When the right hand doesn’t talk to the left hand … (and some musing on this week’s move in the Treasury market)

More on:

- Total “official” (central bank) holdings of Agencies at the end of q1 2007 according to the Federal Reserve’s flow of funds: $537.4b (table L107)

- Agencies held by the Federal Reserve Bank of New York (FRBNY) on behalf of foreign central banks at the end of March: $668.9b (H.4.1). The Fed knows these data series don’t line up – there is a nice explanation for the sources of the difference on the Treasury’s web site (see point 4 in particular).

True official holdings of agencies: Somewhere north of $669b. Not all central banks use the New York Fed as a custodian.

- The change in official Agency holdings in the flow of funds in q1: $73b

- The change in the FRNBY’s custodial holdings in q1: $51.5b

- The change in official Treasury holdings in the flow of funds in q1: $26b

- The change in FRNBY’s custodial accounts: $55b.

It is likely that some of the $65b rise in “private” holdings of Treasuries outside the US reported in the flow of funds come from central banks. Several central banks right now buy their bonds in London and then have FRBNY serve as their custodian.

Caroline Baum really doesn’t like the TIC data. She argues that there is no correlation between official demand – as measured in the TIC – and anything that matters.

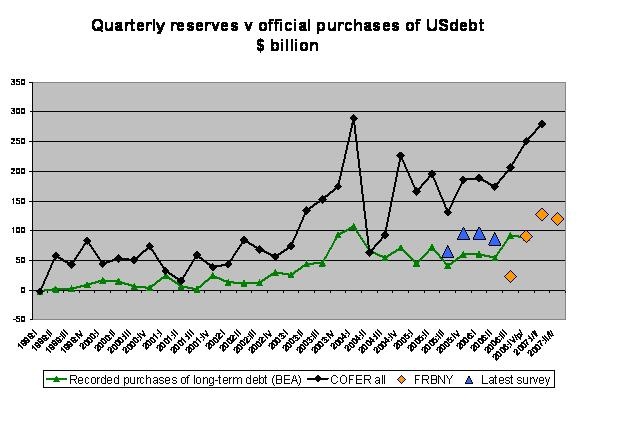

I also don’t like the TIC data, but for a different reason. It clearly understates official purchases of US debt, and thus no longer provides much useful information about how central banks are influencing US markets. The gap between the FRBNY's custodial accounts and other data sources provides one clue. Another clue comes from the last survey, which showed $140b more in official purchases than showed up in the TIC data. That gap likely has increased in the past few months.

I would be surprised if a data (the TIC) series that has underestimated – relative to the survey -- Chinese official purchases by $90b a year since mid 2004 has much predictive power. Garbage in, garbage out.

Unlike Jim Bianco, I think there is a pretty simple set of reasons why the end of Japanese intervention in q1 didn’t have much of an impact on the Treasury market. Japan for one didn't stop buying Treasuries as suddenly as it stopped intervening. Japan had built up huge bank deposits during its peak intervention – and it drew on those deposits to buy treasuries in q2 and q3 2004.

And more importantly, emerging market central bank reserve growth soared just as Japanese purchases tailed off. China added almost $100b to its reserves in q4 2004 (once you adjust for valuation, the real total is more like $80b). The oil exporters started raking in the cash. A lot of that made its way into Treasuries and agencies -- just not in ways that necessarily showed up in the TIC data.

Japan’s MOF (through the BOJ) buys through New York. It is pretty clear that China and even more so the oil exporters buy through London. The revisions in foreign Treasury holdings once the survey data comes out are consistent – UK holdings go down and Chinese holdings go up. For example, the UK’s holdings of Treasuries were revised down by $150b last June.

The following chart shows global reserve growth by quarter (IMF COFER data + SAMA + Chinese bank recapitalization), the BEA’s data series on “official purchases” of US long term debt, the flows implied from mid-05 to mid-06 by the latest survey (expect the BEA series to be revised up at some point, I also turned an annual change into a series of quarterly changes by distributing the overall change using the distribution of recorded purchases) and the recent data on the changes in the New York Fed’s custodial holdings.

There might have been a bit of a dip in official demand in late 2004 and early 2005 v. the q4 03 and q1 04 peak, but not all that big a dip. But by late 2005 and early 2006 central bank demand looks to be back where it was in early 2004 (looking at the survey data).

The strong rise in Treasury yields this week, by contrast, is much more of a challenge to arguments that official demand has helped hold Treasury yields down. Sure, official demand has shifted toward Agencies and away from Treasuries recently. But if the Treasury/ Agency spread got too big, private bond funds would arbitrage out the difference. Total official demand for US securities -- using the measures I like (recently the FRBNY’s custodial data, and more generally total global reserve growth) – has been very, very strong this year.

And given how strong reserve growth has been for the past few months, I would be stunned if official demand for US securities has fallen.

So what might have contributed to the rise in Treasury yields?

- The obvious answer is that expectations about the path of US short-term rates changed, and that drove a change in long-term rates.

- That includes the possibility that the expectations of those central banks now buying US debt changed. In the fall, I thought there was a bit of evidence that central banks – big buyers of US debt – believed that the Fed’s rate hike cycle had peaked and that the next move was likely to be down, so they increased their purchases of long-term securities and stopped adding to their bank deposits and other short-term holdings. Central banks may have concluded that it no longer makes sense to lock in sub 5% US rates.

- A rise in US interest in foreign securities also may be playing a role. The more US investors send abroad, the more foreigners need to lend to the US. Every dollar the US invests in Brazil has to be borrowed from someone, and it is a borrowed dollar that isn’t available to finance the US current account deficit. Or, put a bit differently, if a US investors sells US treasuries to buy Brazilian treasuries, and Brazil’s central bank offsets the capital inflow by building up its reserves (and buying Treasuries), the net effect is a rise in central bank demand for US treasuries but no increase in total demand for US treasuries.

- Higher expectations for global growth – and non-US interest rates – certainly seem to be playing a role. Richard Berner’s argues persuasively that a spending spree in the commodity-exporting economies is generating strong growth in a lot of major US spending partners, and thus pushing up rates globally. European growth is quite strong, leading to higher rates in Europe. Australia and New Zealand recently raised rates. If there is a global yield curve these days, a shift in rates outside the US implies a shift in rates in the US. Gotta keep the funds flowing in.

- And so – perhaps – did convexity hedging. Basically, as rates rise, holders of mortgage backed securities no longer expect as much refinancing. That increases the expected duration of their mortgage-backed securities increased - -and to offset the increase in expected duration of their MBS they sold long-term US Treasury bonds.

Throw it all together though and certainly something did seem to change – even if overall central bank demand for US assets didn't change. Central banks aren't responsible for everything.

And I would still bet that US yields would need to be far higher that they are even now to attract the financing the US needs to sustain its current account deficit without central bank demand. Strong global than US growth doesn't provide a good reason for private funds to flow into the US on a massive scale ....

More on:

Online Store

Online Store