More on:

My colleagues Benn Steil and Dinah Walker recently published a great interactive on the spread of central bank currency swaps since the financial crisis. They find the United States provided developing nations with significant support through swap lines at the height of the financial crisis, but that China has been the most active extender of swap lines since 2009. China now has thirty-one swap agreements outstanding.

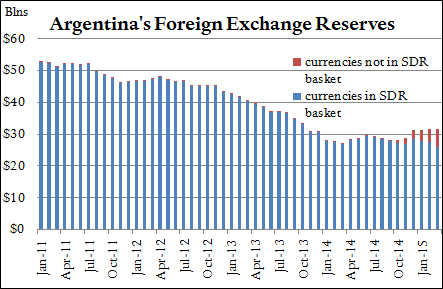

The interactive also tells an interesting Latin America story. Argentina is one of the only countries in the world to take China up on its offer. Last year Argentina activated the swap line, and has since drawn a reported $2.7 billion of an available $11 billion. Under the agreed terms, the RMB may be freely converted into dollars. This is significant for Argentina, whose dollar reserves have plummeted from $53 billion in 2011 to $31 billion today. As such, the swap lines are being used less to settle Chinese goods trade than as a palliative for those unable to rely on the U.S. Federal Reserve, or in Argentina’s case most of the international banking system.

China also maintains swap agreements with Brazil and Suriname, and just this week signed an agreement with Chile. Notably not on this list is Venezuela, which has already received $56 billion in loans since 2007. Even the Chinese seem to have their limits.

Here is a link for more of Steil and Walker’s analyses on the topic.

More on: