Is the Fed Gonna Tighten Like It’s 1994? Or 2004?

More on:

How will the Fed raise rates once it starts? Gradually, in small steps? Faster, with larger steps?

In 2012, before becoming Fed chair, Janet Yellen argued for a later first rate-hike than would be suggested by a traditional “Taylor Rule” approach, followed by more aggressive catch-up rate hikes. Now, however, she is suggesting that those rate hikes will be gradual and measured after all. Almost certainly she is wary of a repeat of 1994, when the Fed began raising rates and bond markets took a pounding.

New York Fed president Bill Dudley said that the pace of tightening would depend on “financial conditions” in the market once the Fed achieves lift-off. He pointed to the spring/summer 2013 “taper tantrum” as a reason to go slow. But he then warned of the risks of repeating the 2004 experience, when the gradual, measured, salami-slice tightening left “financial conditions . . . quite loose,” suggesting that policy should perhaps “have been tightened more aggressively.” These comments suggest that the Fed might be more aggressive this time if longer-term interest rates, like the 10-year Treasury rate, don’t rise with short rates.

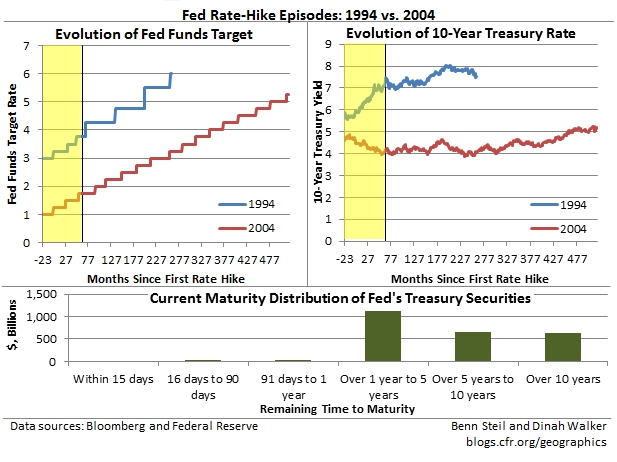

The graphic above shows how the 10-year rate evolved after the 1994 and 2004 tightenings. The Fed, at least as suggested by Dudley’s comments, doesn’t seem to want to repeat either of these episodes. It wants financial conditions to tighten, but not too much.

What accounts for the different market reactions in the 1994 and 2004 episodes?

One possibility is the very different way the Fed handled communications. In 1994, there was no real “forward guidance.” In testimony before the Joint Economic Committee on January 31, 1994, four days before the Fed’s first rate hike, Fed Chairman Alan Greenspan indicated only that “At some point, absent an unexpected and prolonged weakening of economic activity, we will need to move [rates] to a more neutral stance.” In 2004, in contrast, the Fed’s guidance was almost identical to 2014/15: first it said that accommodation would remain for a “considerable period,” then it said it would be “patient” in removing it, and then said rates would go up at a “measured” pace. Going forward, this suggests, all else being equal, that a repeat of the 2004 market reaction is more likely than a repeat of 1994.

To the extent, however, that Dudley’s concerns about 2004 apply to the coming Fed tightening, we can expect the Fed to do something about it. What disturbs us is that Dudley, repeating a Fed pledge from 2011 and 2014, has ruled out using the most obvious tool for affecting long rates. This is to sell longer-term Treasury securities from its balance sheet, which would put upward pressure on their yields and, almost certainly, the yield on longer-maturity private credit. The Fed holds a whopping $1.3 trillion in Treasuries with remaining maturity of 5 years or longer on its balance sheet, as the bottom figure above shows.

Dudley says the Fed will instead simply push harder on very short-term rates, through the interest rate paid on excess reserves (IOER) and the overnight reverse repurchase (ON-RRP) facility. “Macroprudential measures,” which he said should have been considered in 2004, might also be tried.

But the first, indirect, approach makes little sense if the Fed wants to affect longer rates directly. And the second is just a fancy way of saying “do something non-monetary, something we can’t specify.” Neither inspires confidence that the Fed will actually succeed in tightening financial conditions, if this is what it needs to do.

Why did the Fed, then, and Dudley personally, rule out selling assets from the balance sheet? Because they fear 1994 even more than they fear 2004. But here the Fed is once again paralyzing itself with clumsy forward guidance.

Dudley himself has acknowledged that the Fed does not know how the market will react to Fed tightening, and that it should, in fact, itself react to actual market conditions at the time. We agree. But this means that asset sales should be on the table for the eventuality that financial conditions become too loose; the Fed should not be trying to thread the needle between 1994 and 2004 using inappropriate or dubious implements.

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store