term deal that would serve as a “down payment” for a greater fiscal compromise next year. However, Senate Majority Leader Harry Reid (D-NV) condemned the notion of “kicking the can down the road,” saying, “I think we should just roll up our sleeves and get it done.”

In a post-election speech on the fiscal cliff, President Obama urged Congress to act immediately to keep tax rates low for the 98 percent of Americans earning less than $250,000—an issue on which both Republicans and Democrats agree. “Even as we’re negotiating a broader deficit reduction package,” he said, “let’s extend the middle-class tax cuts right now.”

Recommended Resources

This Backgrounder frames the debate over U.S. corporate tax reform.

This Backgrounder outlines the competing policies for fiscal reform and the likely consequences of failing to bring down U.S. debt.

This Backgrounder discusses the costs and consequences of failing to raise the U.S. debt ceiling.t

Colophon

Staff Writers

- Jonathan Masters

Additional Reporting

Header image by Mary F. Calvert/Reuters.