- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedA clear-headed vision for the United States' role in the Middle East that highlights the changing nature of U.S. national interests and the challenges of grand strategizing at a time of profound change in the international order.

Book by Steven A. Cook June 3, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

January 24, 2008

Financial MarketsDiplomatic sovereign wealth funds argue, more or less, that they have no desire for power - so there should be no restrictions on their ability to accumulate property. Those hoping for a cut of the S…

February 8, 2005

The Chairman gave policy makers a green light not to worry about the US current account deficit: the dollar’s existing fall will lead the deficit to turn around. The Chairman’s remarks also seem to …

April 5, 2009

On Friday, Paul Krugman interpreted China’s call for a new reserve currency as a sign of weakness: “But Mr. Zhou’s speech was actually an admission of weakness. In effect, he was saying that China …

April 13, 2007

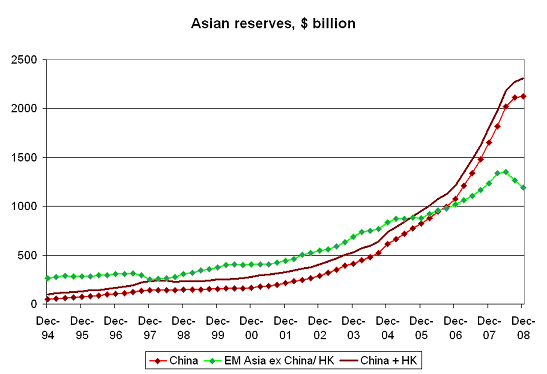

ChinaPlease allow me a bit of latitude. China won’t add $500b to its reserves in 2007 for the simple reason that the central bank will sell some of its reserves to the state investment company. Moreover…

June 27, 2013

United StatesThe World Next Week podcast is up. This week, Bob McMahon and I took a break from our regular discussion of next week’s news to kick off the summer with some reading recommendations. Bob and I beg…

Online Store

Online Store