Which Countries Should Fear a Rate Ruckus?

By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Dinah WalkerAnalyst, Geoeconomics

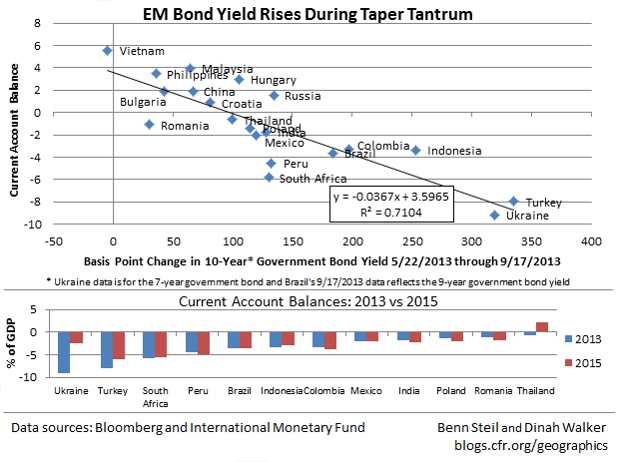

For many Emerging Markets, May 22, 2013 is a day that will live in infamy. It marks the start of the great Taper Tantrum, when Ben Bernanke’s carefully hedged remarks on prospects for slowing Fed asset purchases triggered a massive sell-off in EM bond and currency markets.

Though the sell-off was widespread, it was not indiscriminate. As the top figure above shows, EMs with large current account deficits were the hardest hit. These were countries dependent on inflows of short-term capital facilitated by the $85 billion the Fed was pumping in monthly to buy Treasuries and mortgage-backed securities.

So who is vulnerable now to a possible Rate Ruckus – an EM bond market sell-off triggered by an unexpectedly early or aggressive Fed rate hike?

As the bottom figure suggests, many of the same countries are likely to be in the firing line – in particular, Ukraine, Turkey, South Africa, Peru, Brazil, Indonesia, Colombia, Mexico, and India. Of these, only Ukraine has seen a significant improvement in its current account deficit, which has fallen from a whopping 9.2% to 2.5%. Poland and Romania have moderate (2%) but higher deficits, and could receive a larger jolt this time around. Only Thailand has moved into surplus, and looks likely to be spared.

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”